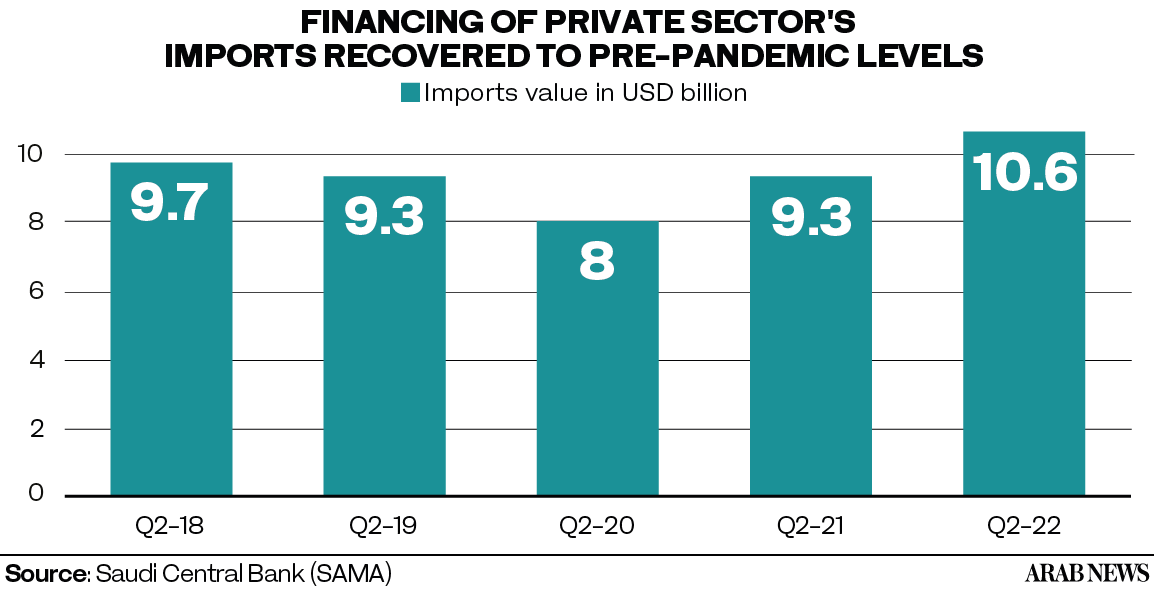

CAIRO: Saudi Arabia’s private sector import financing surpassed pre-pandemic levels totaling SR39.6 billion ($10.6 billion) in the second quarter of 2022 year-on-year, according to data released by the Saudi Central Bank, also known as SAMA.

Private sector imports financed through settled letters of credit and bills received increased by SR5 billion in the second quarter of 2022 year-on-year, surpassing the pre-pandemic aggregate of SR34.8 billion.

During the COVID-19 pandemic, import financing dropped to SR30 billion in the second quarter of 2020, the data showed.

It then recovered to SR34.6 billion in the second quarter of 2021 as the global economy started to rebound. In 2022, import financing hit its highest level since the third quarter of 2016.

Financing to import building materials, machinery, and textiles and clothing saw an increase of SR815 million, SR551 million, and SR38 million respectively in the second quarter of this year compared to the same period a year ago.

HIGHLIGHTS

Private sector imports financed through settled letters of credit and bills received increased by SR5 billion in the second quarter of 2022 year-on-year.

Financing to import building materials, machinery, and textiles and clothing saw an increase of SR815 million, SR551 million, and SR38 million respectively.

The main driver of positive change in the value of the private sector’s imports financed through settled LCs and bills received was the 'other goods.'

Food grains, and fruits and vegetables both increased by SR451 million and SR65 million year on year in the second quarter respectively.

The three sectors accounted for 10 percent, 3.7 percent and 0.5 percent respectively of the total import financing.

The main driver of positive change in the value of the private sector’s imports financed through settled LCs and bills received was the “other goods.” This category totaled half of the total financing and increased by SR4.3 billion year on year this quarter.

Nevertheless, LC and bill financings for the Saudi importers of foodstuffs declined by SR214 million in the second quarter compared to the same period of 2021, showed the data.

Foodstuff, which made up 12.7 percent of the total financing for the private sector’s imports, had categories that both grew and shrunk in the past year.

Food grains, and fruits and vegetables both increased by SR451 million and SR65 million year on year in the second quarter respectively.

Sugar, tea and coffee, livestock and meat and other foods all saw a yearly decline in imports financed through settled LCs and bills by Saudi commercial banks. Sugar, tea and coffee made up 0.4 percent of the total financing, and fell by SR147 million in this quarter compared to the same quarter in 2021.

Livestock and meat made up 0.82 percent of the total, and witnessed a year-on-year decline by SR212 million in the second quarter of 2022. Whereas other foodstuffs made up 6.5 percent of the total, and dropped by SR371 million in the second quarter of 2022 compared to the same period in 2021, showed the data.

Apart from the fall in value of agricultural imports financed through LCs and bills, the financing for motor vehicle imports also fell by SR265 million, and appliances also fell by SR144 million year on year in the second quarter.

Looking at suppliers’ geography, the Gulf Cooperation Council contributed 40 percent of imports financed through LCs settled at Saudi banks (excluding bills), totaling SR10.1 billion in the second quarter of 2022.

A report published by the International Trade Administration stated: “Saudi Arabia has signed various trade agreements (especially with the GCC) that allow member countries total exemption from customs duties.”

Asian countries other than China, Japan and South Korea came in second with 22.9 percent of settled LCs which recorded SR5.7 billion in the second quarter.

Western Europe, China and South Korea followed with 10.2 percent, 8.4 percent, and 7.1 percent.