KARACHI: Pakistan’s newly-elected government continues to worry the business fraternity with its indecisiveness and backtracking on key economic issues, experts told Arab News on Saturday.

The cabinet, led by Prime Minister Imran Khan, was formed on August 20 but has yet to take a major economic decision to allay investors’ fears.

It also remains to be seen whether or not the International Monetary Fund (IMF) will be approached for a bailout package. “There is a major difference between the information they [PTI government] obtained before and after the elections; in fact, the difference is so enormous that they are confused as to how to handle the information in terms of decision making,” Muzamil Aslam, senior economist and CEO of EFG-Hermes Pakistan, said.

Questioning the decision-making ability of Finance Minister Asad Umar, he added: “Up until now, all previous finance ministers would have made decisions, but Asad Umar is making committees on every issue instead of taking prompt decisions. His role as finance minister is quickly becoming that of a coordinator between task forces and committees.”

Pakistan’s economic situation poses a challenge to the new government as the current account deficit in July 2018 jumped to a whopping $2.2 billion due to an increase in imports and an insufficient foreign inflow. The country’s foreign exchange reserves have fallen to $9.9 billion — not enough to meet import obligations of even two months.

The government was expected to deliberate on the issue during the first meeting of the newly-constituted Economic Advisory Committee (EAC), but the meeting, chaired by Prime Minister Imran Khan on Thursday, concluded after the initial introductions.

Dr. Ashfaque Hassan Khan, a member of the EAC, who attended the meeting said: “Though IMF was not discussed at all in the meeting, my personal view is that we should live without the IMF.”

Speaking to Arab News he said: “Instead of taking medicines periodically temporarily, we should diagnose the illness and take remedial measures once for all.”

Dr. Khan said that the prime minister shared his vision of a welfare state and was determined to improve the lives of the poor.

Following the meeting, the stock market closed at 411 points lower, mainly on the weekend, due to the indecisiveness of the government to tackle key economic issues, with external financing topping the list.

“The market is in negative because investors are confused as to how the new government’s economic managers will act considering the rising current account and fiscal deficit. Moreover, there is no clarity on how the dollar funding gap will be bridged – whether this will be done with the support of the IMF or another source,” Muhammad Sohail, CEO of Topline Securities, explained to Arab News.

During the week, the stock market shed 883 points, falling below the 41,000 level, erasing most of the gains made in the period post the 2018 general elections.

Recently, the government was caught in the crossfire following the appointment of Dr. Atif R Mian from the minority Ahmadi community. Ahmadis were declared non-Muslim by the parliament on September 7, 1974.

Information Minister Fawad Chaudhary, defending the government’s stance, had vowed not to bow down before people whom he declared as “extremists”. On Friday, however, the government backtracked and withdrew Mian’s nomination.

“The government wants to take religious scholars and all other segments of society along with them in their decision-making process and if one nomination gives a perception that it is different from the government’s aim, then it is not appropriate,” Chaudhary tweeted.

“Until yesterday they [the government] were defending his [Dr. Atif R Mian] appointment,” Aslam responded, adding that, “they are now shaking because reality has kicked in.”

Dr. Ikramul Haq, a senior economist lamenting the move, said: “This is a disappointment for all those who are concerned about extremists holding the state captive. The right of a citizen, irrespective of their faith, is equal under the constitution. Removal of his name from the advisory body amounts to a violation of Article 25 of the constitution which pertains to the protection of equal rights and does not allow discrimination on the basis of faith, cast and creed etc.”

Indecisiveness on key economic issues sparks confusion in Pakistan, experts say

Indecisiveness on key economic issues sparks confusion in Pakistan, experts say

- Pakistan’s economic situation poses a challenge to the new government as the current account deficit in July 2018 jumped to a whopping $2.2 billion due to an increase in imports and an insufficient foreign inflow

- Authorities fail to reach consensus on whether or not to approach the IMF

Saudi POS transactions see 20% surge to hit $4bn: SAMA

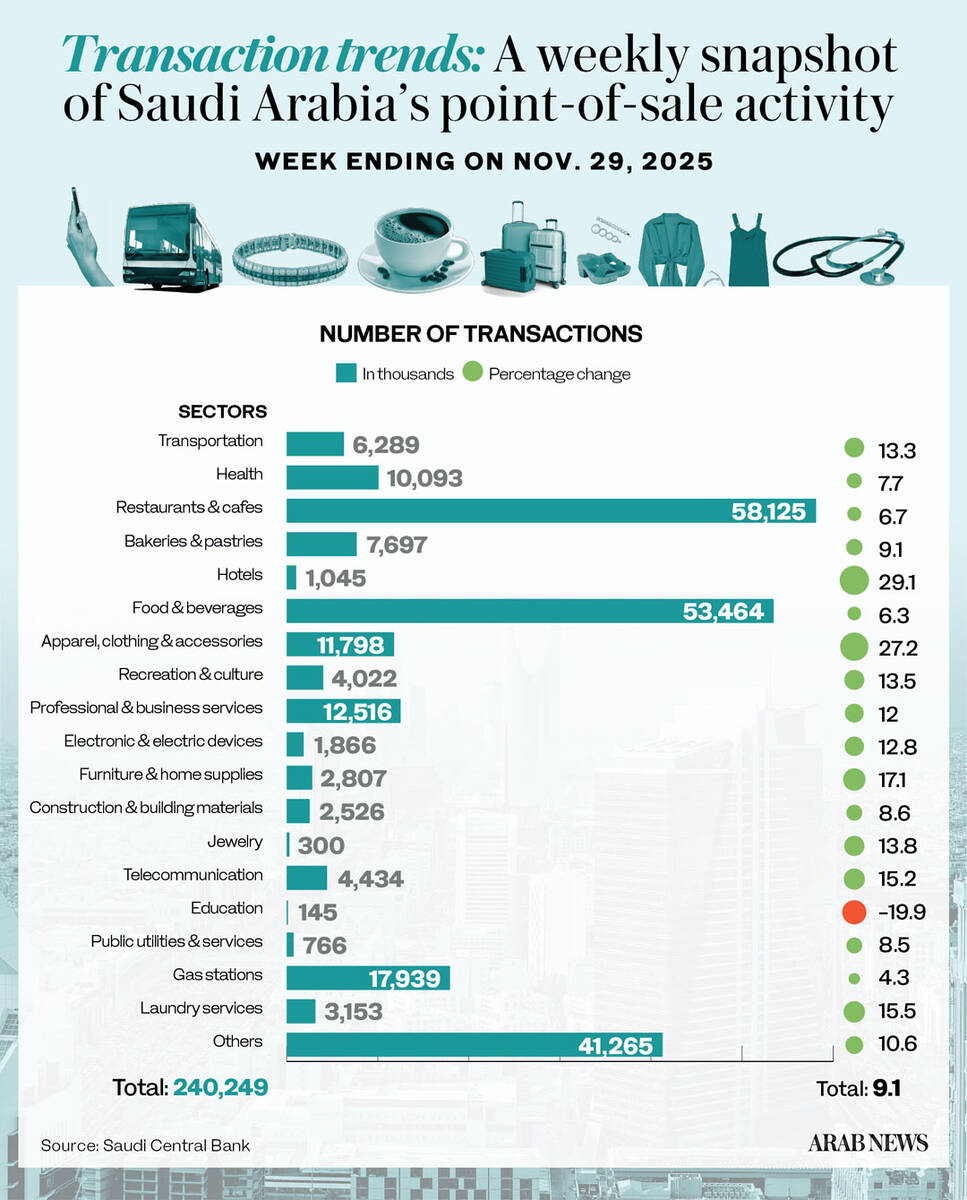

RIYADH: Saudi Arabia’s total point-of-sale transactions surged by 20.4 percent in the week ending Nov. 29, to reach SR15.1 billion ($4 billion).

According to the latest data from the Saudi Central Bank, the number of POS transactions represented a 9.1 percent week-on-week increase to 240.25 million compared to 220.15 million the week before.

Most categories saw positive change across the period, with spending on laundry services registering the biggest uptick at 36 percent to SR65.1 million. Recreation followed, with a 35.3 percent increase to SR255.99 million.

Expenditure on apparel and clothing saw an increase of 34.6 percent, followed by a 27.8 percent increase in spending on telecommunication. Jewelry outlays rose 5.6 percent to SR354.45 million.

Data revealed decreases across only three sectors, led by education, which saw the largest dip at 40.4 percent to reach SR62.26 million.

Spending on airlines in Saudi Arabia fell by 25.2 percent, coinciding with major global flight disruptions. This followed an urgent Airbus recall of 6,000 A320-family aircraft after solar radiation was linked to potential flight-control data corruption. Saudi carriers moved swiftly to implement the mandatory fixes.

Flyadeal completed all updates and rebooked affected passengers, while flynas updated 20 aircraft with no schedule impact. Their rapid response contained the disruption, allowing operations to return to normal quickly.

Expenditure on food and beverages saw a 28.4 percent increase to SR2.31 billion, claiming the largest share of the POS. Spending on restaurants and cafes followed with an uptick of 22.3 percent to SR1.90 billion.

The Kingdom’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 14.1 percent surge to SR5.08 billion, up from SR4.46 billion the previous week. The number of transactions in the capital reached 75.2 million, up 4.4 percent week-on-week.

In Jeddah, transaction values increased by 18.1 percent to SR2.03 billion, while Dammam reported a 14 percent surge to SR708.08 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with the Kingdom’s Vision 2030 objectives, promoting electronic transactions and contributing to the nation’s broader digital economy.