DUBAI: “What the G20 says is, we are all in this together.” Sound familiar? If so, that may be because “we’re all in this together” has become one of the catchphrases of 2020’s coronavirus pandemic.

But this quote actually predates COVID-19. It was spoken in 2018 by the man sometimes referred to as the father of the G20: Paul Martin, Canada’s Liberal prime minister from 2003 to 2006.

It was Martin who, as Canada’s finance minister in the 1990s, looked around the Group of Seven (G7) and thought more countries should be invited to the forum for the world’s top so-called advanced economies. (Canada had been asked to join in 1976 almost as an afterthought, but more about that later.)

Martin talked to US Treasury Secretary Lawrence Summers about making it more inclusive. After the two drew up a list and presented it to the G7, the G20 was created as a parallel organization at the finance ministers’ level in 1999, with Martin as its first chairman.

It was at the G20 meeting in Montreal in 2000 that Canada championed moving the group beyond its financial mandate. The Montreal consensus on globalization affirmed that the benefits of economic growth should be more broadly shared and that the poor should be protected from the costs of globalization.

“The G20 in my opinion is an essential tool because it represents the power of individual regions regardless of the state of your economy,” Martin said in an interview about the G20’s history on the website of the Center for International Governance Innovation.

“I tried very hard to get it up to the leaders’ level, having had something to do with its founding at the finance ministers’ level,” Martin said. “Everybody was on side, except the United States ... I was very sure, as were a number of us, it would take a crisis to bring it to the leaders’ level, and that’s exactly what happened (with) the 2008 crisis.”

After his minority Liberal government lost the 2006 election, Martin stepped down as leader, so ironically, he never got to pose alongside the G20 leaders in the summit’s traditional “class photo.” By the time the G20 reached the leaders’ level in 2008, holding its first summit in Washington that November in response to the global financial crisis, Conservative Stephen Harper was Canada’s prime minister.

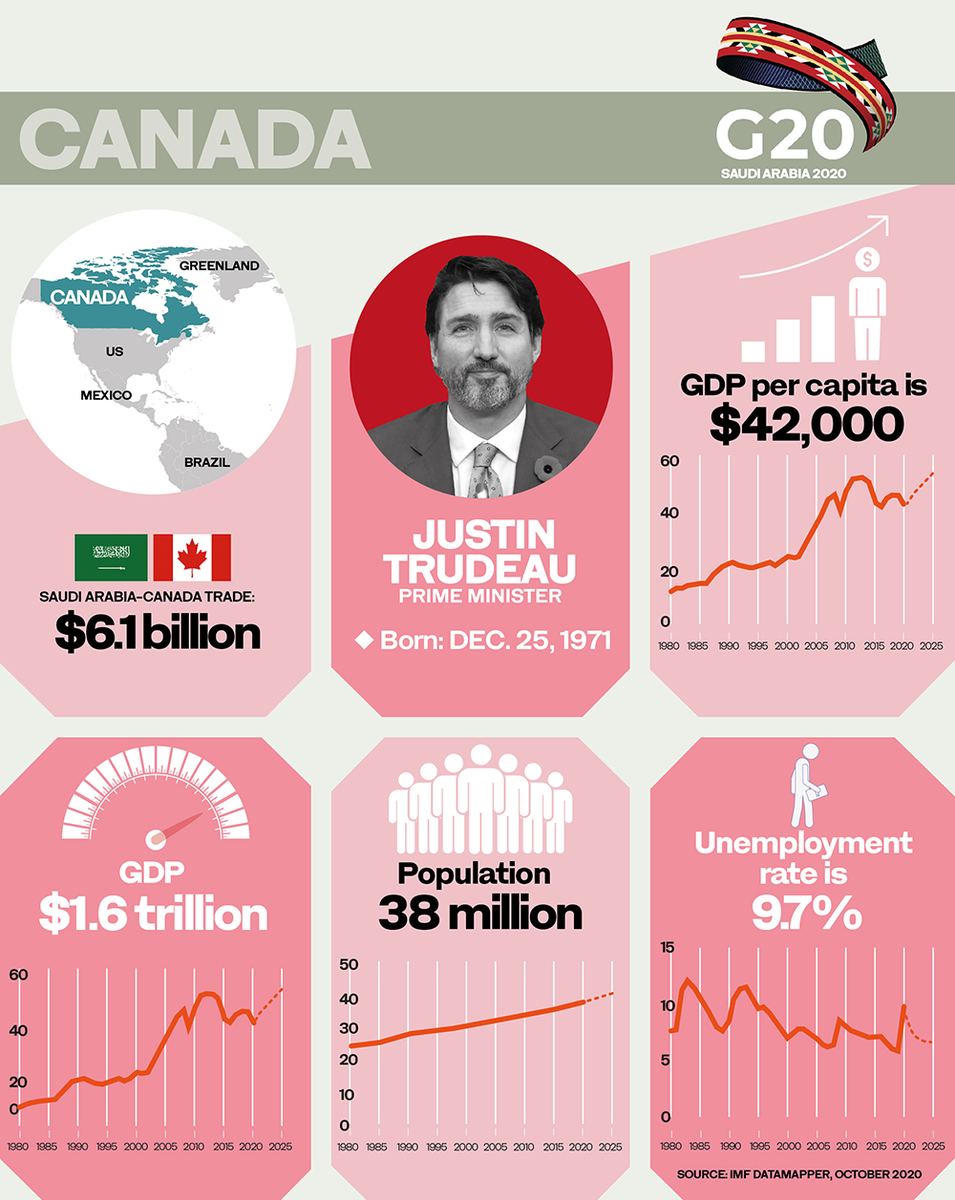

Justin Trudeau, Prime Minister of Canada

It was Harper who presided over the one G20 leaders’ summit hosted by Canada, held in Toronto in June 2010 as the world emerged from the economic recession. While that meeting was relatively uneventful, Harper shook things up at the Australian summit in 2014, when he took a stand against Russia’s annexation of the Ukraine. Russian President Vladimir Putin left the summit early after Harper reportedly told him, while shaking his hand, to “get out of Ukraine.”

This stand appeared to fly in the face of his own wisdom, which Harper had shared at the 2009 summit in Pittsburgh, US: “Canada is big enough to make a difference but not big enough to threaten anybody. And that is a huge asset if properly used.”

It’s an asset that, when properly used, has long gotten Canada invited to the party.

Pierre Trudeau, as Canada’s prime minister, had pushed to be invited to a 1975 meeting of leaders from the US, Britain, France, Italy, West Germany and Japan, dubbed the Group of Six, to discuss solutions to the oil crisis. While initially left out, Canada’s addition a year later made it the G7, and so it seems only fair that it would be the one in the future to push for others to be included.

At the G7 summit in 1976, Trudeau Sr. was already looking to expand the group’s purpose, saying its success should be measured beyond solving economic issues: “The success will be judged by whether we can influence the behavior of people in our democracies and perhaps even as important the behavior of people on the outside who are watching us, in a way in which they will have confidence that our type of economic and political freedom permits us to solve problems.”

We need to work together to have an impact that goes beyond our borders.

Justin Trudeau, Prime Minister of Canada

Justin Trudeau, the current Canadian prime minister, was a mere boy when his father spoke these words. Fast forward to November 2015, and it was at the G20 Leaders’ Summit in Antalya, Turkey that Justin made his heady debut on the world stage, less than two weeks after becoming prime minister. And while the young leader fired up “bromances” with former US President Barack Obama and later French President Emmanuel Macron at summits like this, much has been made about his awkward interactions with US President Donald Trump and Brazil President Jair Bolsonaro.

However, Canada has a global reputation to maintain as a bridge-builder, perhaps best exemplified by another of its Liberal prime ministers, Lester B. Pearson, who won the 1957 Nobel Peace Prize for helping to create the first UN peacekeeping force during the Suez crisis.

This bridge-building spirit was on display after Justin Trudeau attended the extraordinary virtual G20 summit called by Saudi King Salman on the COVID-19 pandemic this past March.

At a press briefing after the summit, Trudeau spoke of the measures the leaders agreed on to tackle COVID-19, including injecting the global economy with $5 trillion and pledging to help more vulnerable countries through organizations such as the UN and the World Health Organization.

“We need to work together to have an impact that goes beyond our borders,” Trudeau pointed out.

Or, as G20 founder Paul Martin put it, “we are all in this together.”