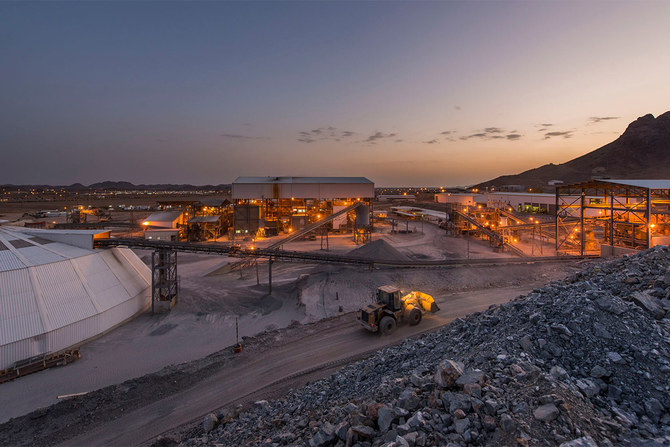

RIYADH: Saudi Arabia has put forward eight mining complexes in the Riyadh region and the Eastern Province for competition, signaling its ongoing commitment to attract investments in the sector.

The Ministry of Industry and Mineral Resources launched this initiative as part of its broader strategy to enhance transparency, attract investment, and foster growth in local communities connected to mining projects.

The Eastern Province will host six of these complexes, including Al-Ghunan, Al-Suman, Al-Misnah, Ras Al-Qaryah, and the eastern and western Salwa complexes. The Riyadh region will see the establishment of two more complexes in Al-Armah and Hofayrat Nesaah.

The move seeks to tap into Saudi Arabia’s abundant mineral resources, driving economic growth.

The ministry also stated that it aims to further promote investment in the mining sector, attract specialized businesses interested in investing, contribute to boosting economic activity and increasing non-oil revenues in line with the objectives of Vision 2030.

HIGHLIGHTS

The Eastern Province will host six of these complexes, including Al-Ghunan, Al-Suman, Al-Misnah, Ras Al-Qaryah, and the eastern and western Salwa complexes.

The Riyadh region will see the establishment of two more complexes in Al-Armah and Hofayrat Nesaah.

Raising the proportion of purchases from local markets in the mining project is also part of the ministry’s goals, as well as developing plans for effective communication in the area surrounding these projects.

Furthermore, the ministry seeks to preserve the environment, promote occupational health and safety, and encourage local communities to take part in the mining sector’s growth.

On the sustainability front, it also aims to boost investors’ confidence in it and protect natural resources from unauthorized encroachment.

The mining sector in Saudi Arabia is witnessing exceptional growth as the government pushes to promote the industry through more investment and improved rules in order to attract more private firms.

In order to advance the industry, the ministry updated its mining investment law in 2020 and created an integrated long-term mining system that would protect both workers and the environment.

The government anticipates that these developments will have a positive ripple effect on related industries, creating jobs and increasing domestic expenditure in Saudi Arabia.

Saudi Arabia is on pace to make mining the third pillar of its economy, and it is working intensively to utilize the estimated 5,300 mineral resource sites worth SR5 trillion ($1.33 trillion).