PESHAWAR: The Khyber Pakhtunkhwa (KP) government last week opened 50 kisan markets in different districts of the province for farmers to directly sell their produce to consumers, but a miscalculation of the strength of middlemen has kept it from being successful.

In Peshawar, four such markets were established on Dilzak Road and in the neighborhoods of Masho Gagar, Naguman and Peshtakhara, which are entrance points to the city. The areas are accessible to both city residents and farmers.

On the day of their inauguration, Peshawar Commissioner Shahab Ali Shah told reporters that the provincial government wanted to directly link consumers and farmers without middlemen, and to guarantee cheap prices. “All district administrations have been instructed to visit kisan markets on a regular basis to ensure the best quality and cheap rates,” he said.

Under the province’s agricultural extension program, the markets are formed to supply fresh vegetables and fruits at cheaper prices, and to end the grip of middlemen on smallholders. The administration offered free space and tents to facilitate the farmers, but did not realize how strong the intermediaries were.

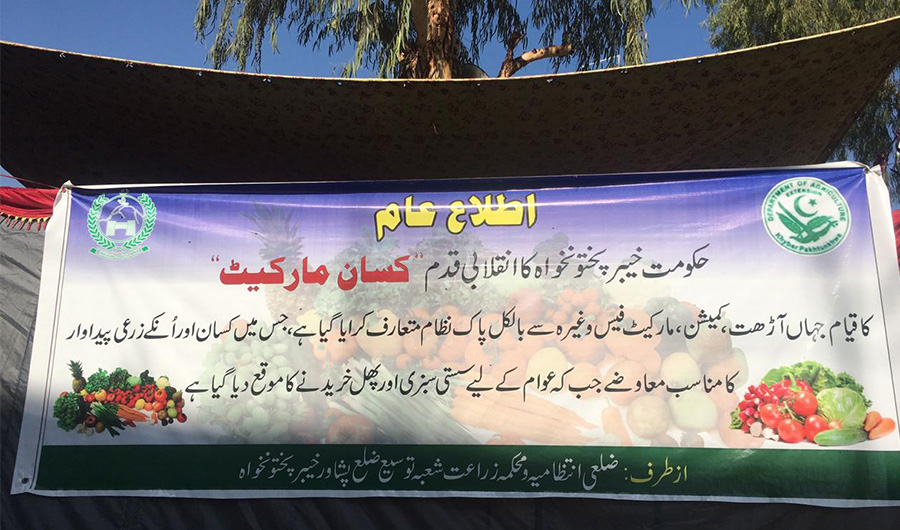

A huge banner on one tent boasted the “revolutionary step” by the KP government, but a week later the market on Dilzak Road was empty.

According to the banner, the KP government has introduced a program free from commission agents, Dilzak Road, Peshawar, Nov.19, 2019. ( AN photo)

Zeeshan Anwar a resident of Warsak Road in Peshawar appreciated the government’s kisan market initiative. “It was a great step, the other day I bought vegetables 30 percent cheaper, but today these tent shops are empty, this upsets me,” he said, adding that the administration should put more effort into sustaining these markets as they are of great benefit to both farmers and consumers.

According to Assistant Commissioner Asif Khan, the provincial government still wants to address the problem of intermediaries.

“Farmers get loans before sowing seeds against expected crops from commission agents and middlemen. The KP government still wants to end the middlemen monopoly on vegetables and fruits, which would ultimately reduce their prices by up to 40 percent and benefit common man,” he told Arab News.

Agricultural produce in Pakistan has been traditionally controlled by middlemen, who give loans to farmers before the harvest season and provide them space at marketplaces.

“Commission agents get all benefits as they give these loans. It compels us to bring our crops to lenders and sell vegetables on agent’s mercy,” said Iqbal Lala, 53, who has been working as farmer for over three decades. “In KP, these middlemen get their commission from farmers and purchasers and it varies from 15 to 20 percent,” he said, adding that farmers often feel “handcuffed” and compelled to follow this “dirty tradition.”

After a week from their launch, kisan markets are empty, Peshawar, Nov.19, 2019. ( AN photo)

According to middleman Jamal Shah, they do not force farmers to anything, but if they take loans, there are obligations to be fulfilled. “We assist farmers in hard days and we trust them and invest before seeding, and it is us who work for the country’s agriculture. Loans vary depending on the size of farming and commission includes labor, food and other expenses,” he said.

Amjad Khan, secretary general of Malakand Model Farms Services Center, which bridges farmers and the agriculture department, said that without government support farmers will not free themselves from middlemen or commission agents. “The kisan markets idea is brilliant, but it was launched in haste, without any research or survey,” Khan told Arab News. “Seeds, pesticides, taxes and fertilizer rates need to be reduced by 50 percent and banks should introduce a trustworthy plan for small farmers, with mini-loans for season crops,” he said, stressing that for self-sufficiency in agriculture, the state must back farmers and kisan markets would not survive if actual growers remain bounded by agents.