Islamabad: Pakistan has urged the international community to ensure rapid, grant-based and predictable financing for climate-vulnerable developing countries, warning that repeated extreme weather events were deepening debt distress and slowing development progress in nations least responsible for global emissions.

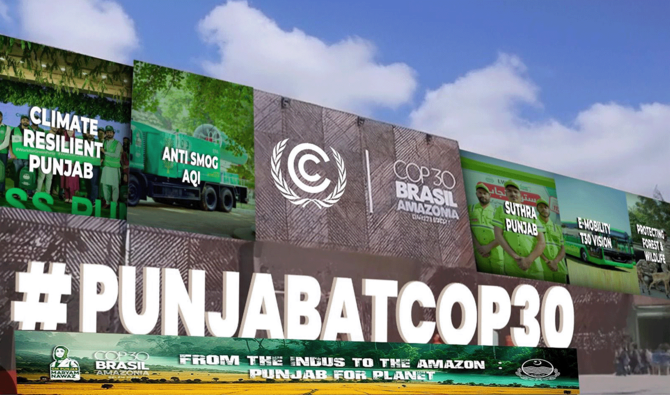

The call was made at a high-level side event, titled “Operationalizing Loss and Damage: Financing Resilience and Recovery in Vulnerable Countries,” organized jointly by Pakistan’s Climate Change & Environmental Coordination Ministry and UNICEF at the Pakistan Pavilion on the sidelines of the UN climate summit (COP30) in Belém, Brazil.

Pakistan ranks among nations most vulnerable to climate change and has seen erratic changes in its weather patterns that have led to frequent heatwaves, untimely rains, storms, cyclones, floods and droughts in recent years. In 2022, monsoon floods killed over 1,700 people, displaced another 33 million and caused over $30 billion losses, while another 1,037 people were killed in floods this year.

In her keynote address at the COP30 event, Pakistan’s Climate Change Secretary Aisha Humera Moriani said Pakistan was investing heavily in strengthening national climate resilience, recalling how the devastating floods in 2022 and 2025 displaced millions, destroyed large-scale infrastructure and caused multi-billion-dollar economic losses.

“The scale and frequency of such disasters in developing countries underscore the disproportionate climate burden placed on nations that played almost no role in heating the planet,” she said, calling for rapid, grant-based climate financing for these nations.

The event brought together representatives of the newly created Fund for Responding to Loss and Damage (FRLD), government officials, development partners and experts to discuss practical steps for operationalizing the global Loss and Damage architecture, according to Pakistan’s Press Information Department (PID).

The speakers noted that repeated climate shocks had pushed many vulnerable economies into what they described as a “debt emergency,” forcing them to borrow for recovery and reconstruction in the absence of adequate grant-based support.

They stressed that new, additional and concessional financing was essential if Loss and Damage assistance was to be transformative rather than short-term. They highlighted that children were bearing the heaviest share of the crisis, with Pakistan having nearly half of its population below the age of 18.

Moriani warned that recurring disasters were undermining nutrition, health, schooling and mental wellbeing of Pakistani children.

“Climate disasters are not only destroying infrastructure, they are also robbing a generation of its right to safety and opportunity,” she said.

The speakers called for prioritizing simplified application procedures, faster disbursement mechanisms and flexible financial windows to ensure timely and equitable financing for countries with limited fiscal room. They urged mechanisms that could respond effectively to slow-onset threats such as glacial melt, sea level rise and desertification, in addition to sudden disasters.

Muhammad Saleem Shaikh, a Pakistani Climate Change Ministry spokesperson, said a major focus of the discussion was directing support toward the most vulnerable segments, particularly children and young people, adding that non-economic losses such as trauma, cultural disruption, displacement and the breakdown of community structure have remained under-addressed in global policy frameworks.

Pakistan announced its readiness to submit two proposals under the FRLD’s initial funding cycle, aimed at reconstruction of critical social infrastructure and strengthening resilience in key sectors, including agriculture, community systems and water resources, according to Shaikh. But the scale of loss far outstrips national capacity, despite continuing efforts to mobilize domestic resources.

While several countries pledged to fund climate-resilience initiatives in Pakistan after the deadly 2022 floods, only a fraction of those pledges could be realized. The situation forced Pakistan to seek a $1.4 billion climate resilience loan from the International Monetary Fund (IMF) and it became the first country in the Middle East and Central Asia region to access the lender’s Resilience and Sustainability Facility (RSF) program.

Moriani reaffirmed Pakistan’s commitment to working with the UN, international partners and climate finance bodies to create a fair global framework for climate recovery. She said the aim was to ensure that vulnerable states receive the resources needed to recover, rebuild and thrive in a world experiencing accelerating climate impacts.

“Climate justice demands immediate access. Our people cannot wait,” she stressed, urging international partners to translate political commitments into concrete financial support for the most vulnerable.