ISLAMABAD: Pakistan’s government under three-time former Prime Minister Nawaz Sharif’s party had the best performance in managing the South Asian nation’s economy over the past three decades compared with rivals, an analysis by Bloomberg Economics published this week said.

Using a misery index for Pakistan — an informal measure of the state of an economy generated by adding together its rates of inflation and unemployment — Bloomberg Economics found that Sharif’s Pakistan Muslim League (PML-N) scored better than Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) and the Pakistan Peoples Party (PPP) of former foreign minister Bilawal Bhutto Zardari.

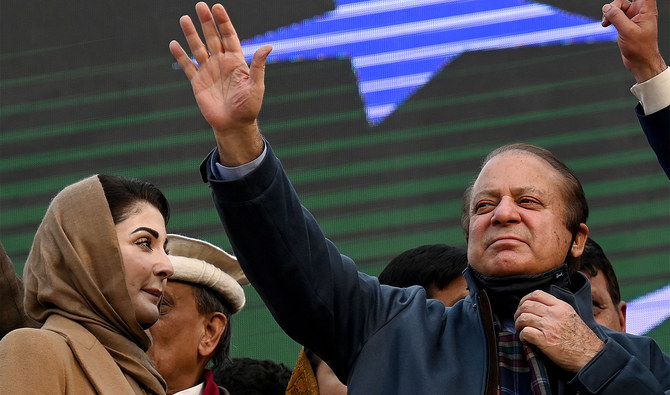

The past three decades saw the PML-N rule Pakistan four times under Sharif and his younger brother Shehbaz Sharif. The PPP under the Bhutto dynasty has held power three times, while Khan was in office for a four-year term ending in April 2022 when he was ousted from power in a parliamentary no-trust vote.

“Bloomberg Economics used an average of the index values over the respective years when each of the major political parties ruled the country since 1990. A higher value indicates more economic hardship for citizens,” the publication said, explaining its conclusions.

Bloomberg Economics Misery Index Results for Pakistan showed the Pakistan Muslim League scored 14.5 percent, Pakistan Tehreek-e-Insaf 16.1 percent and the Pakistan Peoples Party 17.2 percent.

Despite a higher misery index, Khan is still the most popular politician, with an approval rating of 57 percent, according to a recent Gallup opinion poll. Sharif’s ratings have jumped to 52 percent from 36 percent in the past six months.

“The public may be giving Sharif the benefit of the doubt,” Ankur Shukla of Bloomberg Economics wrote in the report, adding that “road ahead won’t be easy for any party that wins the election,” given inflation remains near record highs and unemployment is also elevated.

Inflation is close to 30 percent in Pakistan, the currency was Asia’s worst performer last year and foreign exchange reserves have slumped.

The country is currently relying on a financial bailout from the International Monetary Fund, and under the fund’s conditions, the new government will need to implement policies that may be unpopular with voters, such as withdrawing subsidies and raising taxes.

The IMF expects Pakistan’s economy to grow 2 percent in the current fiscal year after contracting in the previous year.