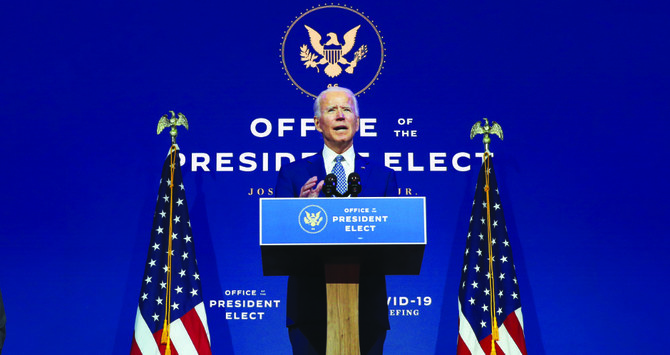

DUBAI: Joe Biden’s victory in the US presidential election has spurred renewed demand for an investment program offering foreign investors a chance to apply for American citizenship, according to two companies promoting the scheme in the region.

The EB-5 Immigrant Investor Program was established by the US Congress in 1990 to boost foreign direct investment in deprived areas of the US. International applicants who invest a minimum of $900,000 can potentially obtain a green card and ultimately apply for full American citizenship.

Biden’s victory over President Donald Trump, and the president-elect’s plans to quickly reverse some of Trump’s policies on immigration, has renewed interest in the program among residents and citizens in the Gulf region.

“We’ve seen a surge of calls,” Shai Zamanian, director of the American Legal Center consultancy firm said. Zamanian, whose company is based in Dubai but has partner offices in Riyadh and Jeddah, said he has seen “a good response” from applicants in the Kingdom.

“There is renewed hope in the US and therefore people are willing to consider and invest and think of the US as a long-term option and a place where they want to take their families,” he added.

There was a similar spike in demand for the EB-5 program when Trump was elected four years ago, due to his economic policies, but his negative stance on immigration and foreign workers resulted in declining interest. Trump signed an executive order in 2017 banning citizens from 13 countries, including Iran, Libya, Sudan, Syria and Yemen, from traveling to the US. Biden has said that he plans to reverse this order on his first day in office.

“We definitely needed Biden to win because one of his main stances has been to change the negative impact that Trump has had on immigration,” said Preeya Malik, managing director of STEP Global Group, a Dubai-based company that offers the EB-5 program.

“When he was elected, the phone started ringing the next day,” she said.

Biden win spurs Gulf US visa scheme demand

https://arab.news/5bm4m

Biden win spurs Gulf US visa scheme demand

- Biden’s victory over President Donald Trump, and the president-elect’s plans to quickly reverse some of Trump’s policies on immigration, has renewed interest in the program among residents and citizens in the Gulf region

Closing Bell: Saudi main index slips to close at 11,228

RIYADH: Saudi Arabia’s Tadawul All Share Index slipped on Sunday, lost 23.17 points, or 0.21 percent, to close at 11,228.64.

The total trading turnover of the benchmark index was SR2.99 billion ($797 million), as 170 of the stocks advanced and 82 retreated.

On the other hand, the Kingdom’s parallel market Nomu gained 449.38 points, or 1.90 percent, to close at 24,093.12. This comes as 43 of the stocks advanced while 27 retreated.

The MSCI Tadawul Index lost 6.07 points, or 0.40 percent, to close at 1,511.36.

The best-performing stock of the day was Obeikan Glass Co., whose share price surged 7.54 percent to SR27.66.

Other top performers included Alamar Foods Co., whose share price rose 6.80 percent to SR47.10, as well as Saudi Kayan Petrochemical Co., whose share price climbed 6.79 percent to SR5.66.

Saudi Investment Bank recorded the steepest drop, falling 3.21 percent to SR13.56.

Jahez International Co. for Information System Technology also saw its share price fall 3.15 percent to SR13.55.

Rabigh Refining and Petrochemical Co. declined 2.78 percent to SR7.34.

On the announcements front, Tanmiah Food Co. reported its annual financial results for the period ending Dec. 31. According to a Tadawul statement, the company recorded a net loss of SR18.8 million, compared with a net profit of SR95.8 million a year earlier.

The net loss was mainly due to ongoing market challenges that resulted in continued pricing pressures in fresh poultry, inflationary cost pressures, higher financing expenses, and depreciation and ramp-up costs from new facilities, partially offset by increased production volumes and cost-optimization initiatives.

Tanmiah Food Co. ended the session at SR58.20, up 3.72 percent.

United International Holding Co., also known as Tas’heel, announced its annual financial results for the period ending Dec. 31. A bourse filing showed the company recorded a net profit of SR273.64 million in 2025, up 23.05 percent from 2024, primarily driven by a 23.4 percent rise in revenues. The revenue growth helped lift gross profit by 23.7 percent.

Tas’heel ended the session at SR146.80, down 0.28 percent.