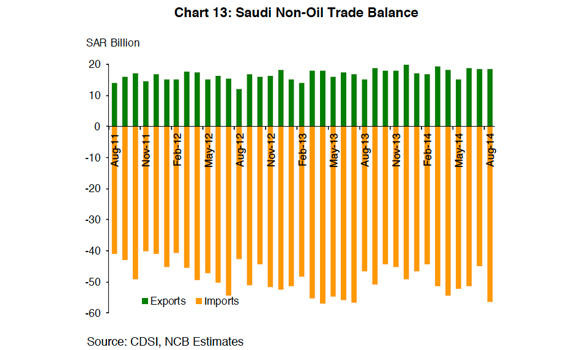

Saudi exports continued their consistent annualized growth in August after realizing SR18.5 billion in returns, a 22 percent surge over the same period last year. Monthly volatility noticeably dampened this year, averaging at around SR18.2 billion a month. The contractual nature of most of the Kingdom’s heavyweight exports limited the negative spillover effects from the waning global demand. Imports, on the other hand, recorded SR56.5 billion; a 19.6 percent Y/Y expansion, according to a report by the National Commercial Bank (NCB).

The data decoupled from last year’s trend in July after it recorded the largest slump to date with SR46.4 billion. This anomaly, along with August’s double-digit growth, occurred in correlation with the shifting seasonality of Ramadan leading to higher annualized data dispersion in July and August. Therefore, the balance of trade gap has widened by 18.4 percent in August compared to last year.

In value terms, the NCB report said more than 34 percent of the export composition consisted of plastics, valued at around SR6.3 billion, and thus leaping over last year’s figure by 7.8 percent. Chemical products recorded SR5.4 billion, rising by 4.4 percent Y/ Y, and making up 29.5 percent of the exports revenue.

Exports of base metals were valued at SR1.7 billion, a solid annualized surge of 42.1 percent despite sliding commodity prices. By destination, the UAE received the lion’s share of just under SR2 billion worth of exports, thus surging by 44.5 percent Y/Y. China came in as a close second with SR1.87 billion, a figure 14.9 percent lower than last year’s, indicating that Chinese troubles are taking their toll on the country’s insatiable demand. India rose above Singapore as the third largest trading partner in August attracting exports valued at SR1.1 billion, a soaring 38.8 percent Y/Y upturn. Machinery and electrical equipment continue to dominate as the most sought after imports in the Kingdom, allocating almost 28 percent of the monthly import bill for this category.

In the month of August, imports of machinery and electrical equipment surged by around 25 percent compared to last year, recording SR15.7 billion. This surge stems from the government’s continued expansionary fiscal policy which includes a 25 percent increased spending on infrastructure projects such as railways, roads and airports. Construction companies raised their capital expenditure to cope with the scope of these projects which also reflected on imports of transport equipment, surging by 28.6 percent to SR9.7 billion.

Imports of base metals also posted a double-digit growth of 21.7 percent worth SR6.9 billion. Over 15.4 percent of the import bill came from China which at SR8.7 billion rose by 35.4 percent Y/Y. US imports to the Kingdom also saw a double-digit growth of 12.7 percent versus last year, valued at SR7.1 billion. Germany is the third largest source of imports as it accounts for over 7 percent of the import bill at SR4 billion.

The NCB report said settled letters of credit (LCs) in the month of August totaled SR20.8 billion, marking the first pick-up since May. On an annual basis, LCs surged by 80.7 percent due to a relatively low figure in August 2013 of just SR11.5 billion. LCs of motor vehicles retained their share as the largest category of goods financed through banks, posting SR4.3 billion, which also returned it to positive annual growth territory of 38.4%. Machinery LCs recorded SR2.2 billion, a staggering 104 percent upturn compared to last year. Building materials’ LCs also soared 80.5 percent Y/ Y, recording SR2.1 billion.

Saudi imports rise 19.6 percent to SR56.5 billion

Saudi imports rise 19.6 percent to SR56.5 billion

Saudi Arabia pulls in most of Partners for Growth $450m capital push

- Global private credit fund leans into region’s largest market for growth-stage technology financing

RIYADH: Saudi Arabia has captured the vast majority of Partners for Growth’s capital deployed in the Gulf Cooperation Council, as the global private credit fund leans into what it sees as the region’s largest market for growth-stage technology financing.

The San Francisco-based firm has deployed about $450 million in commitments in the GCC, and “the vast majority of that is in Saudi,” said Armineh Baghoomian, managing director at the firm who also serves as head of Europe, the Middle East and Africa and co-head of global fintech.

The company was one of the earliest lenders to Saudi fintech unicorn Tabby, and it’s clear the Kingdom is providing fertile territory for ongoing investments.

“We don’t target a specific country because of some other mandate. It’s just a larger market in the region, so in the types of deals we’re doing, it ends up weighing heavily to Saudi Arabia,” Baghoomian said.

Partners for Growth, which Baghoomian described as a global private credit fund focused on “growth debt solutions,” lends to emerging tech and innovation companies, particularly those that struggle to access traditional credit.

“We’re going into our 22nd year,” she said, tracing the strategy back to its roots in a Bay Area investment bank debt practice in the mid-1980s.

Today, the firm lends globally, she said, deploying capital where it sees fit across markets including Australia, New Zealand, and Southeast Asia, as well as Latin America and the GCC, where it has been active for about six years.

Shariah structures dominate PFG’s Gulf deals

In the Gulf, the firm’s structures are often shaped by local expectations. “Most of the deals we’ve done in the region are Shariah-compliant,” Baghoomian said.

“In terms of dollars we’ve deployed, they’re Shariah-structured,” she added.

“Usually it’s the entrepreneur who requires that, or requests it, and we’re happy to structure it,” Baghoomian said, adding that the firm also views Shariah structures as “a better security position in certain regions.”

Growth debt steps in where banks cannot

Baghoomian framed growth debt as a practical complement to equity for companies that have moved beyond the earliest stage but are not yet “bankable.”

She said: “The lower-cost bank type facilities don’t exist. There’s that gap.”

Baghoomian added that companies want to grow, “but they don’t want to keep selling big chunks of equity. That implies giving up control and ownership.”

For businesses with the fundamentals private credit providers look for, she said, debt can extend runway while limiting dilution.

“As long as they have predictable revenue, clear unit economics, and the right assets that can be financed, this is a nice solution to continue their path,” she added.

That role becomes more pronounced as equity becomes harder to raise at later stages, Baghoomian believes.

She pointed to a gap that “might be widening” around “series B-plus” fundraising, as later-stage investors become “more discriminating” about which deals they back.

Asset-heavy fintechs cannot scale on equity alone

For asset-heavy technology businesses, Baghoomian argued, debt is not just an option but a necessity.

She pointed to buy-now-pay-later platform Tabby as an example of a model built on funding working capital at scale.

“Tabby is an asset-heavy business,” she said. “They’re providing installment plans to consumers, but they still need to pay the merchant on day one. That’s capital-intensive. You need a lot of cash to do that.”

Equity alone, she added, would be structurally inefficient. “You would not want to just raise equity. The founders, employees, everyone would own nothing and lose a lot of control.”

We don’t target a specific country because of some other mandate. It’s just a larger market in the region, so in the types of deals we’re doing, it ends up weighing heavily to Saudi Arabia.

Armineh Baghoomian, PFG managing director and head of Europe, the Middle East and Africa and co-head of global fintech

Baghoomian said those dynamics are common across other asset-intensive models, including lending platforms and businesses that trade in large inventories such as vehicles or property. “Those are businesses that inherently end up having to raise quite a bit of credit,” she said. Partners for Growth’s relationship with Tabby also reflects how early the firm can deploy capital when the structure is asset-backed. “We started with Tabby with $10 million after their seed round, and then we grew, and we continue to be a lender to them,” Baghoomian said.

“On the asset-backed side, we can go in quite early,” she said. “Most of the fintechs we work with are very early stage, post-seed, and then we’ll grow with them for as long as possible.”

As the market for private credit expands in the Gulf, Baghoomian emphasized discipline — both for lenders and borrowers.

For investors assessing startups seeking debt, she said the key is revenue quality and predictability, not just topline growth. “Revenue is one thing, but how predictable is it? How consistent is it? Is it growing?” she said. “This credit is not permanent capital. You have to pay it back. There’s a servicing element to it.”

Her advice to founders was more blunt: stress-test the downside before taking leverage.

“You have to do a stress test and ask: if growth slows by 30 to 40 percent, can I still service the debt? Can I still pay back what I’ve taken?” she said.

Baghoomian warned against chasing the biggest facility on offer. “Sometimes companies compete on how much a lender is providing them,” she said. “We try to teach founders: take as much as you need, but not as much as you can. You have to pay that back.”

Partners for Growth positions itself as an alternative to banks not only because many growth-stage companies cannot access bank financing, but because it can tailor structures to each business.

HIGHLIGHTS

• Partners for Growth positions itself as an alternative to banks not only because many growth-stage companies cannot access bank financing, but because it can tailor structures to each business.

• The firm lends globally deploying capital where it sees fit across markets including Australia, New Zealand, and Southeast Asia, as well as Latin America and the GCC, where it has been active for about six years.

One of Partners for Growth’s differentiators, Baghoomian said, is how bespoke its financing is compared with bank products.

“These facilities are very bespoke. They’re custom to each company and how they need to use the money,” she said, adding that the fund is not offering founders a rigid menu of standardized options.

“No two deals of ours look alike,” she said, framing that flexibility as especially important at the growth stage, when business needs can shift quickly.

That customization, she added, extends beyond signing. Baghoomian said the firm aims to structure facilities so companies can actually deploy capital without being constrained, adding: “We don’t want to handcuff you. We don’t want to constrain you in any way.”

As a company evolves, she said the financing can evolve too, because what works on day one often won’t fit nine months later.

“We’ll revise structures,” she said, describing flexibility as core to how private credit can serve fast-moving tech businesses.

She added that a global lender can also bring operating support and market pattern recognition, while still accounting for local nuance.

Baghoomian expects demand for private credit in the Gulf to keep rising. “They are going to require credit, for sure,” she said, pointing to the scale of new platforms and projects.

“I don’t see it shrinking,” she said, adding that Partners for Growth is seeing more demand and is in late-stage discussions with several companies, though she declined to name them.

PFG to stay selective despite rising competition

Competition among lenders has increased since the firm began deploying in the region, Baghoomian said, calling that “very healthy for the ecosystem.”

Most of what the firm does in the region is asset-backed, Baghoomian said, often through first warehouse facilities for businesses financing receivables or other tangible exposures, “almost always Shariah.”

Keeping Egypt on its watchlist

Beyond the Gulf, Baghoomian said the firm is monitoring Egypt closely, though macroeconomic volatility has delayed deployments.

“We looked at Egypt very aggressively a few years ago, and then the macro issues changed,” she said, adding that the firm continues to speak with companies in the country and track conditions.

Even as private credit becomes more common in the region, Baghoomian underscored that debt is not universally appropriate.

“Not every company should take a loan or credit,” she said. “You don’t take it just to take it. It should be getting you to the next milestone.”