RIYADH: The Saudi Cabinet has approved a law allowing the creation of a new type of company in the Kingdom to boost entrepreneurship.

The new Companies law was signed off on Tuesday, and will regulate all provisions related to companies, whether commercial, non-profit or professional.

It allows a new form of company — called a Simplified Joint Stock Company — that meets the needs of entrepreneurship and venture capital growth.

It also allows the issuance of a family charter that regulates ownership in family businesses, in addition to governance, management, work policy, employment of family members and cash profits to ensure the sustainability of these companies.

“The new law will improve the financing and business dynamics in every sector in the economy, it should have a great positive impact on the economy for the next decades,” CEO of Razeen Capital, Mohammed Al Suwayed, told Arab News.

“I can't point out a single impact because the impact is going to be happening in all of the sectors gradually,” he said.

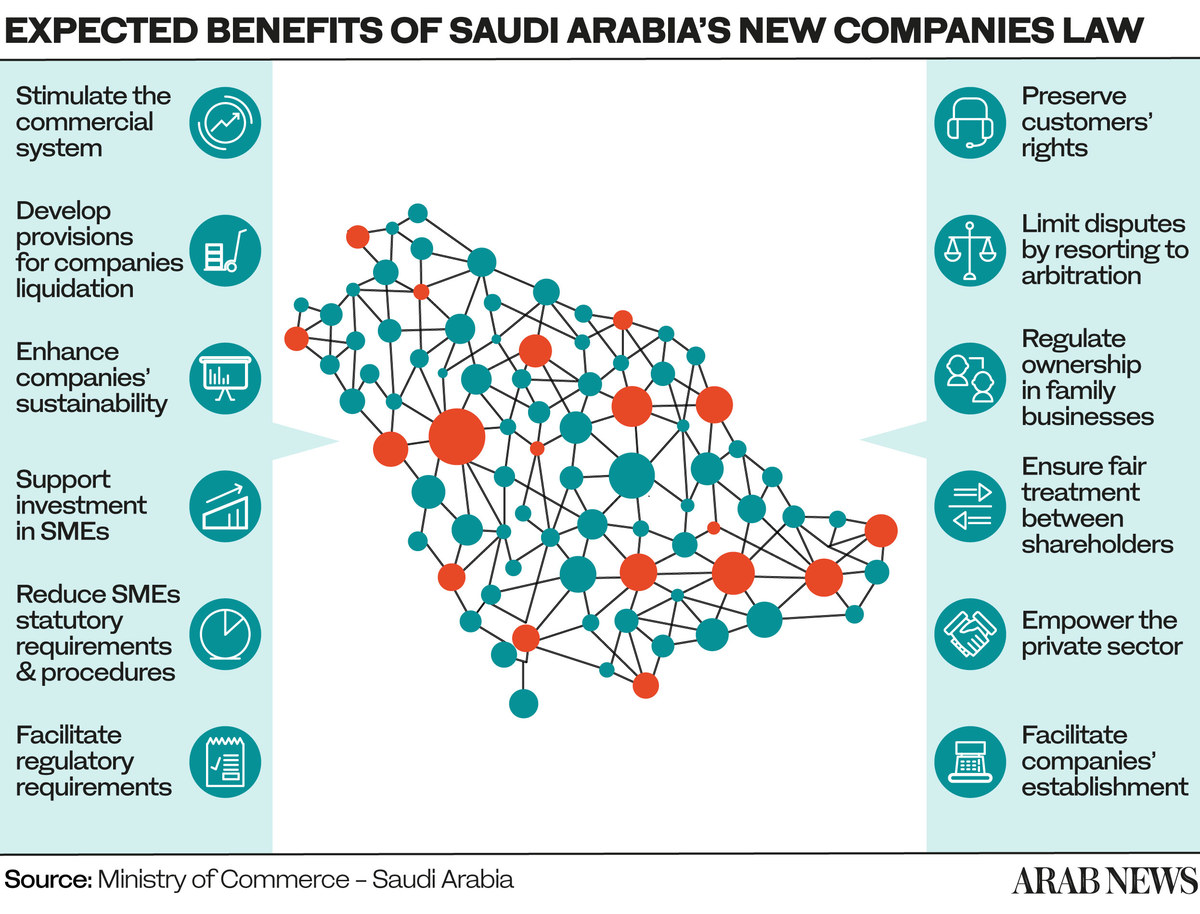

It also reduces the legal requirements and procedures for small and medium enterprises, and simplifies the procedures for establishing companies.

Under this law, many restrictions in the incorporation, practice and exit phases and restrictions on company names have been removed.

According to the Ministry of Investment, the changes will also enhance the diversity and strength of the local market, and raise the level of competitiveness of the Saudi investment environment.

“The new corporate system came to achieve the hopes of family businesses, organize their business by concluding the family charter, encourage bold investment and address the challenges of entrepreneurs by approving the simplified joint stock company,” the Minister of Commerce Majid Al-Kassabi said.

Real Estate Brokerage law

Another law signed off was the Real Estate Brokerage law, which aims to regulate the brokers business and provide innovative and high-quality services to beneficiaries.

“The Saudi Cabinet’s ratification of the real estate brokerage law will help ensure the reliability of real estate transactions through the Real estate General Authority,” Majid Al-Hogail, Minister of Municipal, Rural Affairs and Housing said on Twitter.

He added that It will also help raise the level of services provided and preserve the rights of customers in the sector through standards and procedures for doing business.

Al-Hogail indicated that real estate brokerage services are limited to brokers licensed by the General Real Estate Authority, and brokerage contracts and real estate transactions must be submitted electronically.

He said the commission and prepayment must be determined, and that violators will be subject to penalties under the law.

Abdullah Al-Hammad, CEO of the Real Estate General Authority, described the law as a “positive addition.”

“This law complements the legislative system that the General Real Estate Authority is working on to regulate the real estate market in the Kingdom of Saudi Arabia,” he told CNBC.

The new corporate system will play a pivotal role in supporting and strengthening the regulatory environment for commercial and economic entities, the chairman of the Capital Market Authority said.

The system aims to facilitate the procedures and regulatory requirements to stimulate the business environment and support investment, Mohammed Elkuwaiz added.