RIYADH: Benchmark Brent crude futures for May above $130 a barrel as US decides to ban Russian oil imports. US West Texas Intermediate, or WTI, crude futures for April delivery traded around $126 a barrel.

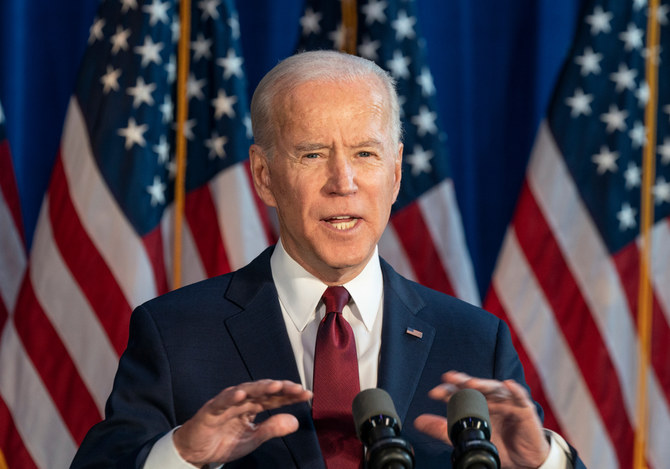

President Joe Biden announced a ban on US imports of Russian oil on Tuesday, in the administration’s most far-reaching action yet to punish Moscow for invading Ukraine.

“We’re banning all imports of Russian oil and gas and energy. That means Russian oil will no longer be acceptable at US ports and the American people will deal another powerful blow to (President Vladimir) Putin,” Biden said in an address from the White House, adding that the decision was taken “in close consultation” with allies.

Today, I’m announcing that the United States is targeting a main artery of Russia’s economy.

We are banning all imports of Russian oil and gas.

— President Biden (@POTUS) March 8, 2022

The ban came with Democrats threatening legislation to force Biden’s hand, despite the likely impact on already soaring gas prices.

UK to phase out Russian oil imports

Britain also said on Tuesday it would phase out Russian oil imports by the end of this year, in line with new sanctions announced by the US following the invasion of Ukraine.

“This transition will give the market, businesses and supply chains more than enough time to replace Russian imports — which make up 8 percent of UK demand,” Business Secretary Kwasi Kwarteng tweeted.

The oil sanction does not apply to Russian natural gas, which accounts for some four percent of UK supply. But Kwarteng said he was “exploring options to end this altogether.”

The announcement came in coordination with an embargo on Russian oil announced by US President Joe Biden.

Oil

The rise in oil prices has prompted the US to open a dialogue with the Venezuelan president on energy matters.

The White House said on Monday that a US delegation held weekend talks in Venezuela with the government of President Nicolas Maduro that included a discussion of energy supplies — as Washington looks for ways to reduce its imports of Russian oil.

The surprise move comes at a time when analysts at Bank of America said that if most of Russia’s oil exports were cut off, there could be a shortfall of at least 5 million barrels per day, pushing prices as high as $200.

JP Morgan analysts said oil could soar to $185 this year, while analysts at Mitsubishi UFJ said oil may rise to $180 and cause a global recession.

Opinion

This section contains relevant reference points, placed in (Opinion field)

Oil prices see-sawed near 14-year highs on Tuesday as the United States considered acting alone to ban Russian oil imports rather than teaming up with allies in Europe, easing concerns of a wider disruption to crude supplies.

Brent crude futures on Tuesday are trading around $125, while US benchmark WTI is near $121.

US-Venezuela talks

Maduro, with whose regime the United States broke off relations in 2019, has been among the few international figures to assure Russian President Vladimir Putin of his “strong support” in the wake of the invasion.

“As it relates to Venezuela, the purpose of the trip that was taken by administration officials was to discuss a range of issues including certainly energy, energy security,” White House Press Secretary Jen Psaki told reporters.

Venezuela’s opposition also said it had met with the high-level US delegation, whose trip to Caracas — reported by multiple US media — came as Washington seeks to isolate Russia over its invasion of Ukraine.

Maduro confirmed the meeting in a televised appearance late Monday, describing it as “respectful, cordial and diplomatic” without going into detail about the issues addressed.

“We did it in the presidential office,” he said. “We had almost two hours talking.”

“It seemed very important to me to be able, face to face, to discuss topics of maximum interest to Venezuela,” he continued.

Iran nuclear deal

Meanwhile, talks to revive Iran’s 2015 nuclear deal with world powers were mired in uncertainty after Russia demanded a US guarantee that sanctions it faces over the Ukraine conflict would not hurt its trade with Tehran.

Iran’s Foreign Minister Hossein Amirabdollahian said Tehran would not allow “any foreign elements to undermine its national interests,” and the Foreign Ministry said it awaited an explanation from Russia.

France told Russia not to resort to blackmail over efforts to revive the nuclear deal, and Iran’s top security official said the outlook for the talks “remains unclear.”

Iran would take several months to restore oil flows even if it reached a nuclear deal, analysts said.

Shell

Shell on Tuesday apologized for buying Russian crude oil last week and said it would withdraw completely from any involvement in Russian hydrocarbons over the country’s invasion of Ukraine.

“We are acutely aware that our decision last week to purchase a cargo of Russian crude oil ... was not the right one and we are sorry,” Shell CEO Ben van Beurden said.

Shell bought a cargo of Russian crude oil from Swiss trader Trafigura in S&P Global Platts window loading from Baltic ports at a record low of dated Brent minus $28.50 a barrel, traders said on Friday.