Muhammad Ali’s refusal to sign his Vietnam-era military draft card upended the boxing champ’s life and added a powerful voice to the anti-war movement. Now that piece of history is coming up for sale.

There’s a blank line on the card where Ali was supposed to sign in 1967 but refused to do so — a polarizing act of defiance as the Vietnam War raged on. It triggered a chain of events that disrupted his storied boxing career but immortalized him outside the ring as a champion for peace and social justice.

“Being reminded of my father’s message of courage and conviction is more important now than ever, and the sale of his draft card at Christie’s is a powerful way to share that legacy with the world,” Rasheda Ali Walsh, a daughter of Ali, said Thursday in a statement issued by the auction house.

The auction house said it will hold the online sale Oct. 10-28, adding the card came to it via descendants of Ali. A public display of the card began Thursday at Rockefeller Center in New York and will continue until Oct. 21. The document could fetch $3 million to $5 million, Christie’s estimated.

“This is a singular object associated with an important historical event that looms large in our shared popular culture,” said Peter Klarnet, a Christie’s senior specialist.

Ali, the three-time heavyweight boxing champion, died in 2016 at age 74 after a long battle with Parkinson’s disease. An estimated 100,000 people chanting, “Ali! Ali!” lined the streets of his hometown of Louisville, Kentucky, as a hearse carried his casket to a local cemetery. His memorial service was packed with celebrities, athletes and politicians.

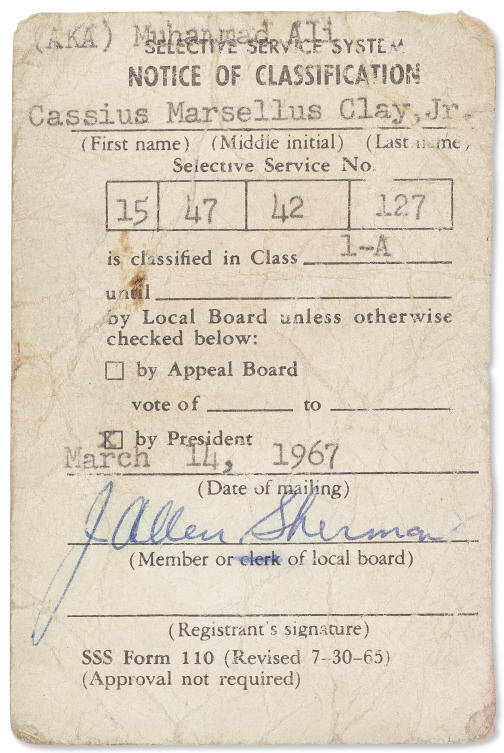

The draft card, typewritten in parts, conjures memories from when Ali wasn’t universally beloved but instead stood as a polarizing figure, revered by millions worldwide and reviled by many.

For refusing induction into the US Army, Ali was convicted of draft evasion, stripped of his boxing title and banned from boxing. Ali appealed the conviction on grounds he was a Muslim minister. He famously proclaimed: “I ain’t got no quarrel with them Viet Cong.”

During his banishment, Ali spoke at colleges and briefly appeared in a Broadway musical. He was allowed to resume boxing three years later.

He was still facing a possible prison sentence when in 1971 he fought Joe Frazier, his archrival, for the first time in what was labeled “The Fight of the Century.” A few months later the US Supreme Court overturned the conviction on an 8-0 vote.

The draft card was issued the day the draft board in Louisville ordered Ali to appear for induction, Christie’s said Thursday in a news release. The card was signed by the local draft board chairman but pointedly not by Ali.

The card identified him by his birth name — Cassius Marcellus Clay Jr. — but misspelled his given middle name. Upon his conversion to Islam, he was given a name reflecting his faith, the Muhammad Ali Center in Louisville says on its website. Meanwhile, the top of the draft card reads: “(AKA) Muhammad Ali.”

The Ali Center features exhibits paying tribute to Ali’s immense boxing skills. But its main mission, it says, is to preserve his humanitarian legacy and promote his six core principles: spirituality, giving, conviction, confidence, respect and dedication.

Now an artifact reflecting how Ali personified some of those principles will be up for auction.

“This is the first time collectors will be able to acquire a vital and intimate document connected to one of the most important figures of the last century,” Klarnet said Thursday.

Muhammad Ali’s unsigned draft card, a piece of Vietnam-era history, will be auctioned

https://arab.news/n257d

Muhammad Ali’s unsigned draft card, a piece of Vietnam-era history, will be auctioned

- There’s a blank line on the card where Ali was supposed to sign in 1967 but refused to do so

- The document could fetch $3 million to $5 million, the auction house estimated

How Netflix won Hollywood’s biggest prize, Warner Bros Discovery

- Board rejected Paramount’s $30 a share bid amid funding concerns, sources say

- Warner Bros board met daily before accepting Netflix’s binding offer

LOS ANGELES/NEW YORK: What started as a fact-finding mission for Netflix culminated in one of the biggest media deals in the last decade and one that stands to reshape the global entertainment business landscape, people with direct knowledge of the deal told Reuters. Netflix announced on Friday it had reached a deal to buy Warner Bros Discovery’s TV, film studios and streaming division for $72 billion. Although Netflix had publicly downplayed speculation about buying a major Hollywood studio as recently as October, the streaming pioneer threw its hat in the ring when Warner Bros Discovery kicked off an auction on October 21, after rejecting a trio of unsolicited offers from Paramount Skydance .

Details of Netflix’s plan and the Warner Bros board’s deliberations, based on interviews with seven advisers and executives, are reported here for the first time.

Initially motivated by curiosity about its business, Netflix executives quickly recognized the opportunity presented by Warner Bros, beyond the ability to offer the century-old studio’s deep catalog of movies and television shows to Netflix subscribers. Library titles are valuable to streaming services as these movies and shows can account for 80 percent of viewing, according to one person familiar with the business.

Warner Bros’ business units — particularly its theatrical distribution and promotion unit and its studio — were complementary to Netflix. The HBO Max streaming service also would benefit from insights learned years ago by streaming leader Netflix that would accelerate HBO’s growth, according to one person familiar with the situation. Netflix began flirting with the idea of acquiring the studio and streaming assets, another source familiar with the process told Reuters, after WBD announced plans in June to split into two publicly traded companies, separating its fading but cash-generating cable television networks from the legendary Warner Bros studios, HBO and the HBO Max streaming service.

Netflix and Warner Bros did not reply to requests for comment.

The work intensified this autumn, as Netflix began vying for the assets against Paramount and NBCUniversal’s parent company, Comcast.

Warner Bros kicked off the public auction in October, after Paramount submitted the first of three escalating offers for the media company in September. Sources familiar with the offer said Paramount aimed to pre-empt the planned separation because the split would undercut its ability to combine the traditional television networks businesses and increase the risk of being outbid for the studio by the likes of Netflix.

Around that time, banker JPMorgan Chase & Co. was advising Warner Bros Discovery CEO David Zaslav to consider reversing the order of the planned spin, shedding the Discovery Global unit comprising the company’s cable television assets first. This would give the company more flexibility, including the option to sell the studio, streaming and content assets, which advisers believed would draw strong interest, according to sources familiar with the matter.

Executives for the streaming service and its advisory team, which included the investment banks Moelis & Company, Wells Fargo and the law firm Skadden, Arps, Slate, Meagher & Flom, had been holding daily morning calls for the past two months, sources said. The group worked throughout Thanksgiving week — including multiple calls on Thanksgiving Day — to prepare a bid by the December 1 deadline.

Warner Bros’ board similarly convened every day for the last eight days leading up to the decision on Thursday, when Netflix presented the final offer that sources described as the only offer they considered binding and complete, sources familiar with the deliberations said.

The board favored Netflix’s deal, which would yield more immediate benefits over one by Comcast. The NBCUniversal parent proposed merging its entertainment division with Warner Bros Discovery, creating a much larger unit that would rival Walt Disney. But it would have taken years to execute, the sources said.

Comcast declined to comment.

Although Paramount raised its offer to $30 per share on Thursday for the entire company, for an equity value of $78 billion, according to sources familiar with the deal, the Warner Bros board had concerns about the financing, other sources said.

Paramount declined comment.

To reassure the seller over what is expected to be a significant regulatory review, Netflix put forward one of the largest breakup fees in M&A history of $5.8 billion, a sign of its belief it would win regulatory approval, the sources said. “No one lights $6 billion on fire without that conviction,” one of the sources said.

Until the moment late on Thursday night when Netflix learned its offer had been accepted — news that was greeted by clapping and cheering on a group call — one Netflix executive confided that they thought they had only a 50-50 chance.