ISLAMABAD: Pakistan sent 151,120 skilled laborers to Gulf countries in the first three months of 2025, state-run media reported on Monday, with Saudi Arabia topping the list of countries where the most number of Pakistani workers went.

A significant number of Pakistanis seek employment opportunities abroad for a better standard of living as the country grapples with macroeconomic challenges. Saudi Arabia, the United Arab Emirates (UAE) and other Gulf countries are key destinations for Pakistan’s skilled and unskilled workers, whose remittances are vital for the cash-strapped country.

“The report stated that the highest number of 121,970 Pakistanis went to Saudi Arabia, while 6,891 people went to the UAE, 8,331 to Oman, 12,989 to Qatar and 939 to Bahrain,” the Associated Press of Pakistan (APP) said.

“Bureau of Emigration and Overseas Employment, an attached department of the Ministry of Overseas Pakistanis and Human Resource Development had sent around 172,144 Pakistani workers abroad to different countries in the first three months of this year.”

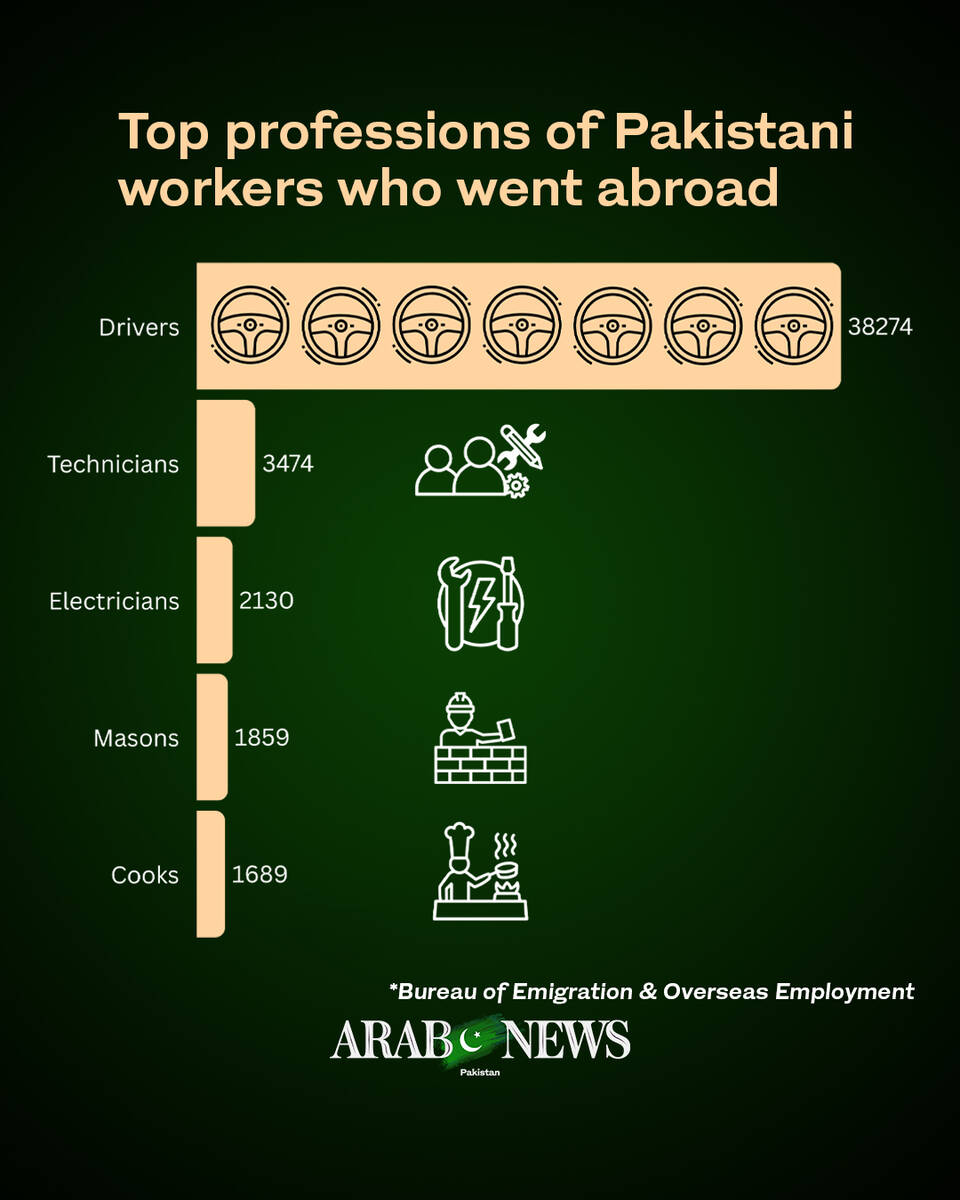

The report said of the Pakistani workers that went abroad, 38,274 were drivers, 3,474 technicians, 2,130 electricians, 1,859 masons, 1,689 cooks, 1,479 engineers, 1,058 welders, 849 doctors, 436 teachers and 390 were nurses.

The report highlighted that 1,454 workers also went to the United Kingdom, 870 to Turkiye, 815 to Greece, 775 to Malaysia, 592 to China, 350 to Azerbaijan, 264 to Germany, 257 to the United States, 109 to Italy and 108 to Japan in the same time period.

In 2024, the Overseas Pakistanis Ministry reported that 727,381 skilled laborers were sent to work in Middle Eastern and European countries. A senior Pakistani official said in February that the government was working to bridge the skills gap and enhance the global competitiveness of Pakistani workers, particularly in the Middle Eastern job market.

In January, Minister for Overseas Pakistanis and Human Resource Development Chaudhry Salik Hussain said Islamabad was focused on increasing the number of skilled workers heading to Saudi Arabia, highlighting the importance of an innovative project management and a well-trained labor force.

Pakistan sends approximately one million skilled workers abroad each year to help reduce unemployment and boost foreign exchange reserves through remittances.

Pakistan also received a record-high $4.1 billion in remittances in March 2025, a positive sign for the government’s efforts to revive an economy it expects to grow by three percent this year, with Saudi Arabia once again leading as the top contributor.