MOSCOW: Saudi Attorney General Sheikh Saud bin Abdullah Al-Mua’jab and his Russian counterpart Yury Chaika held talks in Moscow on Wednesday on a number of issues of mutual interest.

The two sides signed a memorandum of understanding (MoU) on coordination between Saudi Public Prosecution and Russian Public Prosecution in combating crime and its organized forms, terrorism, corruption, protecting human rights and legitimate freedoms.

The two sides agreed that the MoU shall be the basis for cooperation, based on the principle of equality and mutual respect and in accordance with the laws and regulations prevailing in both countries.

They also agreed on holding joint meetings, consultations, conferences, seminars and discussions, in addition to conducting research to ensure proper exchange of experiences and information related to major issues.

Al-Mua’jab thanked the Russian Public Prosecution for the warm welcome and stressed the historical dimension of Saudi-Russian relations.

“This MoU sheds light on the constantly developing Saudi-Russia relations. It comes in line with the Kingdom’s 2030 Vision, which seeks to promote the Kingdom on all levels, particularly its justice system,” he said.

Chaika stressed the importance of the Saudi crown prince’s visit to Moscow in 2017 and the follow-up trips he made to Russia for the positive impact they have had on Saudi-Russian relations.

He also highlighted the already strong relationship the countries have and the similarities of their approaches when dealing with international issues.

Saudi, Russian officials sign MoU to confront crime, protect human rights

Saudi, Russian officials sign MoU to confront crime, protect human rights

- The two sides agreed that the MoU shall be the basis for cooperation

US Embassy marks 248th Independence Day with shared US-Saudi vision for space exploration

- Ambassador Michael Ratney welcomes hundreds of Saudi guests to space-themed Riyadh reception

RIYADH: The US Embassy in Riyadh celebrated the 248th anniversary of Independence Day on Thursday with a reception hosted by US Ambassador Michael Ratney.

The ambassador welcomed guest of honor Prince Faisal bin Abdulaziz bin Ayyaf, Riyadh Region mayor, along with Saudi officials, and hundreds of Saudi guests, as well as visitors from Washington, including members of the US Congress.

The space-themed Independence Day reception served as a symbolic celebration of the future of the US-Saudi cooperation in space, highlighting the profound benefits and possibilities of space exploration, research, and commercial development.

Ratney said the theme reflects the “shared ambition of the United States and Saudi Arabia to embrace opportunities in space, positioning both countries as pioneers in this frontier of innovation.”

The event evoked nostalgia for past achievements, such as the 1969 moon landing, while emphasizing ongoing advancements in space sciences, particularly commercial space exploration.

Ratney highlighted Saudi pioneers in space travel, such as Prince Sultan bin Salman, and astronauts Rayyanah Barnawi and Ali Al-Qarni.

An art installation, “Museum of the Moon,” by artist Luke Jerram, featured NASA’s high-definition imagery of the lunar surface.

According to the US Embassy’s statement, the collaboration between the US and Saudi Arabia continues to advance shared interests in diplomacy, commerce, culture, and more.

The US remains dedicated to enhancing shared US-Saudi shared interests in security and in fostering prosperity in the region, while also exploring new avenues for partnerships in areas such as the arts, education, entertainment, and tourism, it said.

Both countries are poised to explore further cooperation, including potential joint ventures in space, reflecting a vision for an even stronger US-Saudi relationship in the future, the statement added.

Saudi, Cypriot foreign ministers discuss relations

Saudi Minister of Foreign Affairs, Prince Faisal bin Farhan received his Cypriot counterpart, Dr. Konstantinos Kompos, at the ministry’s headquarters in Riyadh on Thursday.

During the meeting, the ministers reviewed the advanced bilateral relations between the Kingdom and the Republic of Cyprus, and ways to promote them in a variety of fields.

They also discussed ways to increase bilateral coordination on issues of common interest and reviewed international developments.

New initiative to train young innovators in nanotechnology

- Program structured in 3 phases for Saudi graduates and entrepreneurs

RIYADH: The Nanotechnology Association, supported by the Misk Foundation, is set to launch the Nanohub Program, aimed at inspiring and equipping the next generation for careers in the sector to help support a brighter future and a thriving economy.

Nanohub, a nonprofit initiative, is structured in three phases to train Saudi graduates and entrepreneurs aged between 20 and 26. It provides workshops and sessions to develop personal skills, gain hands-on experience with nanotechnology, and receive guidance from industry experts.

The program partners with leading local and international organizations to ensure participants are prepared for the workforce.

Nanotechnology is expected to transform business and innovation in various sectors. Understanding its economic impact and the potential benefits of partnerships are of crucial importance for young entrepreneurs.

The program aims to equip participants with the skills and knowledge needed to excel in nanotechnology and inspire them to drive innovation in their industries.

The first phase of the program will focus on soft skills and leadership development. It is scheduled for three days, starting on April 28.

The second phase, which starts on May 5, explores applications of nanotechnology. It runs for five days, covering topics like the fundamentals of nanotechnology, its use in medicine, energy, and renewable energy, as well as sustainability.

The third phase, beginning on May 12 and ending on May 16, provides hands-on laboratory experience through a series of sessions called “Shadowing and Lab Tours.” This phase has two key tracks: the Shadowing Track and the Lab Tours Track.

The Lab Tours Track will give participants an in-depth look at cutting-edge nanotechnology research. They will visit world-class laboratories where nanotechnology innovations are being developed.

Participants will observe advanced equipment and complex techniques central to nanotechnology research. They will see live experiments and dynamic processes that reveal the workings of nanotechnology. This track is more than just a tour as it enhances understanding by connecting academic concepts to real-world applications, giving participants a closer look at the research and development process.

The Nanohub Program is “a transformative initiative designed to elevate the skills and competencies of graduates and new hires with STEM (science, technology, engineering and mathematics) backgrounds,” said Dr. Turki Almugaiteeb, chairman of the board of the Nanotechnology Association.

“This unique initiative aims to enrich participants’ soft skills and technical expertise through curated activities.”

Almugaiteeb added that participants would “have the opportunity to delve into the intriguing realms of medicine and energy, witnessing firsthand how nanotechnology is revolutionizing these industries.”

He added: “By immersing themselves in this dynamic program, individuals will not only broaden their knowledge but also cultivate the multidisciplinary skills needed to thrive in today’s competitive and rapidly evolving STEM landscape.”

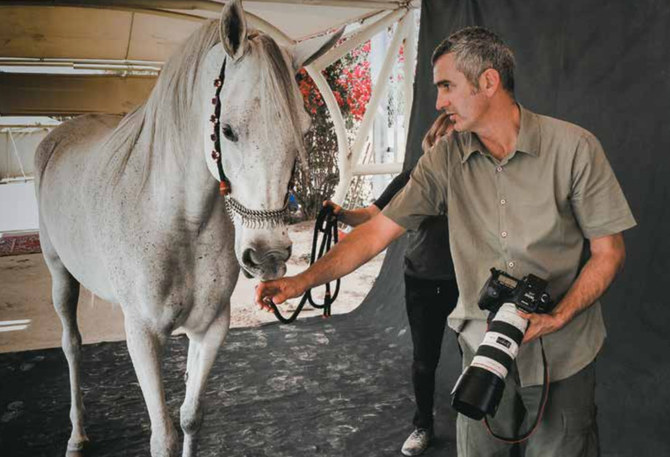

An enduring bond: A Jordanian photographer has turned his focus on two of the Arab world’s most beloved creatures

- Tariq Dajani’s first photographic exhibition of the horse and falcon series is on display at Ahlam Gallery in Al-Olaya, Riyadh

- Arabian horses have been the subject of songs and poetry praising their individual and physical qualities down through the ages

RIYADH: The Arabian horse and hunting falcon are important historical and cultural symbols for the Arab world, both ancient and modern.

Now a Riyadh gallery is highlighting this enduring bond with a series of portrait studies of both creatures by Tariq Dajani, a Jordanian photographer and printmaker.

Arabian horses have been the subject of songs and poetry praising their individual and physical qualities down through the ages.

However, Dajani, an owner of Arabians, chose to reflect his love of these creatures through photography and artworks.

Over the years he spent many sessions photographing horses in his native Jordan, as well as the UAE and Saudi Arabia. Later, toward the end of the project, he added the hunting falcon, another symbol of cultural heritage and pride among Arabs.

Dajani’s first photographic exhibition of the horse and falcon series is on display at Ahlam Gallery in Al-Olaya, Riyadh.

Entitled “Drinkers of the Wind,” the exhibition is the result of 16 years’ work creating portraits of these magnificent creatures.

Dajani told Arab News that he is delighted to be able to display his work in Saudi Arabia, “a country that is deeply connected to the horse and the falcon.”

Ahlam Gallery is the perfect place to showcase these artworks, he added.

Dajani’s treatment of his subjects is not in the usual natural or romantic manner. Instead, and this is partly what sets his art apart, he uses a studio portrait approach, where he takes his studio to the stables or falcon sheds, and spends time carefully working on portrait studies of the creatures.

“My aim is to find a connection of sorts with the horse or the birds,” he said. “I am not interested in documenting the creature; I try to go deeper, to express something emotionally if I can.

“I was living in Sweden when I decided to photograph the Arabian horse. So I had to return to the Middle East, and I started with Jordan, my home country.

“The way I approach the work is to present the horse on a backdrop where all my focus — and thus the viewers of the final picture — will be on the animal itself and not on the environment that it is in.”

While photographing in Jordan, Dajani met Princess Alia Al-Hussein, eldest daughter of the late King Hussein of Jordan. He presented some of his work to her, and received her enthusiastic approval.

Princess Alia gave him permission to photograph the horses of the Royal Jordanian Stud, and has continued to support his work over the years, opening his first two exhibitions in Jordan.

“I had access to some of the most beautiful horses in Jordan when I first started my project. My first exhibition solely of Jordanian Arabians was a great success,” Dajani said.

“Encouraged by the reception, and by now totally absorbed in this project, I went to Dubai, then Abu Dhabi, then Saudi Arabia, where I was presented with some of the most magnificent Arabian horses to photograph. Along the way, I introduced portrait studies of the hunting falcon. They, too, are strikingly beautiful and have a special place in Arab culture and heritage.

“I will always remain very grateful to Princess Alia for her initial support, and to many others for encouraging the work and opening doors for me along the way.”

One of his most striking photographs shows two mares bringing their heads together in a gentle greeting.

“This incredible and totally unanticipated greeting happened while I was photographing at the King Abdulaziz Arabian Horse Center in Dirab, south of Riyadh. The two mares were led out onto my backdrop studio space from opposite sides, and when they approached each other, they gently and courteously touched their heads as if to say hello,” he said.

“It was so special. No one had ever witnessed this before. We all held our breath as we watched in amazement. I frequently think that it would be nice if these sensitive, clever creatures could teach us humans a little bit of gentleness and respect.”

Dajani’s exhibition features high-quality photographic color prints, and a smaller collection of photogravure prints, produced by manually pulling an inked metal plate, engraved with the photographic image, through a traditional printing press — a slow and difficult process that produces prints with a special feel and texture.

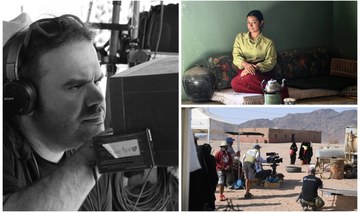

Focus on emerging filmmakers at 11th Showreel Effat International Student Film Festival

- The event included films by young Saudis and their peers from around the world, plus seminars and workshops presented by industry insiders

JEDDAH: Effat University’s School of Cinematic Arts in Jeddah welcomed aspiring filmmakers and cinephiles to the 11th Showreel Effat International Student Film Festival this week.

The theme for the three-day event, which concluded on Thursday, was “Behind the Seen,” reflecting the aim of organizers to shed light on the creative process and less-visible aspects of filmmaking. The program included a diverse range of cinematic offerings celebrating the work and talent of student filmmakers, not only those studying at the school but also their peers around the globe.

Mohammed Ghazala, head of the School of Cinema Arts, set the scene with an overview of the works featured during the festival, at the heart of which were films created by students and graduates of the school, which has been a pioneer in film and animation education in the Kingdom.

Alongside the home-grown talent, the festival provided a showcase for an impressive selection of international student films. These were carefully curated from a pool of 2,150 submissions from more than 115 countries, which were whittled down to a final selection of 57 exceptional works from 27 nations: Saudi Arabia, Egypt, Lebanon, Tunisia, Yemen, Morocco, Turkey, France, Belgium, Japan, Italy, Estonia, the Czech Republic, the US, China, New Zealand, Singapore, Canada, Taiwan, Russia, Greece, Spain, Poland, India, Indonesia, Mexico and Pakistan.

The chosen films competed for awards in seven categories, including Best Saudi Feature Film, Best International Animated Film, and the prestigious Audience Award.

In addition to providing a platform for emerging filmmakers to showcase their talent and creativity, organizers said the festival also aims to foster cultural exchanges and celebrate the art of cinema on a global scale.

Integral to this is a commitment to nurturing talent and encouraging dialogue within the industry, which was reflected in a series of seminars and workshops led by industry professionals. Effat University lecturer and festival coordinator Marina Ivanseva gave an overview of the sessions, which offered insights into a wide spectrum of topics key to the craft.

They included sessions on a creative cinematic post-production workshop supported by video-streaming service Netflix, cinematography workshops conducted by film camera manufacturer ARRI, and a visual effects workshop backed by specialist studio VFX Mojo.

They were presented by renowned figures and industry insiders such as Saudi artist Sarah Taibah, Oscar-winning German director Thomas Stelmach, British professor Rut Luxemburg, American visual effects artist Matt Beck, and cinematographer James Niehaus.

There were also lectures on animation and experimental film presented by the Royal College of Arts in London, while Stellmach offered insights into his professional journey that led to the Oscars. Saudi producer Nadia Malaika shared valuable career insights, Egyptian lawyer Khaled Al-Arabi discussed legal rights in filmmaking, and Mohammed Sobeih looked at the creation of animated films using Toon Boom software. The festival concluded with a session focusing on animated cinema presented by Synergy University.

“We were thrilled to welcome numerous local and international guests who shared their cinematic experiences with us … during the 11th Showreel Effat International Student Film Festival,” said Asmaa Ibrahim, the dean of Effat College of Architecture and Design.

“Students from Dar Alhekma, King Abdulaziz, and Princess Noura (universities) in Riyadh joined us in celebration. It was a delight to host guests from prestigious institutions such as the Royal College of Art, Netflix, Maflam, Film Association and VFX Mojo, who conducted exceptional workshops. The interactive discussions were engaging and we appreciate the participation of everyone.”

Karim Sahai, a visual effects professional from France, said: “I’m proud to have been a part of this incredible festival, with such a fantastic audience and remarkable guests from all over.

“The quality of their engagement and the depth of their questions during my workshop surpassed my expectations. I truly believe I’ll return to bask in this energy once more; it’s truly inspiring.”

Beyond artistic appreciation, organizers said another aim of the festival is to help forge academic and strategic partnerships, and Effat University has built alliances with institutions such as the University of Southern California and the Red Sea Film Festival Foundation with the goal of fostering collaboration and exchange of knowledge on a global scale.