DUBAI: Tabby, a buy-now-pay-later provider based in Dubai, has raised $54 million in its latest funding round, as more Gulf consumers adopt the new payment method.

The Series B round was led by Sequoia Capital India and STV, with additional funds from Abu Dhabi’s sovereign wealth fund Mubadala.

“The rapid adoption we continue to see today shows the urgency of consumer demand for flexible and honest payment experiences over predatory interest-driven credit,” Tabby Chief Executive Officer, Hosam Arab, said.

The Dubai-based fintech startup said they have over 1.1 million active users in Saudi Arabia and the UAE – two of its biggest markets where it was also named among the top shopping applications.

Today’s consumer is a lot smarter. They are a lot more aware of what’s around them and therefore they are able to better make decisions. Today’s consumer is less comfortable getting credit cards

Tabby CEO Hosam Arab

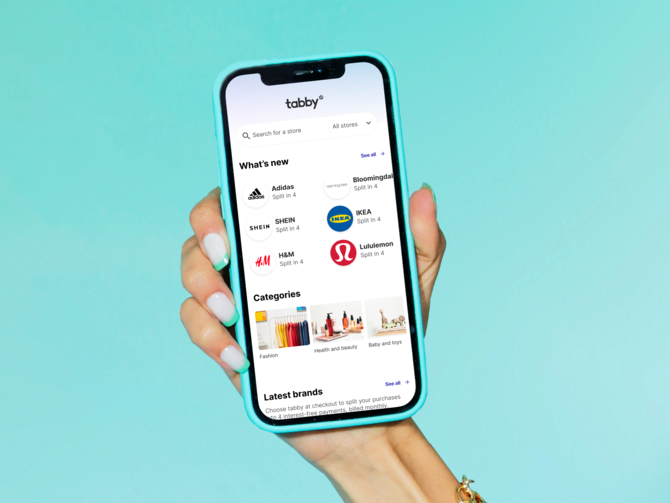

Tabby allows shoppers to split their payments without the usual requirement of a credit card. This BNPL payment method has seen unprecedented global adoption in recent years, especially in the GCC where 24 percent said they have used the option in 2021.

“Today’s consumer is a lot smarter. They are a lot more aware of what’s around them and therefore they are able to better make decisions,” the CEO told Arab News, adding “today’s consumer is less comfortable getting credit cards.

“This is where a Tabby comes in, we tell consumers that you’re able to transact flexibly and get the benefits you would normally get out of a credit card, without the negative associations of a credit card interest,” Arab explained.

Tabby claims they don’t charge the consumers throughout their transactions – instead, they get a commission from retailers on every purchase.

“We get transaction fees in the form of commission from the merchants that we work with – from the consumers we make no revenue,” he said.

Arab said they see Tabby more as a seamless payment method, than a “cash flow tool or credit replacement tool.” He added the platform is being used by those who spend SR200 to SR300 on a purchase, up to those who spend a couple of thousands for car insurance or minor medical procedures.

There are more than 3,000 brands on Tabby, he said, providing these online retailers with an additional payment method for their customers.

The new capital injection will be used to explore further market expansion, Arab said, without giving details, as well as in building its product offering.

“Saudi Arabia for us is one of our core markets, and that’s the market that we will continue to invest in very heavily. It drives the large majority of both our merchant volume, but also for our consumer volume. The plan is to continue to invest heavily in growing our team over there,” Arab said.

Tabby’s success rides on the back of wider gains in the region’s fintech ecosystem – with an active investment flow, as well as high adoption rates of users.

The Dubai-based app has since raised $180 million, with most of it flowing in 2021.