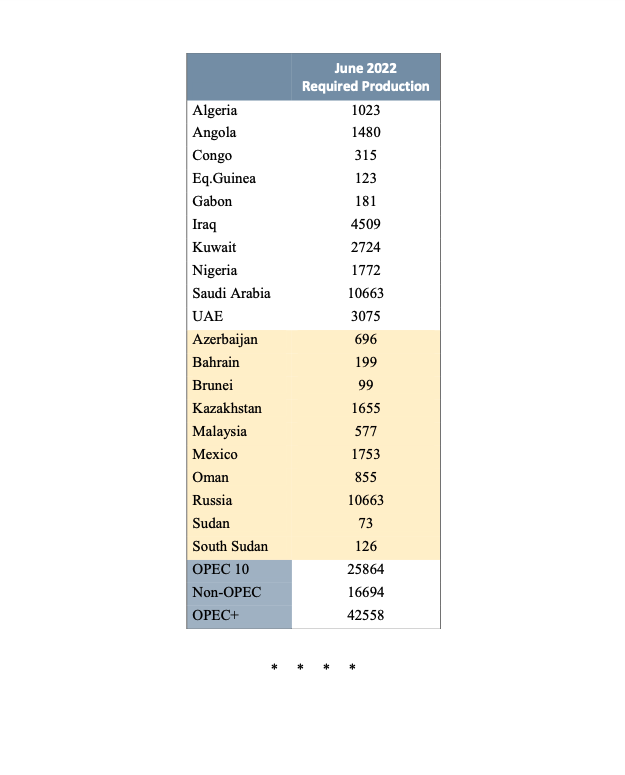

The Organization of Petroleum Exporting Countries and its allies agreed on Thursday to stick to plans for a gradual oil output increase — amounting to 432,000 barrels per day in June.

The decision was taken by all ministers before the formal start of the OPEC+ meeting, according to Reuters, despite the volatility of the markets caused by Russia's invasion of Ukraine and new COVID-19 lockdowns in China.

The decision was later confirmed by an official statement.

The OPEC+ meeting came a day after the EU proposed a phased oil embargo on Russia in its toughest measures yet to punish Moscow for its war in Ukraine.

Speaking ahead of the meeting, OPEC Secretary General Mohammad Barkindo said it was not possible for other producers to replace Russian supply.

“What is clear is that Russia’s oil and other liquids exports of more than 7 million bpd cannot be made up from elsewhere. The spare capacity just does not exist,” Barkindo said on Wednesday.

OPEC now expects 2022 world oil demand to expand by 3.67 million bpd in 2022, down 480,000 bpd from its previous forecast. Barkindo said the Chinese lockdowns were curbing demand.

“Higher prices could be around the corner,” said Bjornar Tonhaugen, head of oil markets research at Rystad Energy, according to AP.

“The oil market has not fully priced in the potential of an EU oil embargo, so higher crude prices are to be expected in the summer months if it’s voted into law,” he added.

OPEC Secretary General Mohammad Barkindo (File/AFP)

Oil markets react

Oil prices extended on Thursday after the OPEC+ announcement.

As of 4.30 p.m Saudi time, Brent crude is priced at $113.83 a barrel, while the West Texas Intermediate is at $111.33 per barrel.

US wants more

The US has repeatedly asked OPEC to raise production but the organization has resisted the calls amid strained relations with Washington.

The West’s energy watchdog, the International Energy Agency, agreed last month to release record volumes of stocks to help cool down prices and offset supply disruptions from Russia.

Read more: US Senate committee to consider bill pressuring OPEC oil group: Reuters