DUBAI: Agthia, a food and beverage company based in Abu Dhabi, has saved 97 million dirhams ($26.4 million) in 18 months as part of its Strategy 2025 program.

Alan Smith, CEO of Agthia, told Arab News that the company had committed to saving 200 million dirhams over five years as part of its long-term strategy envisaged in 2021.

“The company saved 97 million dirhams in just 18 months,” said a beaming Smith, adding that the company plans to become a leader in the Middle East, North Africa and Pakistan by 2025.

The group plans to expand into consumer business and have a consumer-centric mix of 75 percent of revenues.

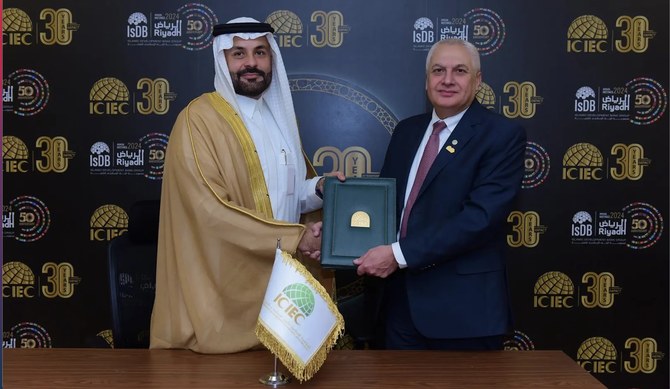

Agthia Group CEO Alan Smith. (Supplied)

In July 2022, the company’s board approved the acquisition of a strategic 60 percent stake in Auf Group, a specialized healthy snacks and coffee manufacturer and retailer in Egypt.

Agthia has also received its board’s approval to acquire 60 percent of Egyptian coffee maker Auf Group as it expanded its footprint in the North African country last month.

Growth crossroads

The company acquired five companies in 2021, which included Al Foah Dates in the UAE, Al Faysal Bakery & Sweets in Kuwait, Nabil Foods in Jordan, Atyab in Egypt and BMB, a fully integrated food company in the UAE.

And these acquisitions contributed 73 percent of the total revenue for the six months ending June 30, 2022.

Agthia Group’s net revenue grew 51 percent year on year to 2 billion dirhams in the first half of this year, according to the company’s results.

Smith said that compared to a few years ago, Agthia’s revenue was 2 billion dirhams on a full-year basis.

BACKGROUND

The company saved 97 million dirhams in just 18 months, said Smith, adding that the company plans to become a leader in the Middle East, North Africa and Pakistan by 2025.

“I think the number is about 73 percent, so we’re very close to our long-term commitments,” he added.

Due to the seasonality advantages the company sees in the snacking business and the growth in the protein business. Smith said the contribution of the consumer business division to the overall revenue will be at least 75 percent on a full-year basis, if not more.

Before acquiring five companies last year, Agthia’s revenue was split 50-50 between consumers and agribusinesses.

Besides the brands acquired in 2021, the consumer business includes Yoplait dairy products and a slew of water and beverage brands such as Al Ain and Al Bayan. On the other hand, the agribusiness produces Grand Mills flour and Agrivita animal feed.

“What we are seeing in quarter two is the consolidation of all five acquisitions we did last year,” he said.

Optimization opportunity

According to Smith, Agthia generates 50 percent of its revenue from the UAE and the rest from other parts of the world.

The company has also taken cost optimization measures to increase its revenue and improve profitability. For instance, the confectionery and healthy food brand BMB had a manufacturing facility each in Dubai Investment Park and Jebel Ali.

After the acquisition, Agthia closed one of BMB’s facili- ties and consolidate it into an existing Agthia manufacturing facility.

“It was a rented facility that we shut down and moved that production into Agthia’s own facility,” Smith said.

Smith said Agthia’s financial results and Strategic 2025 plan are on track despite market volatility.

Agthia is currently setting up a new manufacturing unit in Saudi Arabia for Nabil Foods, the firm’s protein brand, to meet the growing demand for the product line from local customers. Earlier this year, the company announced the greenfield investment of 90 million dirhams to set up the facility.

According to Smith, the facility’s design is completed, and the scope of work for tendering has been outlined. He is now awaiting necessary approvals for the Saudi manufacturing facility from the competent authority.

With this project, Agthia will be able to increase its footprint in the Kingdom and support its strategy to become one of the most prominent players in the Middle East and North Africa consumer packaged goods market.