CAIRO: Saudi Arabia’s bank loan portfolio rose by SR289 billion ($77.1 billion) in the second quarter of this year from the same quarter a year ago, according to a recent statistical bulletin released by the Saudi Central Bank, also known as SAMA.

Bank loans totaled SR2.42 trillion at the end of the second quarter of 2022, up from SR1.95 trillion in the second quarter of 2021, showed the SAMA report.

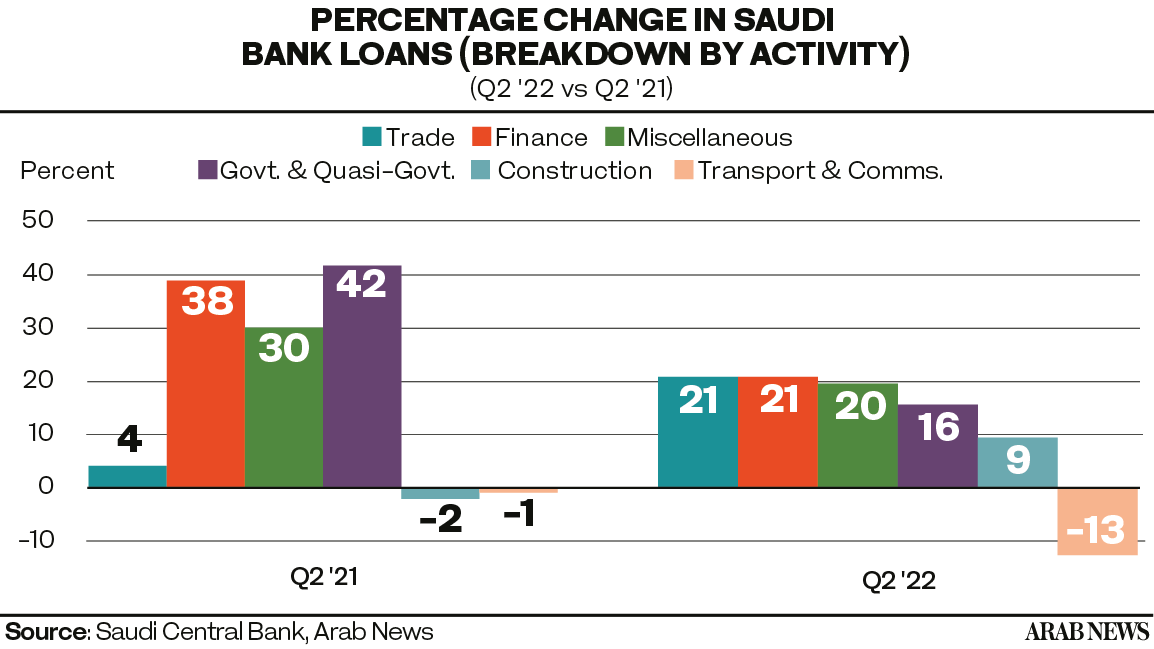

The SR289 billion increase was led by an SR191.1 billion growth in miscellaneous activities. Its share increased by 2 percentage points to 52 percent in the second quarter of 2022.

The data showed that the value of Saudi banks’ aggregate loan portfolio totaled SR2.24 trillion at the end of the second quarter of 2022, up 14.8 percent from the year before and up 4 percent from the previous quarter.

The annual growth in bank loans dropped to a negative in 2017 and remained below zero until the third quarter of 2018. However, bank loans have been seeing an upward trend ever since, according to the SAMA report.

From the third quarter of 2018 until the end of 2019, the value of Saudi bank loans grew at an average rate of 3.7 percent year on year; between 2020 and the second quarter of this year, it grew at an average rate of 14.8 percent year on year.

The dominating segment in the Kingdom’s loans was miscellaneous economic activity, which acquired 52 percent of the total loans this quarter.

Commerce came in second, holding 17.2 percent of total loans in the country, recording SR385.7 billion in the second quarter, showed the data.

The Ministry of Commerce in the Kingdom has been moving toward the Saudi Vision 2030 by developing the trade sector and ensuring its sustainability, according to the Kingdom’s Unified National Platform.

The platform stated: “The Ministry of Commerce’s mission focuses on improving the business environment in Saudi Arabia through enacting, developing and supervising the implementation of flexible and fair trade policies and regulations.”

Even though total bank loans expanded this quarter, two economic activities saw a quarterly decline in bank credit in the second quarter of this year: manufacturing and processing and transport and communication.

Bank loans to transport and communication fell by SR6.2 billion in the second quarter of 2022 from the same quarter the previous year.

Compared to the previous quarter, the sector dropped from 2.1 percent of total loans in the first quarter to 1.9 percent, showed the SAMA bulletin.

Bank loans given to manufacturing and processing fell by SR4 billion in the second quarter of 2022 from the same quarter the previous year.

The data showed that the sector dropped from 7.2 percent of total loans in the first quarter to 6.9 percent compared to the previous quarter.