What happened:

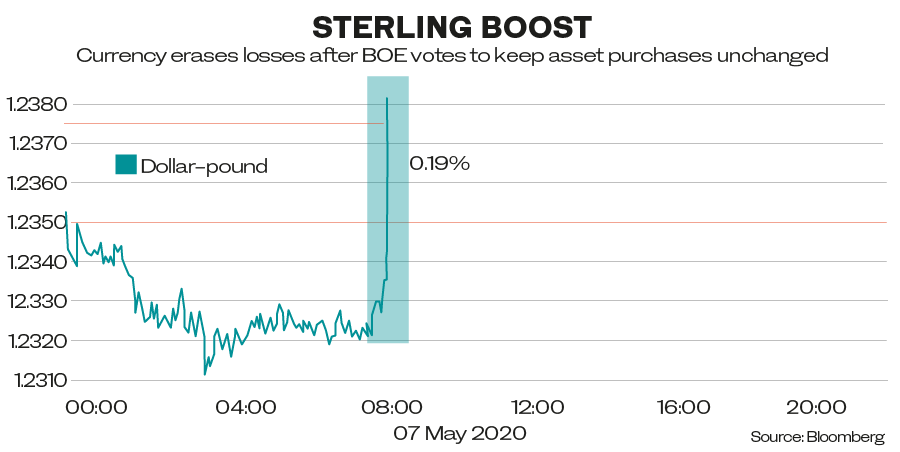

The Bank of England (BOE) left rates unchanged at 0.1 percent. Quantitative easing likewise remains unchanged. The current target £645 billion pounds ($795 billion) will probably be hit by July. Sterling rose 0.2 percent to $1.2369 immediately after the news was released and fluctuated thereafter. BOE Governor Andrew Bailey vouched to insert more monetary stimulus as needed. The bank predicts UK GDP will contract by 30 percent in the first half (3 percent in the first quarter and 25 percent in second quarter), with a preliminary outlook of a 14 percent contraction for 2020, the worst since 1706. House prices could fall by as much as 16 percent and unemployment could rise by 9 percent, bringing the number of unemployed above levels seen after the financial crisis.

Norway’s central bank, Norges Bank, lowered its base rate by 25 basis points to zero.

China’s exports for April grew unexpectedly by 3.5 percent compared to the same month in 2019. This is surprising amid the lockdown measures of China’s major trading partners. Imports dropped by 14.2 percent. The country’s trade surplus for the month stood at $45.3 billion. The economist community expected exports to shrink by 11 percent and imports to do slightly better by only declining 10 percent.

The Turkish lira hit a record low not seen since the 2018 currency crisis after authorities accused London-based banks of manipulation.

Saudi Arabia slashed its discounts on crude for buyers in Asia and other geographies. In Europe, they were reduced from $10 a barrel for Brent to $4. With this action, Saudi Aramco sends two messages to the market: Firstly, that the price war between Russia and the KSA is over and secondly, that they are more confident in oil demand going forward.

Earnings season continued:

Arcellor Mittal reported a net loss of $1.1 billion as opposed to a $400 million loss for the same quarter of 2019. The company abandoned guidance for 2020.

Drinks manufacturer AB InBev reported an EBITDA (earnings before interest, taxes, depreciation and amortization) of $3.9 billion, down 13.7 percent. First quarter shipments fell 9.3 percent while April’s fell 32 percent, prompting the drinks manufacturer to expect the second quarter to turn out far worse than the first due to restaurants and bars being closed amid the lockdown.

Air France KLM Group posted a loss of €815 million ($880 million) with capacity for the second and third quarters of 2020 contracting around -95 percent and -80 percent compared to the previous year.

DSM: Adjusted net profit came in at €168 million, up by 8 percent, reflecting primarily the success of its nutrition segment.

Munich Re reported a first quarter net profit of €221 million, down 65 percent compared to the same period in 2019. The re-insurer booked €800 million in coronavirus-related losses for the first quarter.

Background:

In a telephone call, Blackrock CEO Larry Fink painted a gloomy picture of the US economy, foreseeing bankruptcies on a wide scale. He was apparently particularly worried about what the pandemic would do to the psyche of the US consumer, who contributes 70 percent of the country’s GDP.

He also foresaw empty planes. His bleak outlook on travel and hospitality is reflected in the Intercontinental Hotels Group reservation rates, which were down 25 percent for the first quarter, 55 percent for March, and an unprecedented 80 percent for April.

Partially underlying Fink’s pessimistic views for the US economy were first-time jobless claims, which exceeded 30 million over the last six weeks. This week, Airbnb and Uber announced mass layoffs.

Where we go from here:

Telefonica and Liberty will combine their UK businesses of O2 and Virgin Media in a £31.4 billion deal, expecting synergies of £540 million. The joint company will have revenues of £11 billion and a customer base of 46 million across the collective mobile, broadband and pay-tv segments. The combined company expects to invest £10bn in the UK over the next five years. This will shake up the mobile/broadband market by creating a strong competitor to BT.

ADP reports that an estimated 20.2 million private-sector jobs were lost in April amid the coronavirus crisis. First-time jobless claims for the week ending May 1 and non-farm payroll numbers for April will be released later today.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources