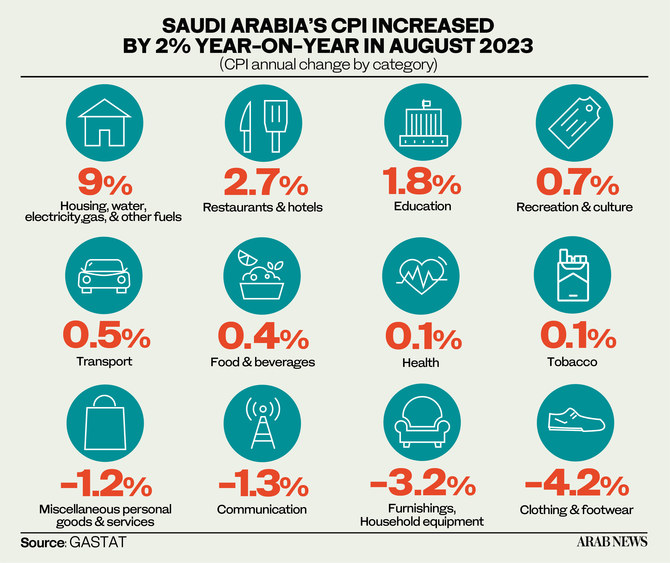

RIYADH: Driven by relatively stable prices across various sectors, Saudi Arabia’s inflation dropped to 2 percent in August compared to 2.3 percent in July, official data showed.

According to the report released by the General Authority for Statistics, one of the key contributing factors to the decrease was the fall in prices of furnishings, household equipment, and maintenance, which experienced a decline of 0.3 percent in August compared to July.

Furthermore, the data revealed that clothing and footwear prices dipped by 0.3 percent during the same period, while expenses related to restaurants and hotels saw a slight uptick of 0.6 percent.

In contrast, housing, water, electricity, gas, and other fuels prices rose by 0.7 percent in August compared to July, primarily driven by a 0.8 percent increase in rent costs.

On an annual basis, Saudi Arabia’s inflation went up by 2 percent, the report showed. This increase is primarily attributed to a rise in actual rents for housing, which surged by 10.8 percent.

“Prices for rents were the main driver of the inflation rate in August 2023 due to their high relative importance in the Saudi consumer basket with a weight of 21 percent,” said GASTAT.

Additionally, the report noted that food and beverages expenses rose by 0.4 percent annually in August, primarily driven by a rise in milk, milk products, and egg prices, which increased by 5.9 percent.

In the same month, restaurant and hotel prices rose by 2.7 percent, largely due to a 2.1 percent increase in catering service prices.

Saudi Arabia’s ability to maintain a healthy inflation rate stands out at a time when many countries around the world are grappling with rising prices due to economic uncertainties.

In the UK, for example, while inflation rates have started to show signs of slowing down, they remain relatively high, with an annual rate of 6.8 percent in July 2023, according to the European Nation’s House of Commons.

Earlier this month, the International Monetary Fund praised Saudi Arabia’s ability to maintain its average consumer price index despite inflationary pressures faced by other nations.

The IMF also highlighted the Kingdom’s strong near-term fiscal prospects, driven by its economic diversification efforts in alignment with the goals outlined in Vision 2030.

Meanwhile, GASTAT, in another report, revealed that Saudi Arabia’s wholesale price index dropped by 0.3 percent in August compared to the same month of the previous year.

The authority said the decrease in the Kingdom’s WPI was driven by the decline in prices of basic chemicals, which went down by 18 percent.

Agriculture and fishery products prices decreased by 2.3 percent in August annually, while metal products, machinery and equipment expenses dipped by 1.1 percent.

According to GASTAT, the Kingdom’s WPI dipped by 0.9 percent in August from July.