RIYADH: Saudi Arabia’s cultural economy is entering a new phase of expansion, continuing to not only develop but also thrive as a key part of the Kingdom’s broader transformation under Vision 2030.

This was emphasized by the Cultural Investment Conference, held under the patronage of Crown Prince Mohammed bin Salman.

In an op-ed published by Asharq Al-Awsat, Saudi Minister of Culture Prince Badr bin Abdullah bin Farhan highlighted the conference as reflective of the Kingdom’s momentum. He referenced the 89 agreements worth SR5 billion (around $1.33 billion) signed at the conference as indicative of its success, as well as the Kingdom’s achievements in developing and diversifying its cultural economy.

Prince Badr described how the sector has evolved over the last several years: “Before 2018, the cultural sector contributed no more than SR30 billion to the national economy”.

Since the launch of Vision 2030, the creation of 11 specialized cultural commissions, the sector has expanded tremendously. In 2023, culture contributed about SR60 billion to the Kingdom’s economy.

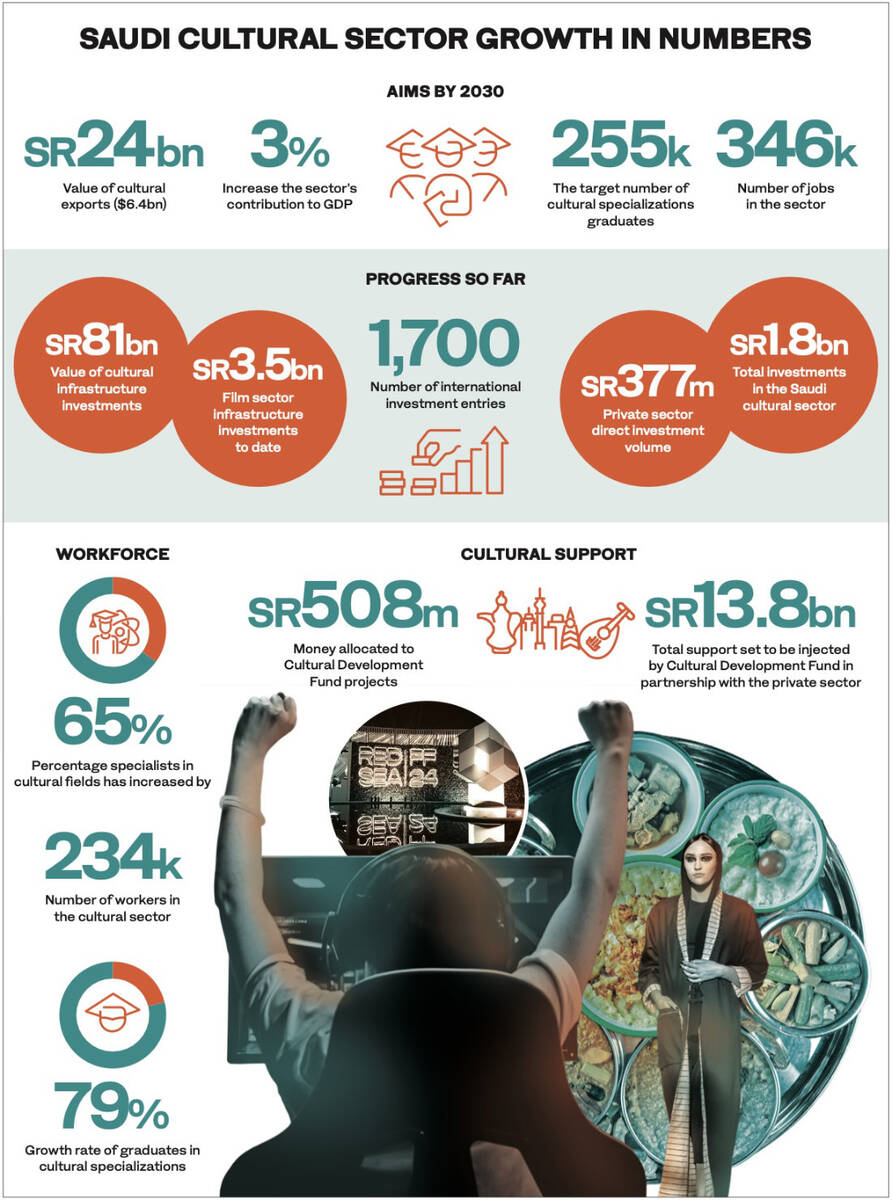

The powerful surge in the sector is highlighted by public and private investments which have exceeded SR81 billion dedicated to museums, venues and large-scale events, making the investment in cultural infrastructure in the Kingdom the largest in Saudi history.

Basil Al-Ghalayini, chairman and CEO of BMG Financial Group, spoke to Arab News about the evolving investment landscape within the Kingdom’s cultural sector and the elements driving the growth.

On the SR81 billion investment, he said: “It says that investing in culturally related projects is one of the pillars of the vision, with at least 3 percent contribution to the GDP.”

He added investor confidence would play a vital role in sustaining this progress, describing it as “a key success factor for any investment, especially with about SR60 billion in contribution to GDP during 2023.”

On a global scale, annual cultural investment is valued at around $2.3 trillion, accounting for 3.1 percent of global economic output. As a result, the Kingdom’s development of its ongoing cultural sector is becoming a core part of economic diversification.

The goal under Vision 2030 targets an increase in graduates in cultural disciplines to 255,000 and the creation of over 346,000 jobs.

Discussing the current investment climate, Al-Ghalayini pointed to the strong performance of small and medium-sized enterprises, saying the workforce has reached around 234,000 and the number of companies operating in cultural activities exceeded 51,000 in 2023, an increase of more than 23.6 percent since 2021.

The number of graduates in cultural fields has risen by more than 79 percent in the past year, with sector’s job market increasing by 65 percent.

Such figures, alongside roughly 1,700 foreign investors, reflect how quickly the sector is becoming a contributor to employment and private-sector growth. Between 2021 and 2024, for example, more than 23.5 million people attended cultural events, already surpassing Vision 2030’s target of 22 million attendees.

Prince Badr’s op-ed also referenced the Cultural Development Fund’s commitment to empowering entrepreneurs: “The Fund has also empowered 1,517 entrepreneurs (both men and women) in all fields through its development programs. It aims to bridge 45 percent of the existing financing gap, inject SR13.8 billion into the sector in financial support in partnership with the private sector, and create 30,000 jobs.”

The op-ed also emphasized the variety of areas funded by cultural investment funds, such as the fashion, film and culinary industries, which are expected to increase in value by between SR31.9 billion and SR34.8 billion by 2030.

Al-Ghalayini said the film industry would likely offer the most attractive returns for investors; the film and cinema sector has attracted more than SR3.5 billion riyals so far, currently generating around SR900 million in ticket revenue annually. The Red Sea International Film Festival stands as an example.

Prince Badr also highlighted an asset he claimed was “the greatest and most valuable of cultural investment” — Saudi artists. He praised their ability to create cultural communication with global audiences in creative and innovative ways and backed the transformation on an international scale.

The op-ed underlined the Kingdom’s commitment to supporting Saudi artists’ careers through cultural and artistic academies, teasing the Riyadh University of the Arts as an upcoming initiative.

As the Kingdom continues to support artists through its dedication to cultural economic expansion, a variety of other sectors thrive. From fashion and film to growing job and investment opportunities, Saudi Arabia has cemented its identity as an influential and transformative asset.