SYDNEY: Australia’s central bank cut interest rates for the third time this year on Tuesday in a bid to stimulate a sluggish economy and signaled it was prepared to do more if needed, knocking the local dollar to a one-month low.

The country’s economy has expanded for 28 years without a recession, but risks have intensified over the past year, with growth slowing, inflation lukewarm, the property market subdued and unemployment ticking higher.

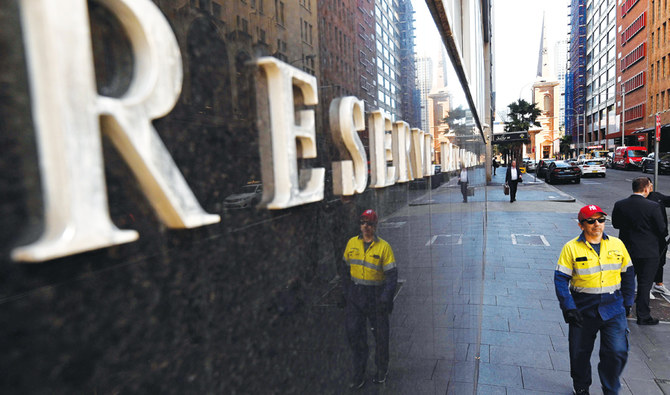

The Reserve Bank of Australia’s (RBA) quarter-point cut took the cash rate to an all-time low of just 0.75 percent, leaving little room for more reductions and raising the possibility of unconventional policy easing.

RBA chief Philip Lowe said moves by global central banks to ease monetary policy played a part in the decision as he signaled the need for an extended period of low rates.

Financial futures are now pricing in a 60 percent chance of a fourth cut to 0.5 percent in November, compared with under 30 percent before the latest decision.

Expectations that rates will be lower for longer sent the Australian dollar slipping to $0.6706, its weakest since early September.

“In cutting rates so aggressively this year, the RBA is hoping to generate a stronger labor market, higher wage growth and to stimulate domestic consumption,” said Anthony Doyle, a Sydney-based, cross-asset strategist at Fidelity.

“Fortunately for the RBA, the transmission mechanism of monetary policy is fairly quick in the Australian economy,” he said, noting around 80 percent of mortgages were on variable rates.

The RBA’s back-to-back easings in June and July have so far done little to boost activity outside of the housing market.

Indeed, figures earlier in the day showed home prices across Australia’s capital cities jumped 1.1 percent in September, but approvals to build new homes collapsed to the lowest since 2013.

Economists expect construction-related job losses in coming months which could take the unemployment rate to as high as 5.5 percent from 5.3 percent now and the RBA’s goal of around 4.5 percent.

“The RBA now has only three, or possibly even fewer, more conventional cuts available before they will have to venture into unconventional monetary easing territory — negative rates, QE (quantitative easing), or bond yield targeting,” Rob Carnell, chief Asia-Pacific economist for ING said.