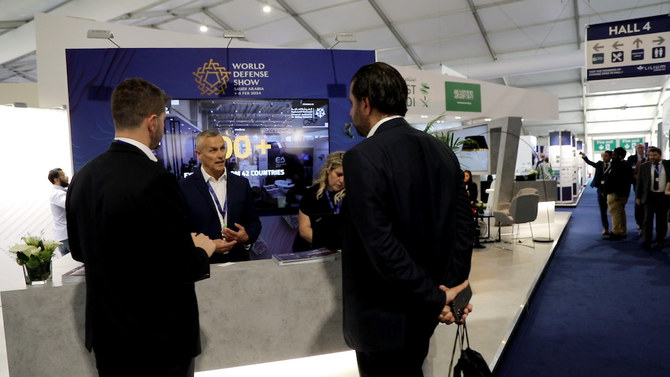

FARNBOROUGH, UK: Saudi Arabia’s World Defense Show is at the UK’s Farnborough International Airshow this week to promote its second expo, which organizers revealed on Tuesday will take place from Feb 4 to 8, 2024.

“We are here promoting the next World Defense Show in 2024, so really we’re selling the show to all of the exhibitors here,” WDS CEO Andrew Pearcey told Arab News.

“A lot of the exhibitors that attend Farnborough are the type of exhibitors we want attending the World Defense Show and there is a really international audience here, which really works well for us.”

WDS is joined at the Farnborough show, which began on Monday and continues until Friday, by the Saudi General Authority for Military Industries, which is the Kingdom’s defense regulator; Saudi Arabian Military Industries, which is owned by the Kingdom’s Public Investment Fund; and Invest Saudi, which is part of the Ministry of Investment.

WDS organizers said that already a number of potential new exhibitors have expressed interest in taking part in the second staging of the event in Riyadh. The first WDS took place in March this year.

“We had such a successful inaugural show — 65,000 trade visitors, over 600 exhibitors, 35,000 square meters of exhibition space — and of course now it’s on the map, definitely awareness has grown. So, we’re expecting the show to get bigger and better,” said Pearcey.

He added that organizers are currently looking at ways to expand the show, including the addition of another exhibition hall. As a result, the floor plan for the event has not yet been finalized but when it is, by September, they will be ready to start contacting interested parties.

“There’s lots of new things, so we’re looking to bring space to the show,” said Pearcey. “So we want to create a space zone, because space is a big area for defense. And in fact aerospace here at Farnborough, it’s a big thing.”

He added there is also a desire to put a greater focus on technology at the 2024 event and showcase the latest developments in that area.

“Saudi Arabia has got really good SME (small-to-medium) innovation companies coming through; we want to showcase that,” said Pearcey. “We will have a technology area and zone that showcases the future of defense and technology … and on top of that we want to see more flying displays.”

When the first WDS was held in March, heavy sandstorms hit the Kingdom and forced the cancelation of most of the planned aerial displays. As a result, organizers decided to shift the next show to February, when the weather is likely to be better.

“So, really it’s about bringing some new things to the show, making the things we have even better and growing it,” said Pearcey.

Given the ambitious climate initiatives and targets adopted by the Kingdom, he added that there will also be a focus on sustainability during the planning and staging of the show, including recycling and other efforts to keep the event’s carbon footprint as small as possible.

“It’s quite difficult to do but it is on our agenda,” he added.