KARACHI: Washington has approved $1.25 billion in US Export-Import Bank financing for Pakistan’s Reko Diq copper-gold mine, Acting US ambassador Natalie Baker said in a video message on Wednesday, adding that the package could unlock up to $2 billion in US equipment and service exports for the project.

The facility, one of the largest US financing decisions in Pakistan’s minerals sector, is expected to help pave the way for US-sourced mining technology, drilling machinery and operations support, while creating jobs in both countries and accelerating development of one of the world’s largest untapped copper deposits.

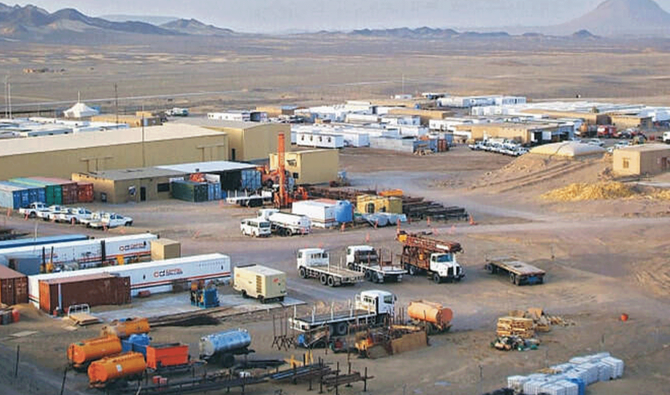

The $7 billion Reko Diq project, located in the mineral-rich southwestern province of Balochistan, is being developed by Canadian mining giant Barrick Gold in partnership with Pakistan’s federal and provincial governments. The mine is central to Pakistan’s effort to expand exports, attract foreign investment and open the country’s largely untapped critical minerals reserves, a segment where copper plays a key role in electric vehicles, renewable energy, AI hardware and global supply chains. Saudi Arabia’s Manara Minerals, a Public Investment Fund and Ma’aden joint venture, has also expressed intent to acquire a 15 percent stake.

“I am pleased to highlight the US Export-Import Bank recently approved financing of $1.25 billion to support the mining of critical minerals at Riko Diq in Pakistan,” Baker said.

“In the coming years, EXIM’s project financing will bring in up to $2 billion in high-quality US mining equipment and services needed to build and operate the Riko Diq mine, along with creating an estimated 6,000 jobs in the US and 7,500 jobs in Balochistan, Pakistan.”

The envoy added that the deal reflects the strategic direction of US commercial diplomacy.

“The Riko Diq project serves as the model for mining projects that will benefit US exporters as well as local Pakistani communities and partners by bringing employment and prosperity to both our nations,” Baker added. “The Trump administration has made the forging of deals exactly like this one central to American diplomacy.”

SECURITY CHALLENGES

Speaking to Arab News last month, Pakistan’s Finance Minister Muhammad Aurangzeb said the broader debt package for Reko Diq was nearly complete, anchored by the International Finance Corporation (IFC) and expected to total about $3.5 billion.

“The financial close, from my perspective, is around the corner,” he said, adding that EXIM participation had been delayed only due to a temporary US government shutdown restrictions, now lifted.

If financing closes on schedule, Reko Diq is projected to generate $2.8 billion in export potential in its first year of shipment, nearly 10 percent of Pakistan’s existing export volume, and could embed the US as a long-term strategic investor alongside Canadian and Saudi partners. The project added 13 million ounces to Barrick’s gold reserves in 2024 and is expected to produce 200,000 metric tons of copper a year in its first phase, doubling after expansion, with projected free cash flow of more than $70 billion over 37 years.

Lenders including the International Finance Corporation and the Asian Development Bank among others are assembling a financing package exceeding $2.6 billion.

Balochistan suffers frequent attacks by separatists and other militants, making security a major concern for the mining scheme. The project also requires a railway line upgrade to transport copper concentrate to Karachi for processing abroad.

Barrick returned to Pakistan in 2022 after a years-long legal dispute was settled, and the mine has since become a flagship investment for the country as it seeks to draw more capital into its minerals sector.