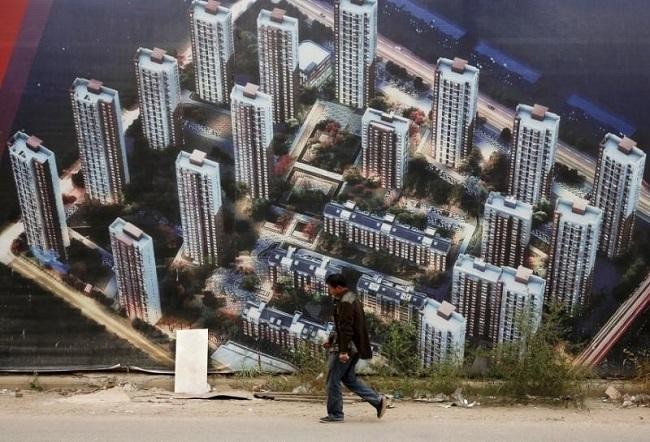

BEIJING: China aims to pursue “stable and healthy development” of the property market in 2018 with an increased focus on providing affordable housing and developing the rental market, Premier Li Keqiang said in a government work report released on Monday.

“China will maintain the position that homes are for living in, not for speculation,” the report said, adding it will continue to adopt a differentiated approach on property policy, which suggests the government will continue to crack down on speculation to prevent bubble risks while destocking inventories in some smaller cities.

Rampant speculation has stoked prices and raised concerns of a sharp correction. The authorities have introduced a flurry of cooling measures since early 2016 in the latest round of speculative buying.

China’s top leadership, however, has stressed the need to avoid sharp price fluctuations, concerned about their impact on the world’s second-largest economy.

Average new home prices in China’s 70 major cities rose 5 percent in January from a year earlier.

The government should take steps to contain the frothy home markets in tier-two and tier-three cities in particular, Yang Weimin, a deputy director at the Office of the Central Leading Group on Financial and Economic Affairs, was quoted as saying by the Securities Times on Sunday.

“We can neither let the bubbles burst nor let it grow bigger,” Yang said.

But the government will support people’s legitimate needs for housing, the work report said, adding it will step up efforts to provide public rental housing, cultivate the rental market and push for the development of shared-ownership homes.

China has also been pumping credit into a home-revamping project to improve housing conditions for the poor. People were often given financial compensation to buy existing homes in the city after their shantytown dwellings were dismantled, in part contributing to a price surge in smaller cities.

Li said in the work report that China plans to revamp 5.8 million shantytown homes in 2018, after investing a total of 1.84 trillion yuan ($290.6 billion) to upgrade more than 6 million homes in the previous year.

A notable difference in this year’s report is the lack of emphasis on destocking the housing glut in tier-3 and tier-4 cities, which some analysts say reflects a more cautious stance as prices have risen sharply in some smaller cities as inventories fell.

The report also said China would steadily push for a property tax law this year. China is “accelerating efforts” on a draft law on property tax, Zhang Yesui, spokesman for the National People’s Congress, told a press briefing on Sunday.

Zhang said China’s tax reforms, including the introduction of a property tax, are expected to be completed by 2020.

China has considered a property tax for more than 10 years, but the idea of a tax has met with push back from stakeholders including local governments who heavily rely on land sales as a key source of financing.

Pilot tax schemes were introduced in cities such as Shanghai and Chongqing but the slow progress to roll it out nationwide has drawn criticism as prices continue to rise.

Critics say that in the absence of a property tax, short-term government measures are not capable of altering a deep-seated market perception that home prices will rise perpetually and that officials will never let the market fall, a view that has fueled speculative purchases over the years.

Liu Shijin, vice chairman of state think tank the China Development Research Foundation, told Reuters that he thinks property tax legislation will likely “pick up pace” in the coming years.

China aims to keep property market stable in 2018

China aims to keep property market stable in 2018

Saudi non-oil exports jump 21% as trade balance improves: GASTAT

RIYADH: Saudi Arabia’s non-oil exports, including re-exports, rose 20.7 percent year on year in November to SR32.69 billion ($8.72 billion), official data showed.

According to preliminary figures released by the General Authority for Statistics, national non-oil exports, excluding re-exports, increased by 4.7 percent in November compared with the same month in 2024.

The strong performance highlights progress under the Kingdom’s Vision 2030 strategy, which aims to diversify the economy and reduce its long-standing dependence on crude oil revenues.

In its latest report, GASTAT stated: “The ratio of non-oil exports, including re-exports, to imports increased in November 2025, reaching 42.2 percent, compared with 34.9 percent in November 2024. This increase was driven by a 20.7 percent rise in non-oil exports, alongside a 0.2 percent decline in imports over the same period.”

It added: “The value of re-exported goods increased by 53.1 percent during the same period, driven by an 81.9 percent increase in ‘machinery, electrical equipment and parts’, which accounted for 51.5 percent of total re-exports.”

Machinery, electrical equipment and parts also led the non-oil export basket, making up 24.2 percent of outbound shipments and recording an 81.5 percent annual increase. This was followed by products of the chemical industries, which represented 20.3 percent of total non-oil exports and rose 0.5 percent year on year.

The data adds to signs of resilience in Saudi Arabia’s non-oil economy, with S&P Global’s Purchasing Managers’ Index at 57.4 in December, well above the 50 threshold that separates expansion from contraction.

Top non-oil destinations

The UAE was the leading destination for Saudi non-oil exports in November, with shipments valued at SR10.48 billion.

India ranked second at SR3.01 billion, followed by China at SR2.32 billion, Singapore at SR1.76 billion and Bahrain at SR900.7 million.

Exports to Egypt totaled SR815.5 million during the month, while Turkiye and Jordan received goods worth SR799.1 million and SR773.3 million, respectively.

GASTAT said ports and airports played a central role in facilitating non-oil shipments in November.

By sea, Jeddah Islamic Seaport handled the largest volume of non-oil exports at SR3.57 billion, followed by King Fahad Industrial Seaport in Jubail at SR3.51 billion.

Ras Al-Khair Seaport was the exit point for non-oil goods valued at SR2.66 billion, while Jubail Seaport and King Abdulaziz Seaport in Dammam handled outbound shipments worth SR2.32 billion and SR2.14 billion, respectively.

By air, King Abdulaziz International Airport handled goods worth SR5.60 billion, while King Khalid International Airport in Riyadh processed exports valued at SR3.53 billion.

Exports and imports

Saudi Arabia’s total merchandise exports reached SR99.73 billion in November, representing a 10 percent increase compared with the same month in 2024.

“Merchandise exports in November 2025 increased by 10.0 percent compared to November 2024, and oil exports increased by 5.4 percent. The percentage of oil exports in total exports declined from 70.1 percent in November 2024 to 67.2 percent in November 2025,” GASTAT added.

China remained the Kingdom’s largest export destination, accounting for 13.5 percent of total exports, followed by the UAE at 11.7 percent and Japan at 9.9 percent. India, South Korea, the US, Egypt, Singapore, Bahrain and Poland were also among the top 10 destinations, which together accounted for 71.4 percent of total exports.

Imports declined by 0.2 percent year on year in November to SR77.38 billion, while the merchandise trade surplus surged by 70.2 percent, the report showed.

China was the Kingdom’s largest source of imports, accounting for 26.7 percent of inbound shipments, followed by the US at 10.2 percent and the UAE at 6.2 percent.

“Germany, Japan, India, Italy, France, Switzerland, and Egypt were also among the top ten import sources, with total imports from these ten countries representing 68.6 percent of Saudi Arabia’s overall imports,” added GASTAT.

King Abdulaziz Port in Dammam was the leading entry point for goods, handling 22.8 percent of imports in November. Jeddah Islamic Port followed with 22.6 percent, ahead of King Khalid International Airport in Riyadh at 17 percent and King Abdulaziz International Airport in Jeddah at 11.9 percent.