ISLAMABAD: Pakistan’s Finance Minister Muhammad Aurangzeb has invited firms in the United States (US) to explore investment opportunities in the South Asian country, the Pakistani government said late Thursday, amid Islamabad’s push to boost investment and trade to support its weak economy.

Pakistan, which recently secured a $7 billion bailout from the International Monetary Fund (IMF), has been making attempts to overcome an economic meltdown that sent its foreign exchange reserves to critically low levels, led to currency devaluation and high inflation.

The Pakistani finance minister is currently in the US to attend the annual World Bank and IMF meetings, where global finance leaders have convened to address challenges such as sluggish international growth, managing debt distress and financing the transition to green energy.

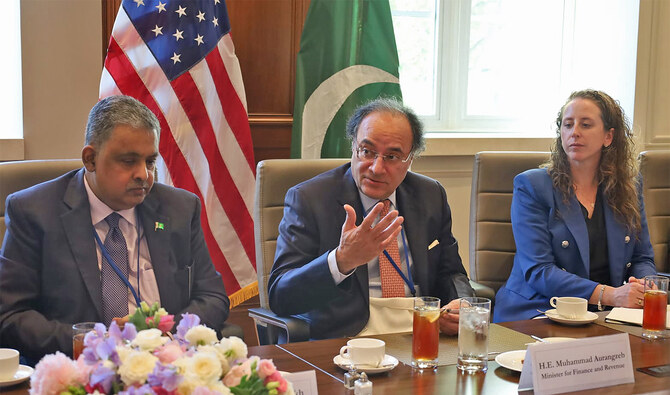

On Thursday, Aurangzeb had a luncheon with members of the US-Pakistan Business Council (USPBC), which aims to enhance trade and investment between the US and Pakistan, in Washington, according to the Press Information Department (PID) of the Pakistani government.

“The minister noted that the presence of over 80 US enterprises in Pakistan reflects the profit potential of a 240 million strong market,” the PID said in a statement. “He invited US firms to take advantage of the government’s investment-friendly policies and the one-window facility offered by the Special Investment Facilitation Council.”

The finance minister acknowledged the contributions of the USPBC in strengthening trade and investment ties between Pakistan and the US, reiterating the prime minister’s invitation to the council to lead a business delegation to Pakistan this year to explore mutually beneficial partnerships.

Pakistan has increasingly sought trade and investment cooperation with allies and beyond in recent months as it navigates the macroeconomic crisis that has drained its resources. The South Asian country has had a flurry of high-level exchanges with Saudi Arabia, Japan, Azerbaijan, Qatar and Central Asian countries in a bid to support its $350 billion fragile economy.

Separately, Aurangzeb attended a series of investor fora organized by Citibank, Standard Chartered and JP Morgan in Washington. During these interactions, he briefed the investors on the Pakistani economy’s performance for the last fiscal year.

“The minister highlighted key reforms in taxation, energy, SOEs [state-owned enterprises], privatization, and right-sizing of the government,” the PID said. “He emphasized the role of provincial governments in raising the tax-to-GDP ratio and discussed the National Fiscal Pact signed by the Federal Government.”

He also addressed investor questions about the Sovereign Wealth Fund, Special Economic Zones, and Power Purchase Agreements being negotiated with Chinese independent power producers.

Finance minister invites US firms to explore investment opportunities in Pakistan

https://arab.news/6jqh4

Finance minister invites US firms to explore investment opportunities in Pakistan

- Muhammad Aurangzeb is currently in the US to attend the annual World Bank and IMF meetings

- Pakistan is seeking to boost trade and investment as it navigates a tricky path to economic recovery

Pakistan-origin fintech holds workforce pay workshop in Saudi Arabia

- Riyadh event promotes earned wage access to support employee liquidity

- Abhi Saudi says flexible pay models can boost retention and productivity

KARACHI: Pakistan-origin fintech Abhi Saudi hosted a workforce-focused workshop in Riyadh, the company said in a statement on Thursday, bringing together senior business leaders to discuss employee financial well-being and flexible pay solutions as Saudi Arabia advances reforms under Vision 2030.

Abhi, a financial technology firm founded in Pakistan and operating in the Gulf through Alraedah Digital Solutions, provides earned wage access (EWA) and small and medium enterprise (SME) financing solutions.

EWA allows employees to withdraw a portion of their already-earned salary before the official payday, helping them manage short-term liquidity needs without relying on traditional credit.

Abhi partners with thousands of firms across the region, offering payroll-linked financial services to employers and their staff.

“The event focused on modern workforce strategies and flexible pay solutions, highlighting how financial well-being initiatives such as Earned Wage Access (EWA) are supporting improved employee engagement, retention, and productivity while aligning with the objectives of Saudi Vision 2030,” the company said.

The “Wages Well-being Workshop” brought together professionals from sectors including telecommunications, banking, consulting and human resources to examine how changing workforce expectations are influencing compensation models and employer responsibilities amid the Kingdom’s broader economic transformation.

According to Abhi, discussions centered on the organizational impact of rigid salary structures, the link between financial stress and workplace performance and how flexible pay models could enhance financial stability without adding operational costs for employers.

Saudi Arabia’s Vision 2030 reform agenda seeks to diversify the economy, strengthen private-sector participation and modernize labor market practices, with financial inclusion and workforce productivity forming key pillars of the strategy.