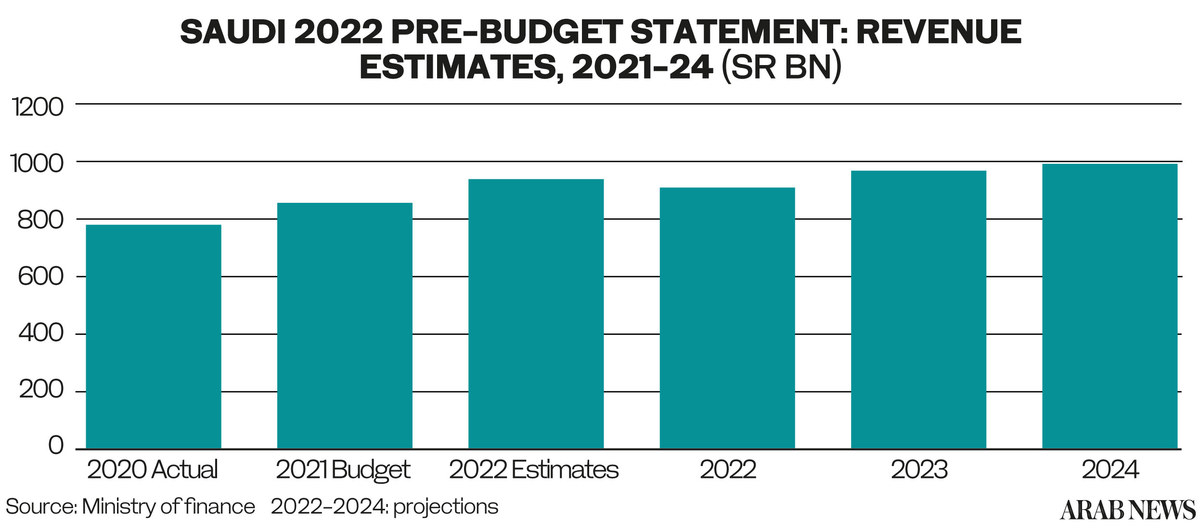

RIYADH/JEDDAH: Rising oil prices, coupled with a more positive post-pandemic outlook, has Saudi Arabia expecting a narrower budget deficit this year.

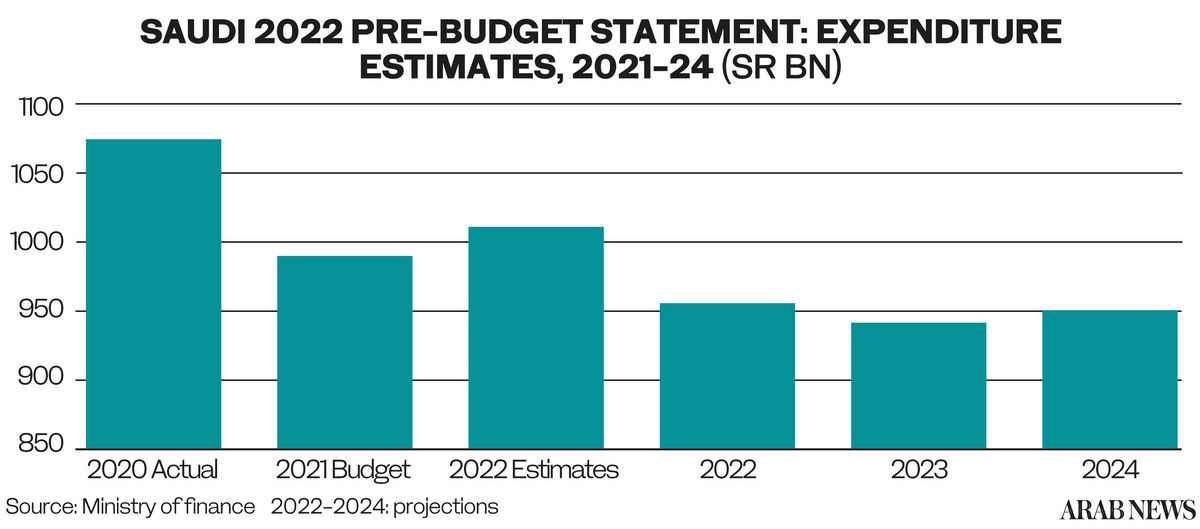

But based on a budget forecast from the Saudi Ministry of Finance, the Kingdom is expecting to see a budget deficit of SR52 billion ($13.9 billion) in 2022.

According to an independent financial analyst, the indicators for the 2022 budget “target economic and fiscal growth driven by rational public spending.” Talat Hafiz said growth in the non-oil GDP and the performance of the private sector supported the Kingdom’s expected financial standing

“Efficient spending also helped a lot in achieving such good results,” he said. “Finally the focus of the Kingdom on privatization will support in enhancing government’s revenues and reduces expenditures.”

In 2022, Saudi Arabia’s revenues are expected to reach SR903 billion, while spending SR955 billion.

This projection comes after the Kingdom’s budget deficit narrowed sharply in the first six months of this year due to more fiscal discipline and increasing non-oil revenue. It dropped 92 percent to SR12 billion.

HE Mr. Al-Jadaan: The actual performance indicators for #Budget_2021 confirm that the structural reforms and the Government’s initiatives and programs are progressing steadily. https://t.co/PFFUGBcEzz

— وزارة المالية السعودية (@MOFKSA) September 30, 2021

Saudi Arabia’s national debt is expected to be at SR989 billion, or 31.3 percent of its GDP in the next fiscal year, according to the Ministry of Finance forecast in its budget statement on Thursday.

The debt will jump from 30.2 percent of the country’s GDP that is forecast this year, according to the statement. Next year the principal repayments on the debt will reach SR76 billion, the ministry said, adding that in “the medium-term, public debt levels are projected to remain constant.”

“Through coordination between the Ministry of Finance and the National Debt Management Center, the annual borrowing plan is being prepared within the framework of a medium-term debt strategy,” the statement said.

The ministry expected the Saudi GDP to grow at 7.5 percent in 2022, assuming a recovery in economic activities and an improvement in the Kingdom’s balance of trade “in light of positive performance in the first half of 2021.”

The government strives to control the budget deficit which is projected to be approximately 1.6 percent of the GDP in 2022.

“The major elements that stand out from this pre-budget statement indicate a steady improvement in all major economic and fiscal matrices,” economist Mohamed Ramady said.

“We need to continue a conservative approach in budgeting oil and non-oil revenues as a precautionary measure against risks of the resurgence of the COVID-19 pandemic or changes in the current bullish fortunes of oil prices.”