LONDON: Toyota is the favorite Japanese car brand among Arabs, according to the YouGov poll, a result that bodes well for the company’s plans to transform from a manufacturer to a mobility provider in the region.

The poll, which asked residents across the MENA region for their views on a range of questions related to Japan, found that many Arabs associate Japan with car making, with 56 percent of respondents listing it as one of the things they associate with the country the most.

In the GCC this figure was particularly high, with more respondents associating Japan with car manufacturing than with sushi or samurai.

It is possible that when Arabs associate Japan with car manufacturing, they are thinking of one brand in particular — Toyota.

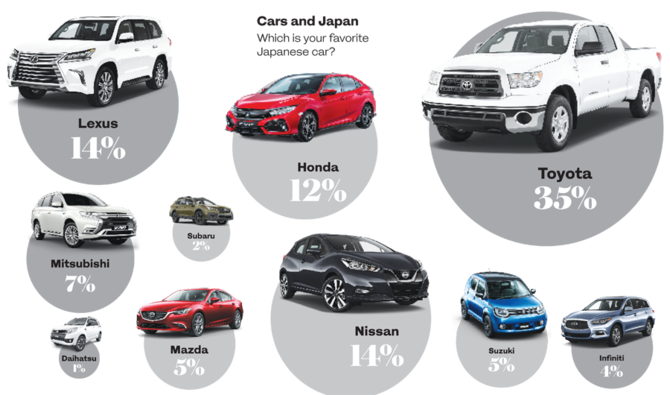

After all, when asked to name their favorite Japanese car brand, 35 percent of respondents selected Toyota, a huge majority over the other Japanese manufacturers that were listed in the poll.

The car brands that were placed second in the poll, Nissan and Lexus, were each named as the favorite by only 14 percent of respondents, a small figure in comparison to Toyota’s dominance, although Lexus performed notably strongly in the GCC, with 23 percent of respondents from this region listing it as their favorite.

Toyota’s strong reputation in the region is also shown by YouGov’s 2019 BrandIndex, an authoritative measure of brand perception which tracks brands based on metrics relating to the brand’s health, media activity and customer experience.

ALSO READ: Arab consumers associate Japan with high quality

Toyota came top of the 2019 BrandIndex for car makers in Saudi Arabia, ahead of German competitors Mercedes and BMW. Lexus was ranked fourth on the index, above South Korean car-maker Hyundai, which was placed fifth.

A BrandIndex spokesperson said: “YouGov BrandIndex data in the Car Makers sectors in KSA for the first nine months of 2019 shows that on 14 of the 16 metrics we track in BrandIndex, Toyota tops the sector among virtually all demographic segments of the market including among the general population.

Such indicators of Toyota’s strength in the Middle Eastern market augur well for its vision to transform from a car manufacturer to a mobility company.

Highlights of Toyota’s transformational strategy were shared with those at the inaugural Dubai World Congress for Self-Driving Transport on Oct. 15.

The company’s decision to look beyond vehicle manufacture toward broader issues of mobility is designed to address the challenges of the future, from congestion in large cities due to overpopulation to the decline in rural mobility globally.

Mandali Khalesi, vice president of automated driving at the Toyota Research Institute for Automated Driving Development, told the conference: “The vehicle is not the purpose. The purpose is access to mobility. Mobility becomes a right that you have to get from A to B, regardless of the mode of transportation.”

Toyota is making clear steps to transform from a car maker to a major mobility provider, and its partnership with Al-Futtaim and the RTA in Dubai is evidence of this.

Given the support for the brand among Arab consumers, Toyota is in a strong position in the Middle East to build on its reputation as a car manufacturer as it seeks to move into other markets.