ISLAMABAD: A massive surge in fake news was witnessed during last month’s protest by former prime minister Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) party in Islamabad, the Fake News Watchdog said in its report on Sunday.

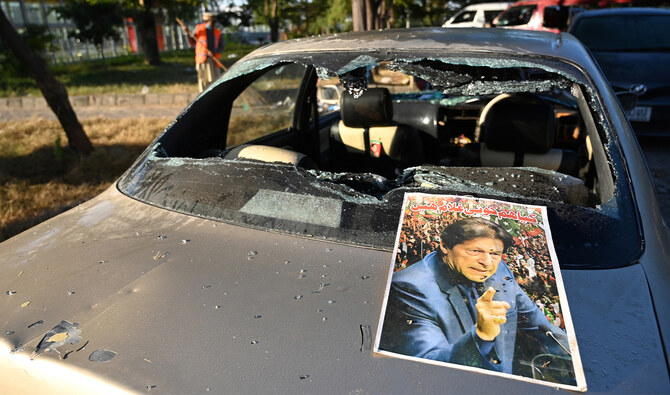

Khan’s party on Nov. 24 led thousands of supporters to Islamabad, seeking to pressure the government to release the ex-premier from jail and order an audit of Feb. 8 national election results. The protests resulted in clashes that Pakistan’s government says killed four law enforcers and injured hundreds of others.

The PTI has named 12 people and says it has evidence they lost their lives during the crackdown, however, several PTI members have given varied accounts of casualties during the protests. Pakistani authorities have denied the deaths, saying security personnel had not been carrying live ammunition during the protest.

Fake News Watchdog, an Islamabad-based non-profit organization fighting disinformation and misinformation, said in its report released on Sunday the Islamabad protest was marked by a “significant role of information warfare in shaping the narrative,” with dissemination of fake news and misinformation across print media, social media and television.

“The events surrounding the PTI protests from 24–27 November 2024 underscored the profound impact of fake news on political, social, and institutional dynamics in Pakistan. Misinformation during this period did not merely serve as a byproduct of political unrest; it actively shaped the narrative, inflamed tensions, and influenced public actions,” the report read.

“Fabricated content — whether through manipulated images, doctored videos, or false statements attributed to key figures — spread rapidly across social media and traditional news platforms, magnifying confusion and mistrust. This phenomenon revealed vulnerabilities in the country’s information ecosystem, where unverified claims gained traction in the absence of effective countermeasures.”

The watchdog said the role of social media was particularly significant, acting as both a tool for mobilization and a breeding ground for misinformation.

“The platform’s speed and reach allowed false narratives to proliferate unchecked, with emotionally charged content exploiting public sentiment,” it said in the report.

“At the same time, lapses in journalistic standards by mainstream media contributed to the problem, as unverified reports from influential outlets further legitimized misleading information.”

It said the widespread misinformation eroded public trust in media and government institutions, deepened political polarization, and led to exaggerated claims of violence, arrests and fatalities, contributing to unnecessary confrontations between protesters and law enforcers.

The coalition government of Prime Minister Shehbaz Sharif formed two task forces in the aftermath of the Islamabad protest: one to identify and take legal action against rioters and another to track and bring to justice suspects behind what the government described as a “malicious campaign” to spread “concocted, baseless and inciting” online news, images and video content against the state and security forces.

Last week, Pakistan’s army also called for action against “political elements” using “fake news for vested interests.”

“This pre-planned coordinated and premeditated propaganda reflects continuity of a sinister design by certain political elements as an attempt to drive a wedge between the public & Armed Forces and institutions of Pakistan,” the army said in what was a clear reference to Khan’s PTI party, following a meeting of its top commanders.

“This futile attempt, fueled and abetted by external players, will never be successful.”

Khan, who remains a popular figure in Pakistan despite being in prison and facing several court cases, has led a campaign of unprecedented defiance against the Sharif coalition and the all-powerful military, which he accuses of being behind his ouster from office in 2022. The army denies it interferes in politics.

Last week, the ex-premier also threatened to launch a civil disobedience movement and asked supporters to converge on Dec. 13 in Peshawar, the capital of the Khyber Pakhtunkhwa (KP) province which is ruled by his party.