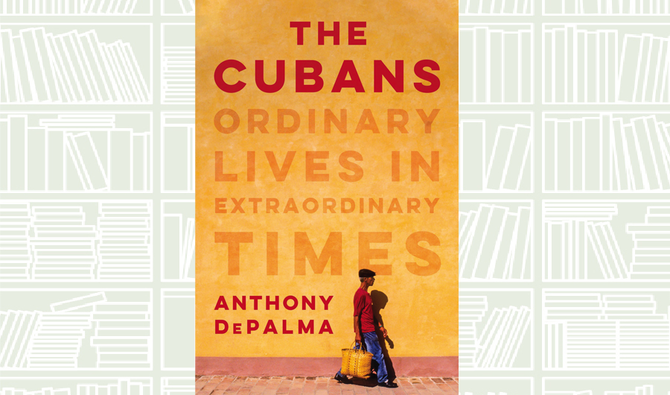

The Cubans from Anthony DePalma, a former foreign correspondent for The New York Times, is a must-read for anyone interested in Latin America, say critics.

“In his thoroughly researched and reported book, replete with human detail and probing insight, DePalma renders a Cuba few tourists will ever see,” said Marie Arana in a review for The New York Times.

DePalma burrows deep into one enclave of Havana, the historic borough of Guanabacoa, some three miles southeast of the capital.

“Lying across the famous harbor from the city center, Guanabacoa is close enough to have ties to Havana’s businesses, politics and culture,” he writes.

“Yet it operates at its own speed, with its own idiosyncrasies and an overriding sense, as one Cuban told me, of ‘geographic fatalism’ that comes from being so close to the capital, yet so very hard to reach from there.”

The book sadly leaves scant hope that anything will change in Cuba in the foreseeable future, but is testament to the resilience and ingenuity of the Cuban people.