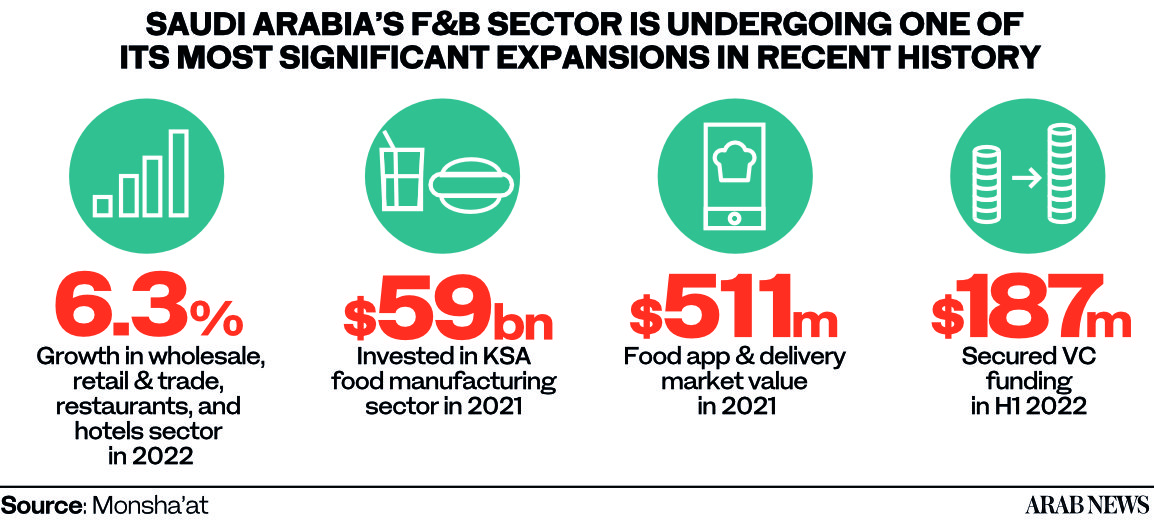

CAIRO: Saudi Arabia’s food and beverage sector increased 6.3 percent in the first half of 2022, according to the Kingdom’s Small and Medium Enterprises Authority, also known as Monsha’at.

Small and medium enterprises have made the sector even more attractive for investors, as $187 million were invested in the Kingdom’s F&B startups in the first half of 2022, according to research firm MAGNiTT’s Saudi Arabia Venture Capital report.

Foodics, one of Saudi Arabia’s leading startups in the F&B space, spearheaded the investment growth in the second quarter of 2022, raising $170 million in April from Saudi, Dutch and Indian investors.

The food app and delivery markets are also seeing huge growth as they were valued at $511 million in 2021 and are expected to grow by 10 percent annually through 2026.

The Kingdom has been betting big on diversifying its economy. With the rise of an entrepreneurial generation, the government aims to attract 100 million visitors annually through the F&B sector by 2030.

In the second quarter of 2022, some of the leading international restaurant chains in the US, UK and UAE have entered the Saudi market, such as New York-based Black Tap, London’s AOK Kitchen, and Double Like Burger and Lobster from the UAE.

Monsha’at attributes the growth to a new generation of entrepreneurs entering the F&B industry with diverse ideas like food trucks, cafes, pop-up dining, restaurants and food delivery businesses.

Besides the diversity in ideas, there has been an increase in women consumers with the end of gender-segregated dining, a rise in large sporting events, and Monsha’at’s support for burgeoning enterprises.

“We were fortunate to get an enormous amount of help from Monsha’at. Waiving our Ministry of Labor fees made a tremendous difference in allowing us to hire and expand exactly when the company needed to,” founder of Saudi-based startup Falak Foods, Bakr Alhozaimi, said in a statement.

Bandr bin Abdullah Alobied, deputy governor for strategy at Monsha’at, said in a statement that despite being one of the most competitive industries, F&B is booming in the Kingdom because of good disposable income, a diverse palate and new cultural outlets.

“In the past quarter alone, we have seen new German, Greek, Italian, French, American, British and Emirati restaurants, cafes, concepts and chains open across Saudi Arabia.

“Blessed with a young and highly educated population that has come of age with greater exposure to the world, people are experimenting with new culinary traditions, not to mention a wide array of high-quality new cafes,” Alobied added.

Moreover, the Kingdom has also seen vast growth in the coffee sector as the Saudi government declared 2022 the Year of Saudi Coffee.

Cultivating rich Arabica beans, the Kingdom has planted over 400,000 trees in over 2,500 plantations in the three coffee-producing cities, Jazan, Al Baha and Aseer.

The Jazan province alone has over 330km of coastline, 1,985 coffee farms and 340,000 coffee trees. It grows 2,040 tons of green coffee beans per year.

Recognized as one of the Kingdom’s national treasures, the Khawlani coffee bean has seen a 70 percent increase in production over recent years.

A Public Investment Fund company, the Saudi Coffee Co., is also joining in to boost growth as it plans to invest $319 million in sustainable coffee production over the next 10 years.