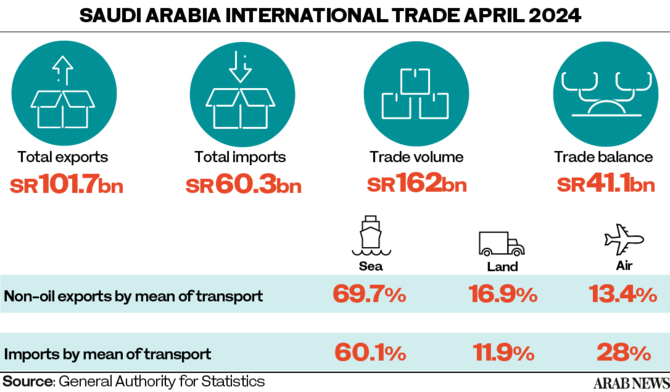

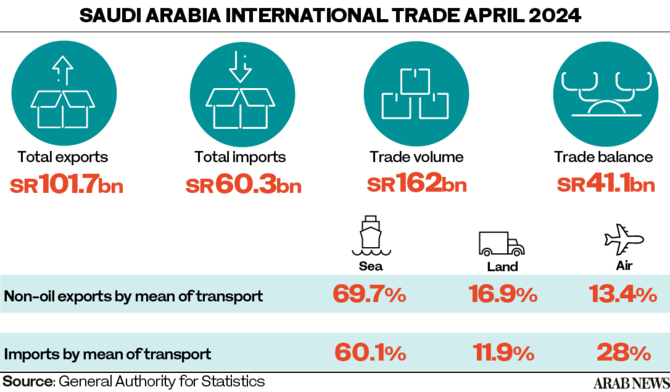

RIYADH: Saudi Arabia’s trade balance surplus hit a year-high of SR41.4 billion ($11.04 billion) in April, a 36 percent increase from the previous month, fueled by a surge in non-oil exports.

According to the General Authority for Statistics, the Kingdom’s non-oil shipments rose by 12.4 percent in April compared to the same month last year.

This comes as the Kingdom intensifies its efforts to boost non-oil exports to reduce its reliance on the energy sector and diversify its economy. The significant growth underscores Saudi Arabia’s commitment to strengthening other sectors and achieving a more balanced economic structure.

National non-oil exports, excluding re-exports, saw a modest rise of 1.6 percent in April this year compared to April 2023, while re-exported goods experienced a substantial increase of 56.4 percent over the same period.

In contrast, overall outbound merchandise supply fell by 1.0 percent, primarily due to a 4.2 percent decline in oil exports. As a result, the proportion of oil in total outbound supply decreased from 80.6 percent in April 2023 to 78.0 percent in April this year.

Imports also saw a slight decline of 1.3 percent, and the merchandise trade balance surplus dropped by 0.5 percent compared to the previous year.

Month-over-month comparisons show a decrease in the value of merchandise exports by 1.7 percent, non-oil exports by 6.3 percent, and imports by 17.4 percent. However, the Kingdom’s trade balance still saw a substantial increase.

The ratio of non-oil merchandise exports to imports improved significantly, rising to 37.1 percent in April from 32.6 percent in April 2023. This improvement is attributed to the increase in non-oil exports and the decrease in imports.

Plastics, rubber, and their products were among the top non-oil exports, making up 26.2 percent of the total and growing by 20.5 percent compared to April 2023.

Chemical products also constituted a significant portion, accounting for 25.7 percent of non-oil exports, although they saw a 13.8 percent decrease from the previous year.

On the import side, machinery, electrical equipment, and parts were the leading category, representing 26.6 percent of total imports and increasing by 32.4 percent compared to April 2023.

Transportation equipment and parts followed, making up 11.7 percent of imports but decreasing by 24.5 percent from the previous year.

China remained Saudi Arabia’s largest trading partner, receiving 16.6 percent of total exports in April 2024. Japan and India followed with 9.2 percent and 8.1 percent of total exports, respectively.

These top three countries, along with South Korea, the UAE, and the US, alongside Poland, Bahrain, Malaysia, and Singapore, collectively accounted for 65.6 percent of the Kingdom’s total exports.

China also led in imports to Saudi Arabia, constituting 22.4 percent of total imports. The US and India followed, with 8.3 percent and 6.6 percent of total imports, respectively.

Imports from the top ten countries made up 62.2 percent of the total.

The main entry points for imports into the Kingdom included King Abdulaziz Sea Port in Dammam with 29.7 percent, Jeddah Islamic Sea Port with 18.4 percent, and King Khalid International Airport in Riyadh with 14.3 percent.

Other ports included King Abdulaziz International Airport with 7.6 percent and King Fahad International Airport in Dammam with 5.9 percent.

Together, these five ports handled 76.0 percent of Saudi Arabia’s total merchandise imports.

These statistics are based on administrative records from the Zakat, Tax and Customs Authority and the Ministry of Energy, with classifications according to the Harmonized System maintained by the World Customs Organization.