RIYADH: Saudi Arabia is forecasting budget surpluses from 2023 as the economy experiences a “noticeable and anticipated uptick,” the Ministry of Finance said on Thursday.

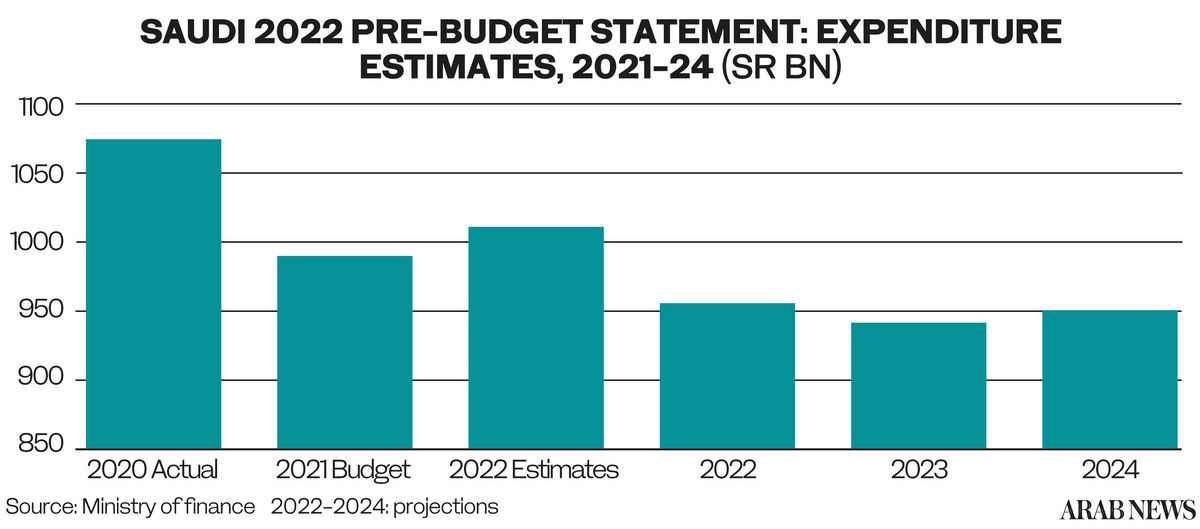

The Kingdom will post a surplus of about SR27 billion in 2023, rising to SR42 billion in 2024, the ministry said in a report. That compares with a projected deficit of SR85 billion in 2021 and SR52 billion in 2022.

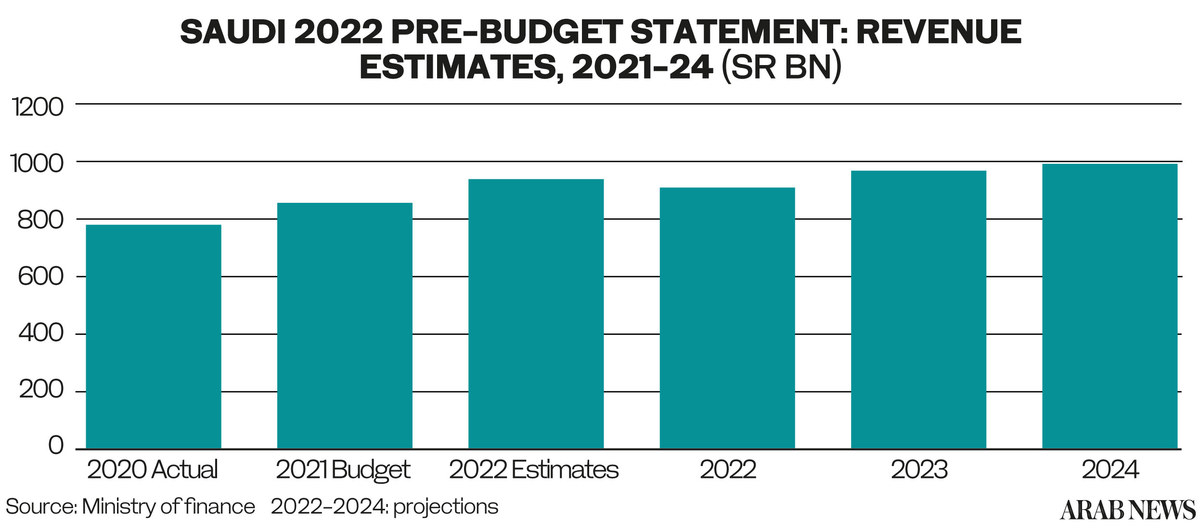

Government revenue will slip to SR903 billion in 2022 from SR930 billion in 2021, but will have reached SR992 billion by 2024, the Ministry of Finance said.

The extra revenue will come from government initiatives and reforms aimed at enhancing and developing non-oil revenues as the pandemic diminishes.

The government aims to sustain the spending ceilings approved last year for the medium-term, the ministry said. Expenditure is projected to reach approximately SR955 billion for fiscal year 2022 before falling to SR951 billion in fiscal year 2024.

The Saudi government aims to continue economic and fiscal reforms it has implemented under Vision 2030.

The annual borrowing plan is being prepared to meet funding needs within the framework of a medium-term debt strategy, through the coordination between the ministry and the National Debt Management Center.

Public debt is expected to reach SR989 billion by 2022, or 31.3 percent of GDP. The size of the public debt is anticipated to remain fixed in the medium-term whereas debt-to-GDP ratio is projected to decline 27.6 percent in fiscal year 2024.

While budget surpluses, projected to be realized starting in fiscal year 2023, are to be used to enhance government reserves, new debt issuances will be directed toward principal repayment, the MoF report said.

Government deposits at SAMA are expected to exceed initial projections in the fiscal year 2022, and to continue to grow due to expected surpluses in fiscal year 2023 and fiscal year 2024.

Saudi oil revenues are expected to reach SR545 billion by the end of 2021, while total state revenues could reach SR925 billion, according to Al-Rajhi Capital.

The investment bank based its estimates on Brent prices of $75 per barrel, with a Saudi average oil production of 9.1 million barrels per day, of which 6.2 million to be exported by the end of the year.

The bank's estimate for non-oil revenue is at SR380 billion, unchanged from an earlier forecast, and it is driven by the increase in VAT last year to 15 percent from 10 percent.