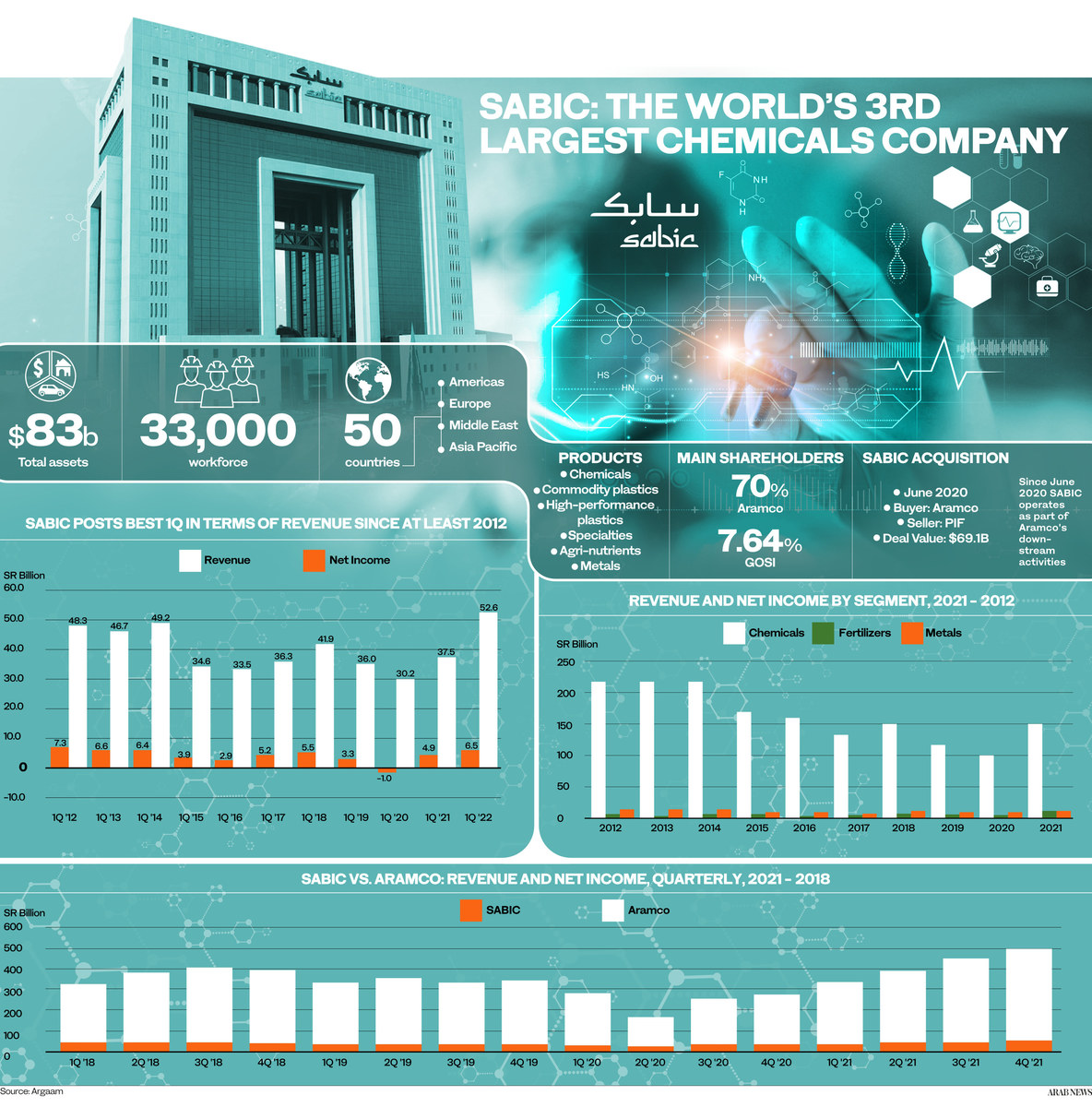

RIYADH: Saudi chemical giant SABIC has reported a 33 percent surge in first-quarter profits, buoyed by 40-percent growth in sales to SR53 billion ($14 billion).

Profits soared to SR6.47 billion last quarter, compared to SR4.9 billion in the same quarter a year earlier, according to a bourse filing.

The Riyadh-based company attributed the stronger results to higher average selling prices which were up 3 percent on a quarterly basis as well as an increase in sales volume.

SABIC’s net profit of SR6.47 billion ($1.72 billion) after Islamic zakat and other taxes topped the 5.125 billion riyals forecast by analysts, Refinitiv data showed.

Sales rose 40 percent to SR52.64 billion, topping analysts forecast of SR50.042.

“SABIC’s first-quarter results demonstrated strong performance driven by continued healthy demand for our products, higher oil prices, and our diverse global portfolio,” commented CEO, Yousef Al-Benyan.

“In 2022, SABIC will remain focused on delivering its growth strategy, achieving operational resilience, and meeting our ESG commitments while at all times maintaining a strong balance sheet,” he added.

Among the major developments this quarter, SABIC announced the successful start-up of the Gulf Coast Growth Ventures, a world-scale manufacturing facility in San Patricio County, Texas.

It also completed its purchase of Clariant’s 50 percent share in Scientific Design, a leading catalysts producer and licensor of high-performance process technologies. This will unlock new growth potential for SABIC by strengthening and complementing the high-performance capabilities of its Specialties business.

SABIC’s first-quarter results demonstrated strong performance driven by continued healthy demand for our products.

Yousef Al-Benyan, CEO

During the first quarter of 2022, SABIC continued to drive greater sustainability and innovation across the global chemicals industry. The company recently introduced a new bio-based and ISSC+ certified copolymer to help the consumer electronics industry achieve net-zero carbon emission goals.

In the reporting period, five innovative technologies created by SABIC were named among the winners of the annual Edison Awards, which honor the world’s most innovative new products, services and business leaders. The awards in four different categories reflect SABIC’s diverse range of innovative solutions.

SABIC’s commitment to adopting the highest Environmental, Social and Governance (ESG) Standards was also recognized during the first quarter of 2022, with the company claiming the “Best ESG” Award at the Saudi Capital Market Awards 2021

State oil giant Saudi Aramco bought a 70 percent stake in SABIC from Public Investment Fund in June 2020.

SABIC said synergies from Saudi Aramco’s stake purchase as of March 2022 stood at SR2.09 billion, including SR334 million in 2022.

Outlook

Commenting on the performance, Al-Benyan said the results for the first quarter were unprecedented, but cost pressures are expected to weigh on earnings for the rest of the year.

Speaking at SABIC’s post-earnings announcement conference, he reiterated that solid figures were supported by enhanced diversification of products, higher oil prices and stronger global reach, with SABIC’s latest ExxonMobil venture in the US Gulf Coast contributing largely to the results.

Still, a drop in demand on the back of higher inflation and interest rates as well as rising feedstock costs and supply chain woes remain a challenge.

“The average of the cost increased by 3 percent compared to the fourth quarter in 2021, and by 90 percent from the first quarter of 2021,” Al-Benyan noted.

Al-Benyan concluded that geopolitical tensions which sent oil prices to record levels posed no threat to SABIC’s operations, adding that it still doesn’t plan to enter the debt market.

Shares down

Shares of Saudi Basic Industries Corp. went down on Thursday. The Riyadh-based company saw its share price drop by 1.6 percent to SR121 ($32.3) at the closing bell, hours after it announced a surge in first-quarter profit.

Despite a 33 percent profit jump, the chemical major said it expects a drop in demand in addition to rising costs to weigh on earnings for the rest of the year.