LONDON: Saudi mining colossus Ma’aden is riding a wave of investor confidence as profitability is driven by robust commodity prices, growth in production across its minerals suite of phosphate, gold, copper and aluminum, as well as a cost-cutting program that has strengthened the balance sheet.

Now, there is market chatter that the next chapter of the growth story could be overseas. Some say Ma’aden will one day follow SABIC, KSA’s petrochemicals champion, by expanding its footprint in growth segments abroad, although its core business will always be at home.

“At the moment there is plenty of growth to go for in Saudi,” said Yousef Husseini, a broker at EFG Hermes in Cairo.

“But in the longer term, the company could shift its focus to global expansion similar to what SABIC has done in the last couple of decades as local market opportunities decline.”

Husseini said: “As Ma’aden de-levers its balance sheet and starts generating substantial free cashflow, that could potentially give it more resources to pursue inorganic expansion and diversify its asset base.”

For those who lift the bonnet to look inside Ma’aden’s KSA mining operations, they will find the company is already involved with international metals companies via joint ventures on its home turf. That allows it to look at global developments — and, perhaps, future opportunities — via business partnerships with international firms, particularly North American ones.

Ma’aden’s tie-up with Barrick Gold of Canada, the largest gold producer in the world, is a case in point. Ma’aden Barrick Copper, formed in 2014, is a 50-50 joint venture that has been producing gold at the Jabal Sayid copper mine, 120 kilometers southeast of Madinah, since June 2016. It is a not insignificant driver of group profitability. There is also a partnership with American industrial group Alcoa (25 percent) established in 2009. The upshot has been the construction of a state-of-the-art aluminum production complex in Ras Al-Khair.

Ma’aden-Alcoa has contributed about $4 billion to Saudi Arabia’s gross domestic product (GDP), it was revealed at the Saudi-US CEO Forum in Riyadh in May, reported by Arab News. The joint venture supports 3,500 direct jobs and 12,000 indirect jobs. If an expansion plan proceeds, aluminum capacity could be increased by 600,000 metric tons annually and result “in over 3,000 high quality direct and indirect jobs,” it was disclosed at the forum.

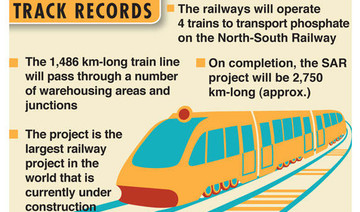

Additionally, Ma’aden and Minnesota-based Mosaic announced a memorandum of understanding to bolster their phosphates partnership. Together with SABIC, they have already invested about $8 billion in developing an existing phosphate operation. (For the uninitiated, phosphate rock is the primary source for phosphorus, one of three elements along with nitrogen and potassium that is critical as a crop nutrient that enhances plant growth and is used as a phosphate fertilizer.)

Ma’aden is advancing another phosphate property, with production slated to begin early in the next decade — bringing an additional 3 million tons per year for an investment in the region of $6.4 billion.

Estimated benefits from the project include a GDP contribution for KSA of about $2.4 billion and employment of 7,000, many of which would be high-quality jobs, it was said at the Saudi-US forum.

Husseini at EFG declines to speculate about which foreign territories might draw investment from Ma’aden in the longer term, or whether any cross-border activity would be executed with or without partners. “I simply don’t know,” he said.

He would only say that “we believe the company would initially be likely to focus on gold or copper projects (there are plenty of these in neighboring Africa) as Saudi’s phosphate resources are currently large enough to pursue further expansion in the Kingdom itself,” he said.

East Africa is viewed as an important region for Ma’aden. CEO Khalid Al-Mudaifer, who recently met with Kenyan fertilizer customers, was cited on the company’s website as saying: “In only a few years, Ma’aden has grown sales in East Africa by over 80 percent.” He added that some estimates suggest that the African agribusiness will become a 1 trillion dollar industry by 2030. But there is no evidence that Ma’aden is actively considering setting up mining operations in Africa at the moment.

Under Vision 2030, plans to reduce oil dependancy mean a tripling of the mining industry’s contribution to Saudi GDP over the next 24 years, making Ma’aden a major player in the reform program.

Structural reforms are planned in the mining sector, including the compilation of a database of the Kingdom’s resources to provide greater transparency to enable foreign as well as domestic miners to more accurately assess the viability of projects.

“Increased investment in Saudi Arabia’s mining sector looks set to lift its GDP contribution significantly in the coming years, as part of an accelerating push to diversify the economy under the Vision 2030 development plan,” said a report by the Oxford Business Group (OBG).

Ma’aden’s new Ad Duwayhi gold mine and processing plant has nameplate capacity of 180,000 ounces per year, making it the country’s largest to date. Its opening last year should create opportunities for a range of firms in the gold-extraction industry.

OBG said that surveys record 600 gold-bearing sites in KSA so far, most of them in the country’s west, only 29 of which have seen initial exploratory drilling.

“Some estimates put the value of Saudi Arabia’s gold reserves at $240 billion, which alongside extensive reserves of bauxite, copper, uranium and phosphate, bring the total worth of its mineral reserves to as much as $1.3 trillion,” OBG said.

The Vision 2030 document states: “We have been blessed with rich mineral resources. Although the mining sector has already undergone improvements to cater to the needs of our industries, its contribution to GDP has yet to meet expectations. As such, we are determined to ensure it reaches SAR97 billion by 2020, creating 90,000 job opportunities in the process.”

KSA also wants to stimulate private-sector investment by intensifying exploration, as well as reviewing the licensing procedures for extraction.

“We will form strategic international partnerships and raise competitiveness and productivity of our national companies. This will boost their contribution to the sector’s growth, as well as to the localization of knowledge and expertise,” the Vision 2030 statement said.