RIYADH: Wa’ed, the entrepreneurship arm of Saudi Aramco, has boosted its investment in a digital mapping and indoor navigation startup in a bid to help it expand globally.

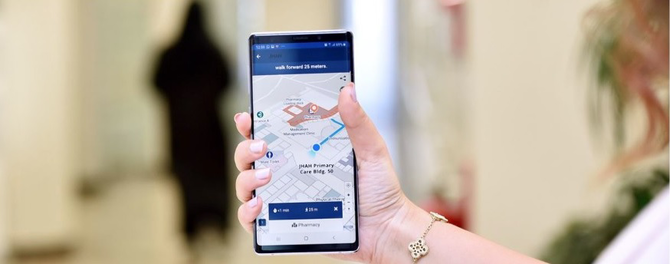

Alkhobar-based NearMotion provides mobile navigation tools for airports, hospitals, shopping malls, museums, theme parks and event stadiums, allowing users to get real-time information and services. This will be Wa’ed’s second investment in the company, having previously backed it in 2016.

Some of the startup’s clients include Johns Hopkins Aramco Healthcare in Dhahran, Dallah Hospital in Riyadh and MediClinic Middle East in Dubai.

The company also won a SR1.2 million ($320,000) contract for digital mapping services at the Saudi Ministry of Education’s 200,000 square-meter headquarters in Riyadh.

“We initially invested in NearMotion because its technology was unique and game-changing, and its success in the [Gulf Cooperation Council] has shown this,” Wassim Basrawi, managing director of Wa’ed, said in a statement. “With this second investment, we aim to help globalize this exciting Saudi success story.”

Wa’ed was established by Saudi Aramco in 2011 to offer loan financing activities to entrepreneurs, while its Wa’ed Ventures venture capital arm oversees a $200 million investment fund and a portfolio of more than 30 Saudi-based companies.

Wa’ed last week launched its first roadshow event to unearth and fund the next generation of Saudi entrepreneurs. With up to SR100 million at its disposal, Wa’ed is planning to hand out loans and venture capital investments to commercially feasible ventures that would fill existing gaps in the Kingdom’s economy.

The roadshow will visit Jubail, Yanbu, Riyadh, Jeddah, Makkah and Madinah. Online applications for all Saudi-based entrepreneurs opened on Wednesday last week.

“Seventy out of over 100 startups we supported were the first of their kind and received their first-ever investment from us, and this is what we are targeting now: Distinguished and not yet supported startups and ideas,” Basrawi said.