After listed companies on the Saudi Stock Exchange, Tadawul, posted earnings, Arab News studied the income statements of three food retailers and one fashion chain. Only Alhokair, predominantly a clothing chain, boosted profits.

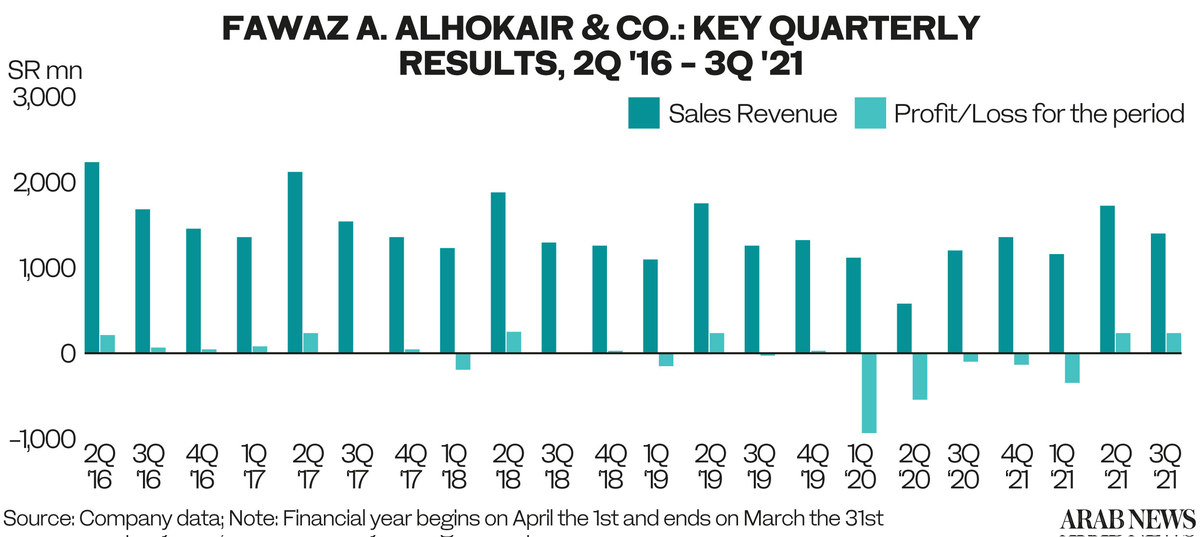

Rising sales at Alhokair saw annual profits jump 75 percent to SR1,311 million. A fall in depreciation and amortization was also a factor due to store closures. Finance costs fell by over 25 percent as the company continued its policy of closing non-profitable outlets. The group also runs a much smaller food business.

“The pandemic helped make quick decisions to get rid of stores, and during the last seven fiscal quarters, about 600 unprofitable stores were closed. At the same time, 300 new stores were opened,” the company’s CFO, Ahmed Belbesy, told Al Arabiya in a recent interview.

He explained that during the first six months of the year, from the beginning of April, the firm opened 11 food branches. As for clothing brands, the company continued to dispose of branches that do not generate sufficient sales.

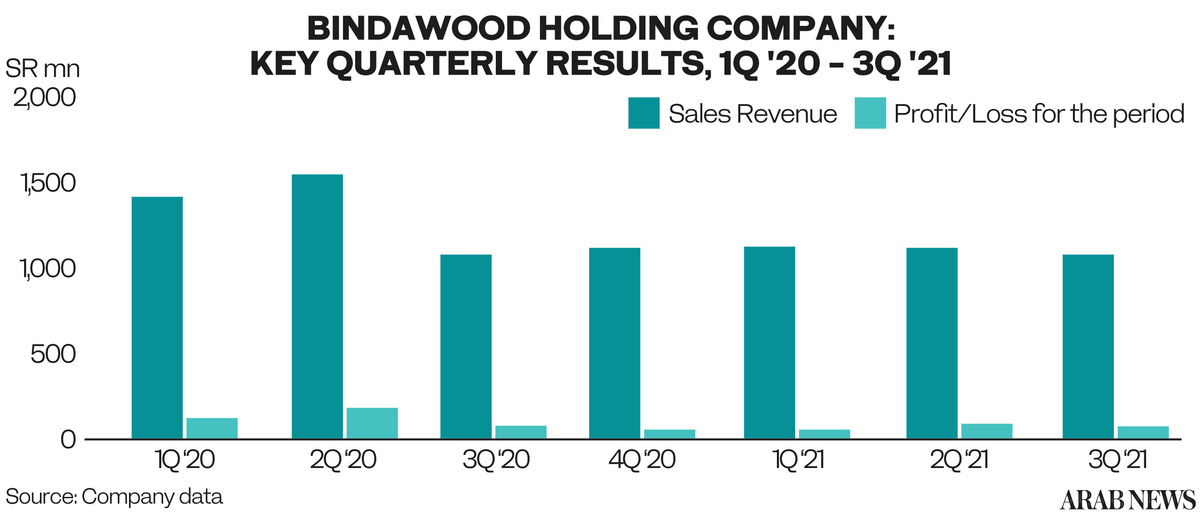

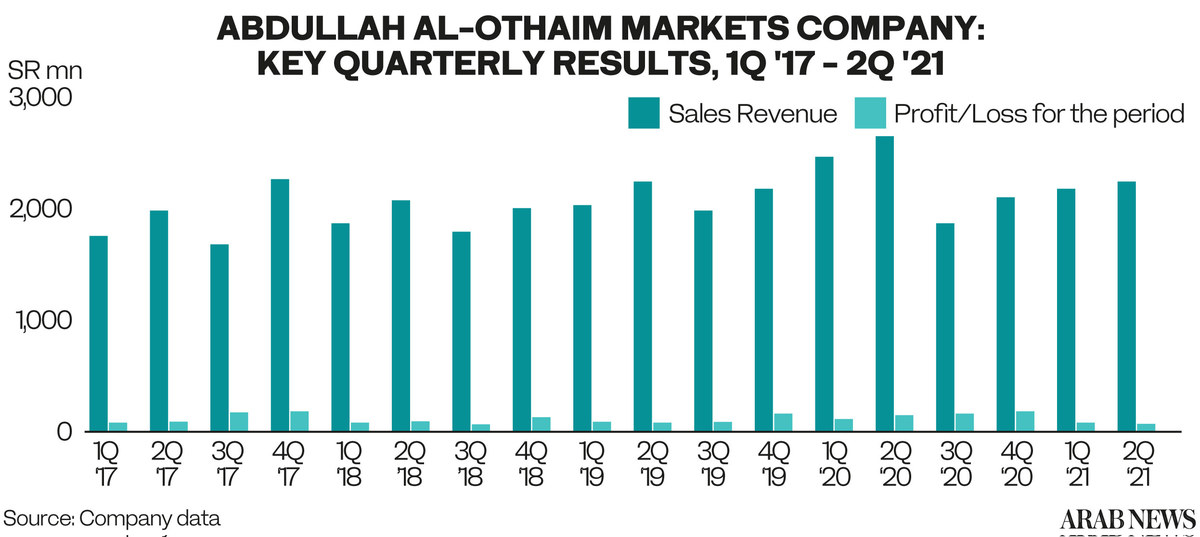

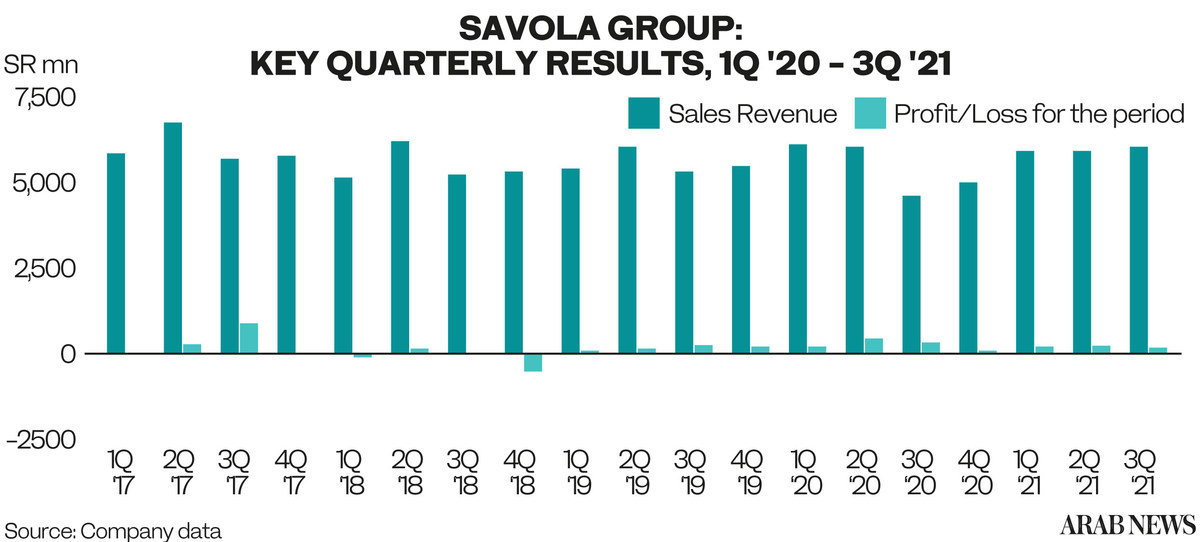

On the other hand, Savola Group, Fawaz Al-Othaim and BinDawood Holding, all predominantly food retailers, saw their net profit over the first nine months of this year fall by over-35 percent.

Fawaz Al-Othaim and BinDawood Holding both cited slowing sales following record 2020 numbers. Both companies said that growth in operating costs was a factor in the slowdown in their profits.

This is a turnaround from last year, when during the height of the health crisis food retailers posted robust income statements.

At this time, last year’s rising pandemic was almost a disaster for Alhokair. The company was hit by a loss of SR1.7 billion, the worst in its history.

Sales at the chain plunged by more than half, from a pre-pandemic level of SR1.29 billion in the quarter ending in December 2019, to SR565 million in the quarter ending in June 2020.

Over the same period, big Saudi food retailers saw revenues jump in the second, and even in the first quarter of last year, usually a weaker season for sales.

One of these retailers is Savola Group, a holding company with assets in food production and food retail. It controls 28 percent of the Saudi retail market due to its 98.8 percent-owned grocery chain, Panda Retail, and its 49 percent-owned Herfy Food Services Co. Herfy is a restaurant, industrial bakery and meat processing business.

Savola Group’s sales came in at SR6.12 billion in the first quarter of 2020, its largest first-quarter sales on record. Net income for the year surged to SR1 billion from SR657 million in 2019.

Sales at Abdullah Al-Othaim Markets Co., a Saudi food wholesale and food retail business, hit record levels in each of the first three quarters of 2020, with annual net profit surging 72 percent to SR600 million from 2019.

Another Saudi retailer Arab News looked at was the supermarket and hypermarket chain owner, BinDawood Holding Company. Its main activity is selling food and household goods, as well as running bakeries and restaurants.

Both sales and profits grew by 13 percent in 2020 compared to results in 2018.

The reason was a hike in food and hygiene products in 2020, due to panic buying from consumers in the face of the pandemic.

By contrast, Alhokair’s food business is a secondary unit, so it did not benefit from strong profits enjoyed by grocery-heavy rivals last year. In the second quarter of 2021, its food and beverages business, mostly cafeterias in food courts at the company's stores, accounted for just 10 percent of the group’s overall revenues, according to company filings.

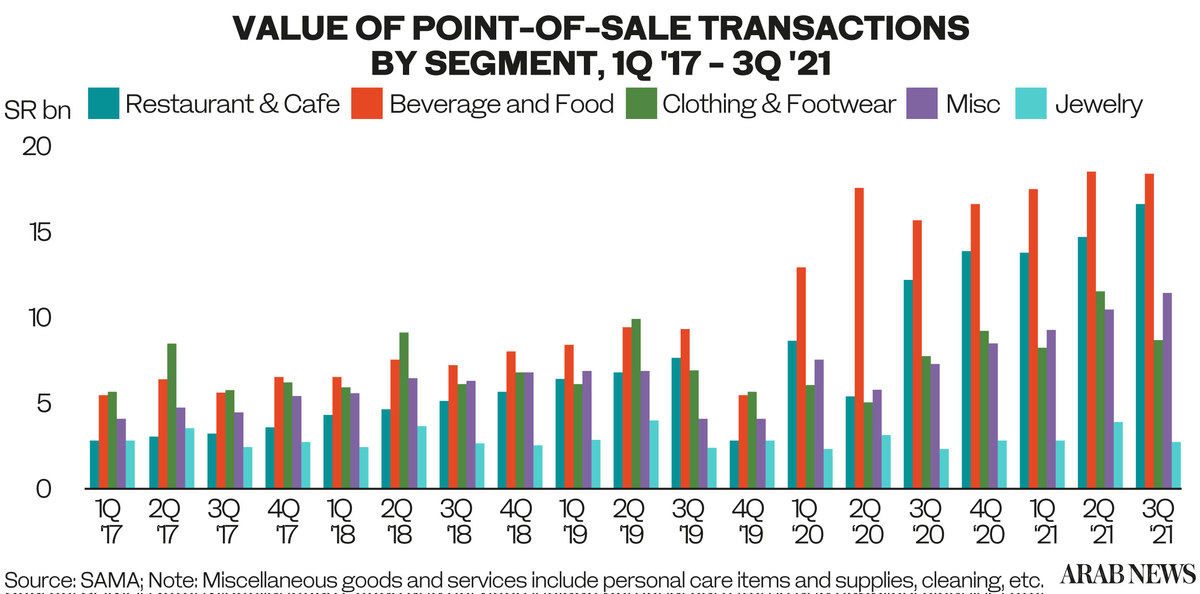

The value of the Kingdom’s point-of-sale transactions, a key Saudi retail market indicator, showed that sales of food and beverages surged by 68 percent in 2020 to SR62.4 billion, from the previous year. Also, transactions more than doubled to 794 million from 388 million.

By contrast, the value of transactions in the clothing and footwear segment lifted by just 9 percent to SR30.5 billion, while the volume of transactions fell by 7 percent to 138 million.

It is clear the turnaround at Alhokair came this year, after surviving the ravages of the pandemic leaving it able to grow profits.