RIYADH: Saudi entrepreneurs are among the most optimistic in the world, a new survey shows, with an overwhelming majority believing the Kingdom offers good opportunities to start a business despite the economic impact of the coronavirus disease (COVID-19) pandemic.

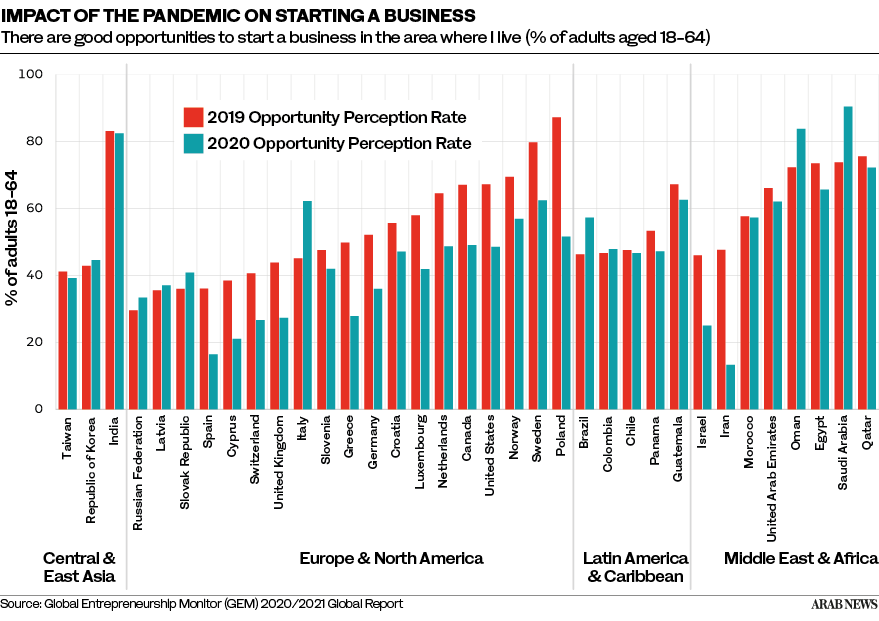

The Global Entrepreneurship Monitor (GEM) 2020/2021 report, which surveyed adults aged between 18 and 64, found that 90.5 percent of those surveyed in Saudi Arabia believed there were good opportunities to start a business in their area, ranking it first in the world among 43 countries surveyed.

At the same time, 91.5 percent of respondents said that it was easy to start a business, again ranking the Kingdom first in the world on this issue, while 86.4 percent said they believed they possessed the skills and knowledge to launch a business, second only behind Togo.

Despite the high level of optimism, the pandemic has had an impact on the business community’s outlook. The percentage of Saudi adults who said they were planning to start a business within the next three years has dropped from 32 in 2019 to 25 percent in 2020.

The main reason for this was fear of failure, cited by 51.6 percent of respondents and earning the Kingdom sixth place in the global rankings.

Of those who were looking to start a business, 90 percent said they had delayed their start date as a result of the pandemic, with only Italy seeing higher delayed business launches.

The survey also found that 41.6 percent of respondents said that they knew someone who had started a business during 2020, while 57.1 percent said they also knew someone who had stopped working on a new venture as a result of the economic impact of COVID-19.

A positive factor for Saudi entrepreneurs was the Kingdom’s performance on access to funding. Saudi Arabia earned a score of six on this category, up from five in 2019 and placing it third overall globally.

This is demonstrated by the fact that Saudi Arabia saw a surge in financing awarded to small and medium-sized enterprises (SMEs) in 2020 by the Kingdom’s banks and financial companies.

Figures released by the Saudi Central Bank (SAMA) in late January showed that in the third quarter of 2020 the total amount of credit awarded to SMEs was SR176.2 billion ($46.99 billion), up from SR115 billion in Q3 2019 and SR106.7 billion in Q3 2018.

While the total figure rose 8.3 percent in 2019, it surged 52.4 percent in 2020. Among the four categories of companies monitored by SAMA, the biggest increase was for micro companies — classed as those with fewer than five employees — which saw an 89 percent rise in the total credit awarded to them.

Commenting on the results, Wassim Basrawi, managing director for Wa’ed, the entrepreneurship arm of Saudi Aramco, told Arab News: “In 2020, we also experienced rising demand for our loan, venture capital and incubation services at Wa’ed. The demand was there. We are doing this because we have full confidence and trust in our entrepreneurs and are deeply committed to supporting new ideas, solutions and products that fill critical gaps in the Kingdom’s economy and promote economic diversification.”

Basrawi also confirmed that Wa’ed is planning to double its deal volume in the next three years to meet this increasing demand for financing by SMEs.

The GEM survey also showed that Saudi Arabia has a high percentage of adults who have supported entrepreneurs, with one in 10 revealing that they have personally helped fund a startup business. This compares to one in 20 in many other developed nations. The average amount invested by Saudi adults was $6,000.

In May, the monthly IHS Markit Purchasing Managers’ Index survey found that firms in the Kingdom also boosted staff numbers for the first time in five months, as business activity in the non-oil private sector accelerated at its fastest pace in three months.

This backs up the results of the GEM survey, which found that 9.4 percent of Saudi adults said that they planned to hire six or more employees within the next five years, one of the highest rates among all countries surveyed.