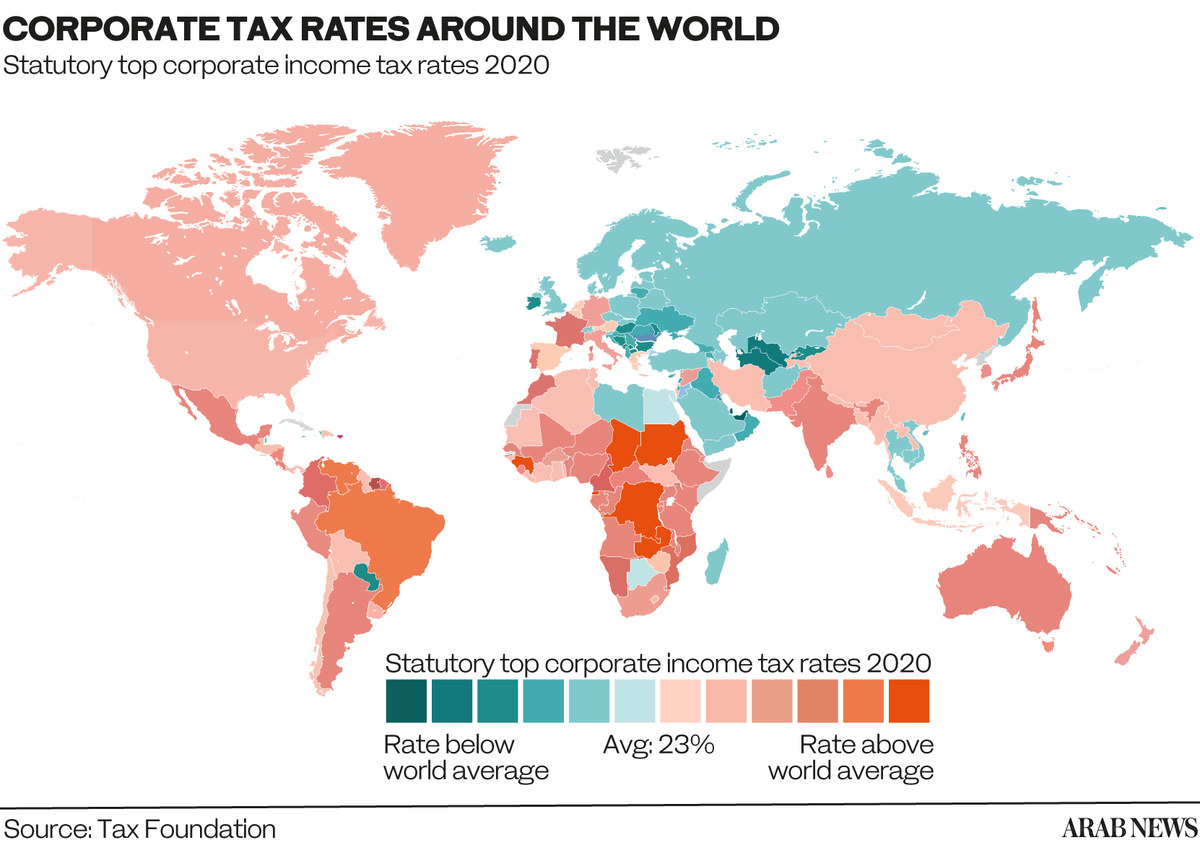

DUBAI: The threat seemed clear. The low-tax countries of the Middle East would have to fall in line with the high tax-and-spend economies of Europe and North America, and impose big tax increases that would threaten their global competitiveness.

But although initially hailed as “historic,” when the experts and policymakers got down to the nitty-gritty of the recent Group of Seven (G7) proposals for a uniform global corporate tax system, they seemed more inclined to ask what all the fuss was about.

None more so than in the Middle East. Initially, the G7 plan appeared to be a threat to the low-tax regimes in place in most GCC countries, which have been regarded as a crucial part of their strategies for economic growth.

Financial experts were quick to recognize the implicit threat to GCC economies. “You could argue that the G7 proposals are an example of the rich developed countries trying to impose their own economic and fiscal regimes on the rest of the world, where many like the GCC have managed with their own practices perfectly well up to now,” Tarek Fadlallah, Dubai-based CEO of Nomura Asset Management Middle East, told Arab News.

Saudi Arabia was regarded as especially exposed to the fallout from a global tax. The Kingdom is a member of the G20 group of countries, and bound by the decisions that body takes in its annual meetings. The G7’s next step with their tax plan is to put it to the wider G20, where Saudi policymakers would have to take a stance on the proposals.

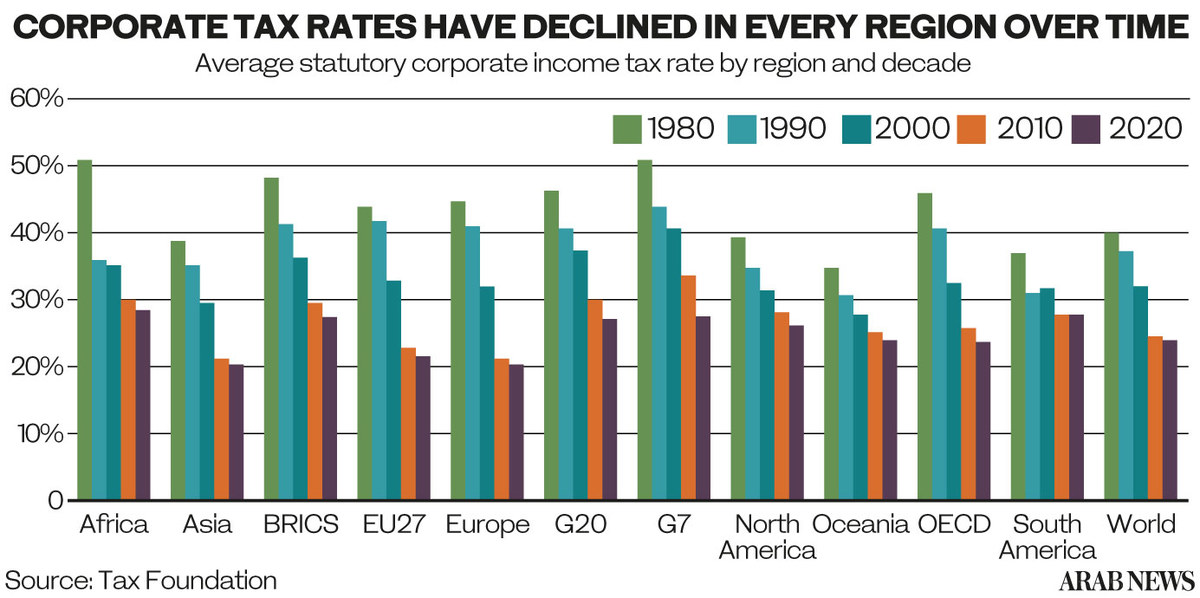

Economic consultant Nasser Saidi said the implementation phase of the proposals would make for hard negotiations. “It will have to be accepted by the G20, laying bare the differences between the tax-raising needs of the developed G7 countries facing unprecedented budget deficits (in part due to cover stimulus spending and lower revenues) and developing countries that want low corporate tax rates to attract investment, technology and know-how,” Saidi told Arab News.

But Mohammed Al-Jadaan, the Saudi minister of finance, appeared to be sanguine about the G7 proposals, welcoming them and pointing out that the previous year’s G20 summit had specifically endorsed plans to budget for post-pandemic recovery through the tax spend of the world’s biggest economies.

Asad Khan, head of asset management at Emirates Investment Bank (EIB) of the UAE, agreed that the devil will be in the detail of the proposals for regional policymakers. “Now, for the G7 deal to be a global success in the long run, the broader G20 which includes major economies like China, India, Russia and Saudi Arabia need to come on board and ratify the agreement,” he told Arab News.

“The sticky details like ‘at least 15 percent minimum tax’ and ‘above 10 percent profit margin’ would remain a bone of contention, but the essence of the deal is appreciated and may well be endorsed by the G20, albeit with several exceptions.”

But whatever compromise deal is hammered out by the global policymakers, the G7 proposals again turn the spotlight on the sensitive subject of tax in the Middle East. The region has regularly featured on lists of global tax havens where “shady men in sunny places” can avoid paying their dues.

For example, earlier this year, the lobby group Tax Justice Network placed the UAE in the top 10 tax havens where companies could set up in a spree of “global corporate tax abuse.”

The UAE has waged a campaign to get itself taken off “blacklists” compiled by international financial authorities.

Opinion

This section contains relevant reference points, placed in (Opinion field)

Some experts believe this is a misconception of the role that tax has played in the region. Although personal income tax is still unheard of in the Gulf, many countries have introduced value added tax on consumption, with Saudi Arabia tripling the rate to 15 percent last year to meet the economic demands of the pandemic recession.

Corporation tax is also payable in a range of industries — notably oil and banking — in many GCC countries. And there are a wide range of government fees and levies imposed across all business sectors throughout the region.

The International Monetary Fund has regularly suggested a form of personal income tax in the region, a call that has so far been resisted by economic policymakers conscious of the need to attract expatriates to live and work in GCC countries.

One tax lawyer, who asked not to be named, told Arab News: “The UAE and other GCC countries are not tax havens in the same sense as the Cayman Islands or Lichtenstein. They are jurisdictions that have historically been averse to imposing taxes, and have actually used that as a tool of economic policy.”

The best illustration of this are the free zones (FZs) and special economic zones (SEZs) that have sprung up in the region as a way of attracting foreign direct investment.

Could this successful formula be jeopardized by the G7 proposals?

“Countries that have relied on zero taxation in their FZs and SEZs to attract capital and diversify their economies will stand accused of facilitating tax avoidance and growing demands for exchange of information for tax purposes and higher corporate governance standards, transparency and disclosure,” said Saidi.

The Kingdom recently promised a raft of incentives, including tax breaks, to multinationals that set up their headquarters in Riyadh as part of the strategy to make the city the financial hub of the Gulf.

Details of the plan, which would become effective in 2024, are still being worked through. “The jury is still out on how a 15 percent corporate tax rate across the GCC would impact the competitiveness of the various financial hubs vying for supremacy in the region,” Fadlallah said.

Initially, the G7 plan appeared to be a threat to the low-tax regimes in place in most GCC countries, such as Saudi Arabia, which have been regarded as a crucial part of their strategies for economic growth. (AFP/File Photo)

Khan of EIB said that tax policy was only one factor in the region’s competitiveness. “In our view, GCC governments have been constantly trying to compete for foreign capital on terms other than low taxes,” he told Arab News.

“While we agree the minimum tax clause forces a rethink for zero-tax countries of the region to attract and retain FDI, our sense is that the Middle East remains a strategic regional hub for global corporates and Western powers.

“The region boasts of a young, dynamic workforce and extremely favorable demographics with a higher disposable income. The region is also a big, stable source of funding for new-age startups via the sovereign wealth funds.”

All in all, the G7 proposals got some big headlines for the tax-and-spend developed countries, and will be a boon for the global tax lawyers and accountants. But they are unlikely to be a significant factor in economic policymakers’ long-term thinking in the Middle East.

------------------

Twitter: @frankkanedubai