What happened:

An EU-led, G20-supported multilateral fund-raising drive to fund research and manufacturing of COVID-19 vaccines and medicines was able to raise €7.5 billion ($8 billion) — including €4 billion going toward vaccines and €2 billion toward medicines.

Apple and others continued the dash for refinancing their debt and shoring up their balance sheets. They are taking advantage of low interest rates and the fact that the Fed widened its bond-purchasing program to the corporate bond sector.

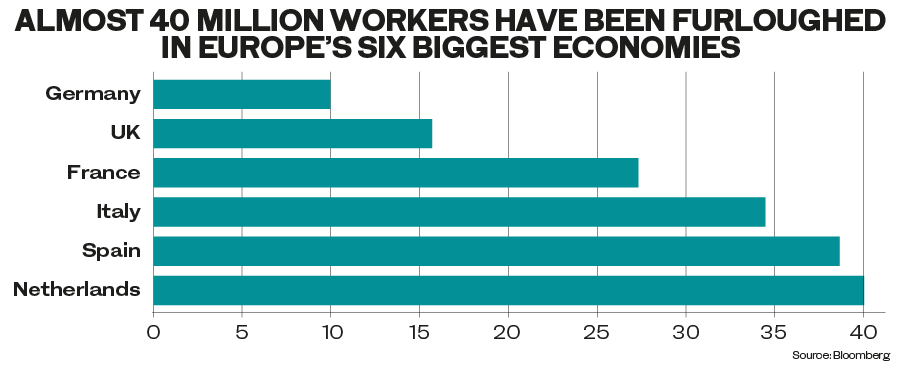

The number of people furloughed in Europe surpassed 40 million.

First quarter revenues for Adecco, the world’s leading provider of temporary and permanent staffing, were down by 9 percent. They were down by 19 percent in March and by about 40 percent for April, reflecting the dire employment situation in OECD countries.

BNP Paribas reported net income of €1.3 billion, down 33 percent for the same quarter last year. Like most of its peers it shored up loan-loss provisions, which now stand at €502 million.

Vestas posted a €54 million loss while sales for the first quarter had risen by 29 percent to €2.2 billion. The wind turbine manufacturer had abandoned guidance for the rest of the year.

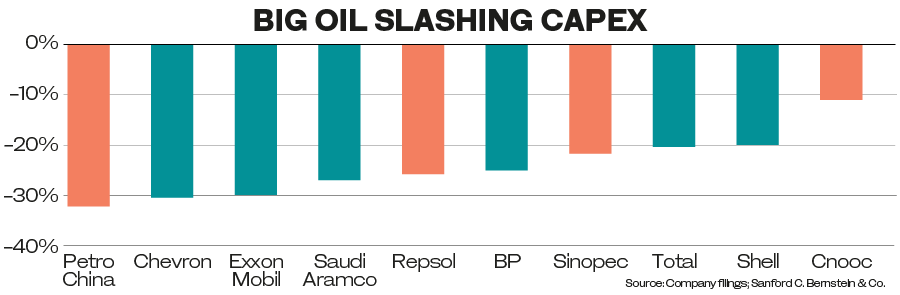

The last two of the big integrated oil companies reported on Monday: Total’s first quarter net profit was down by 35 percent and came in at $1.8 billion. Unlike Shell, the company will maintain dividend. CAPEX for 2020 was cut by 20 percent.

Repsol reported a net loss of €487 million for the first quarter and CAPEX was cut by 26 percent.

After more than 50 percent of companies have reported, we can see three trends weaving through the earnings season. More than 50 percent of companies abandoned guidance, most banks shored up their loan-loss provisions significantly in anticipation of what the lockdown would do to their loan portfolios. All major oil companies slashed Capex by at least 20 percent. Some of them maintained dividend, namely Aramco, BP and Total, whereas others cut them — most remarkably Shell, which did so for the first time since World War II. The dividend cut came in at 66 percent.

Background:

Ten investment-grade companies tapped into the US corporate bond market on Monday alone. The most prominent was Apple, which issued $8.5 billion worth of bonds. The company had missed its forecast for the first-time last week and already sits on a $200 billion cash pile. Other companies, including Avis, raised $400 million and Oneok Inc, a mid-stream oil company, raised $1.5 billion, rated by Standard and Poor’s just above junk.

Several of the “fallen angels” companies that were downgraded because of faltering financials due to the corona crisis had tapped the markets as well. They included, among others, Starbucks and Kraft Heinz.

A dash to the fixed-income markets started in mid-March when the Fed announced it would start buying corporate bonds. Companies are taking advantage of low interest rates as well as the Fed generating additional demand for their bonds.

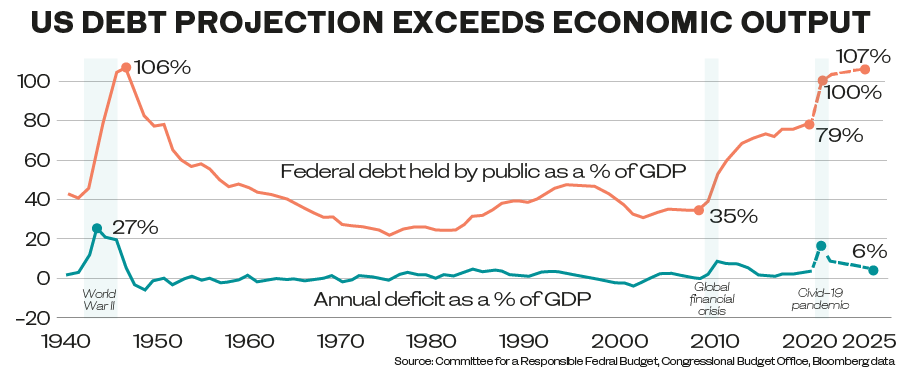

On one hand, it makes sense for many of these companies to shore up their balance sheets and liquidity at reasonable cost to weather the uncertain times. On the other hand, it increases corporate indebtedness if the amounts they raise are larger than the debt they are refinancing on more advantageous terms. This will add to the debt overhang, which already exists in the system and will become a lot worse when we are exiting lockdown.

In Europe the market was more muted due to the sluggish economy and worries of the White House rhetoric reigniting US-China trade wars.

Going forward:

US Secretary of Treasury Steven Mnuchin announced that he would raise another $3 trillion, which will allow the US-debt-to-GDP-ratio to skyrocket to hitherto-unseen proportions.

Germany’s constitutional court declared aspects of the ECB’s Public Sector Purchase Programme, which was the quantitative easing program during the financial crisis, as not violating the constitution per se but not conforming with aspects of the European treaties. The court has given the ECB three months to address issues pertaining to the Pandemic Emergency Purchase Programme (PEPP). In the next issue we shall look into how this ruling could affect PEPP going forward.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources