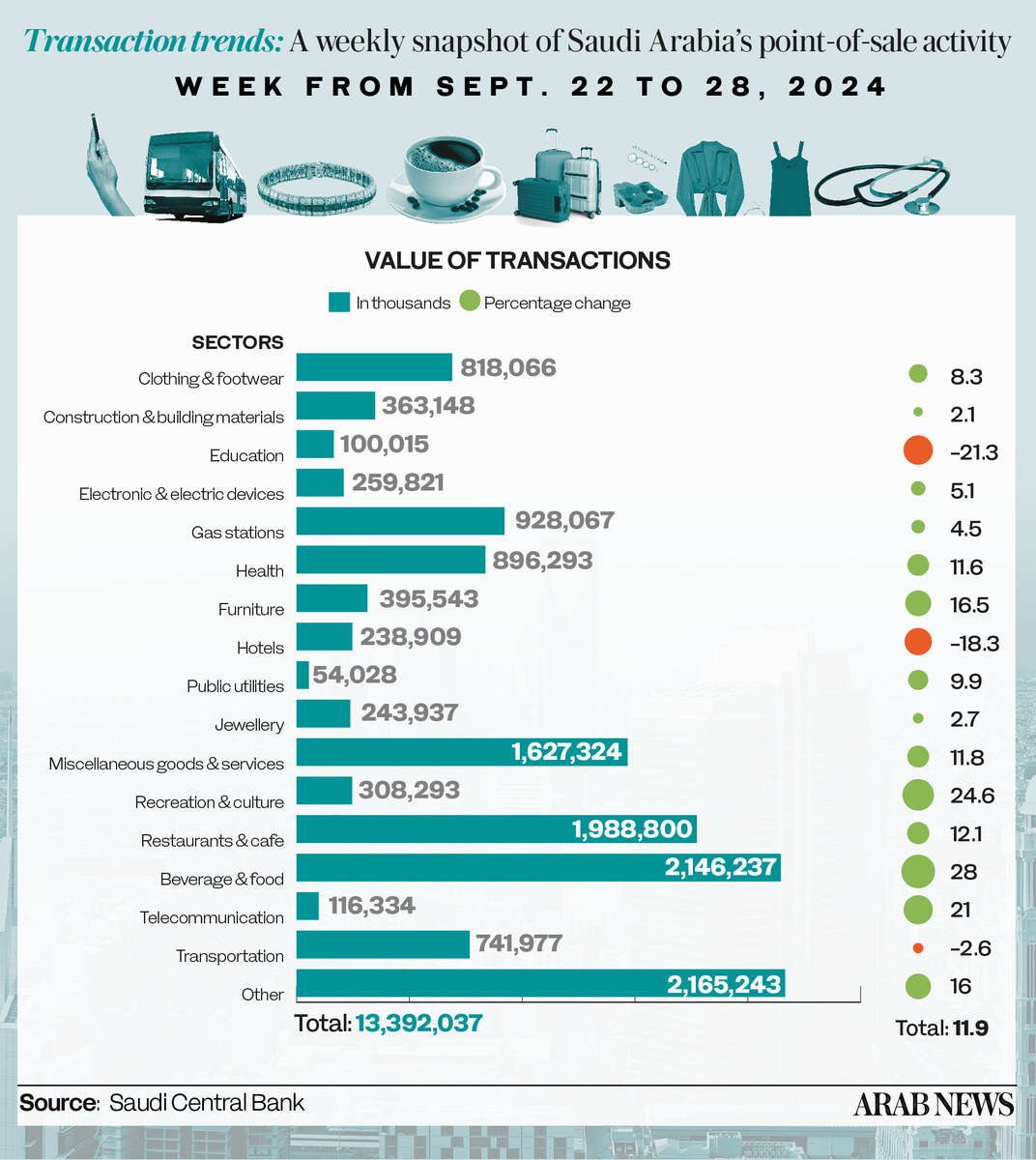

RIYADH: Saudi Arabia’s point-of-sale transactions surged 11.9 percent in the last week of September, reaching SR13.3 billion ($3.4 billion), with the food and beverages sector leading the uptick.

The latest figures from the Saudi Central Bank, also known as SAMA, showed that spending in this sector during the week from Sept. 22-28 recorded the highest increase at 28 percent, with total transactions reaching SR2.14 billion.

Spending on recreation and culture followed with a 24.6 percent increase to SR308.2 million. The telecommunications division recorded the third largest uptick with a 21 percent positive change, reaching SR116.3 million.

Expenditure on education recorded the most significant decline at 21.3 percent, coming in at SR100 million during this period. The latest figures showed that spending in the education sector continued its downfall trajectory for over a month after surging for four consecutive weeks, coinciding with the start of the academic year on Aug. 18.

Saudis spent SR238.9 million on hotels in the seven-day period, reflecting an 18.3 percent drop frrom the previous week, and SR741.9 million on transportation, marking a 2.6 percent decrease.

Only those three sectors experienced declines this week, with most other industries seeing growth.

The food and beverages sector saw the largest share of the POS, followed by restaurants and cafes at SR1.98 billion and miscellaneous goods and services at SR1.62 billion.

Spending in the top three categories accounted for approximately 43 percent or SR5.7 billion of this week’s total value.

Geographically, Riyadh dominated POS transactions, representing 33.5 percent of the total, with spending in the capital reaching SR4.49 billion — an 8.4 percent increase from the previous week.

Jeddah followed with a 6.8 percent surge to SR1.82 billion, accounting for 13.6 percent of the total, and Dammam came in third at SR658.7 million, up by 7.1 percent.

Tabuk saw the most significant increase in spending, up by 23 percent to SR265.1 million. Hail and Abha came in second and third places, with expenditures surging 22.5 percent and 11 percent to SR220.9 million and SR167.8 million, respectively.

In terms of the number of transactions, Tabuk recorded the highest increase at 10.9 percent, reaching 4.7 million transactions. Makkah recorded the smallest increase at 2.2 percent, reaching 8.2 million.