RIYADH: Saudi Arabia is emerging as a global leader in fixed-income and debt markets, as the Kingdom’s economic transformation accelerates under Vision 2030.

The shift comes due to the rise in ambitious construction projects and infrastructure development, and the need to diversify financial portfolios and manage risks more effectively.

The expansion into these divisions highlights Saudi Arabia’s growing influence in global finance, positioning it to play a significant role in capital markets traditionally dominated by more developed economies.

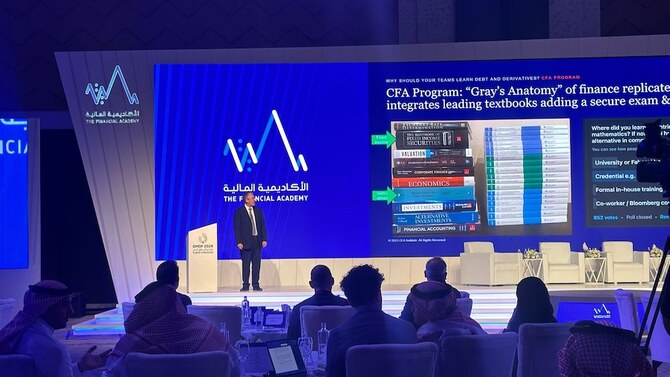

At the Debt Markets and Derivatives Forum 2024 in Riyadh, experts discussed the Kingdom’s increasing engagement with fixed income, debt, and derivatives, underscoring their importance in driving the country’s financial growth.

Financing Vision 2030: The role of debt markets

Saudi Arabia’s ambitious Vision 2030 plan has brought massive investments in infrastructure and development, primarily financed by debt.

As the world’s largest construction market, the Kingdom now surpasses China in concrete consumption per capita, a sign of the rapid pace of development.

Speaking during a panel at the event, Rob Langrick, the chief product advocate at the US-based Chartered Financial Analyst Institute, said that debt financing is critical in this context, adding: “Construction tends to be financed with debt, and Saudi Arabia is leading the world in both concrete usage and fixed income issuance.”

Saudi Arabia’s rise as a major player in the bond market is also a direct result of Vision 2030 and, since its inception in 2016, the country has seen a surge in bond issuances, especially in dollar-denominated fixed income. Today, it has surpassed China as the leading emerging market issuer of fixed-income securities, a testament to its evolving financial landscape.

A long road ahead for debt issuance and the potential of green bonds

Despite the significant increase in bond issuance, Saudi Arabia retains considerable potential to increase its debt further. The Kingdom’s debt-to-gross domestic product ratio stands at around 30 percent, relatively low compared to other emerging markets.

Langrick said this provides a “long runway” for further debt issuance to finance future projects, particularly those tied to Vision 2030’s transformative goals.

This runway presents opportunities for domestic growth and positions Saudi Arabia as a hub for global fixed-income investors.

The country’s financial markets are focused on traditional debt instruments and capitalizing on the rising global demand for sustainable finance. Green bonds, in particular, are seen as a future growth area, especially with the Kingdom’s vast potential in renewable energy.

The nation is well-positioned to develop large-scale solar and wind projects due to their vast supply, and Langrick said that issuing green bonds could help finance these undertakings, adding a new dimension to the Kingdom’s bond market and aligning with the broader Saudi Green Initiative launched in 2021.

Building the derivatives market: A path to deeper financial integration

While fixed income is an established area of growth, the derivatives market in Saudi Arabia is still in its early stages, having launched in 2020. Over the past four years, the necessary building blocks have been put in place for the sector to grow.

According to the head of custody and securities services at Saudi National Bank, Jalal Faruki, capital and stock lending has been one of the primary drivers of this growth, specifically over the past 18 months.

Faruki said: “Stock lending is a natural activity that drives derivatives markets, and we’ve seen it picking up recently, creating opportunities for further market development.”

The SNB head also emphasized the importance of educating retail investors, who still dominate the Kingdom’s market, on the intricacies of derivatives. The challenge lies in helping these backers understand the potential of these financial instruments to hedge risks and enhance returns, specifically as the market matures.

Fixed income and derivatives: Critical for sovereign wealth funds

As Saudi Arabia’s Public Investment Fund continues its trajectory to becoming the world’s largest sovereign wealth backing by 2030, learning to manage fixed income and derivatives becomes even more crucial.

Fixed income markets provide a stable, uncorrelated asset class that can generate consistent returns, which is vital for long-term financial sustainability, according to Langrick.

Derivatives, on the other hand, offer sophisticated tools for hedging risks, including currency mismatches that could arise as Saudi Arabia increasingly imports goods for its infrastructure projects.

Langrick stressed the importance of mastering these markets, saying: “Fixed income is always a feature of sovereign wealth funds.”

By developing expertise in these areas, the Kingdom’s financial institutions can better navigate the complexities of international markets, ensuring sustainable growth and economic stability.