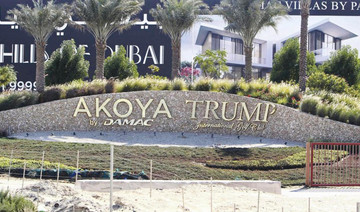

DUBAI: Dubai’s Damac Properties, owner and operator of the only Trump-branded golf club in the Middle East, is confident of its financial position despite registering its worst quarter in terms of booked sales since the company went public five years ago, its chief financial officer said.

Damac is feeling the impact of a real estate market in Dubai that is under pressure because of lower property prices and subdued sales as new developments hit the market.

“In a cyclical market it’s important to have some sense of certainty over direction, and from that perspective, we’re satisfied,” Adil Taqi said in a phone interview on Tuesday after the publication of Damac’s results for the first half of 2018.

“We’re also satisfied in a way that every day in a weak cycle that we put behind us puts us closer to the turnout.”

Taqi said the firm was “holding its nerve” in terms of cash balances and payment plans.

Damac’s second quarter profit from continuing operations fell by around 46 percent year-on-year to 378.2 million dirhams ($103 million). Total revenues for the first six months stood at 3.7 billion dirhams, year-on-year growth of 5 percent.

Dubai’s real estate prices, hit by new supply, could decline by 10 to 15 percent over the next two years, after falling between 5 to 10 percent in 2017, according to S&P estimates earlier this year.

Damac has not pulled or delayed any existing projects, and 2018 is likely to be a bumper year in terms of property deliveries, the CFO said.

In the first half of the year, Damac delivered 1,490 units compared to 1,071 units in the same period last year. The company plans to deliver over 4,000 units in 2018.

Damac’s unsold inventory, which extends beyond Dubai, is about $400 million-$500 million, said Taqi. “In the short term, unless the market improves, this will build up slightly more.”

But the firm does not plan to sell assets to counterbalance the market slowdown. “We will not throw value away because we’re under pressure. We recognize we’re in a tough market and we need to be able to manage that.”

Damac has no significant capital expenditure commitment for the rest of the year, and currently has $2 billion in cash, of which $350 million-$400 million is unrestricted, or not earmarked for a specific purpose.

“We’re well capitalized, I don’t see any question over our cash ability,” said Taqi.

Damac has $270 million in Islamic bonds due early next year and plans to pay them down, rather than approaching the market to refinance them. It has around $180 million in bank debt that it mostly plans to refinance in the near-term, also to maintain relationships with local banks, he added.

Damac Properties ‘holds its nerve’ amid Dubai real estate slump — CFO

Damac Properties ‘holds its nerve’ amid Dubai real estate slump — CFO

- Damac’s second quarter profit from continuing operations fell by around 46 percent year-on-year to 378.2 million dirhams

- Damac has no significant capital expenditure commitment for the rest of the year

The Family Office to host global investment summit in Saudi Arabia

RIYADH: The Family Office, one of the Gulf’s leading wealth management firms, will host its exclusive investment summit, “Investing Is a Sea,” from Jan. 29 to 31 on Shura Island along Saudi Arabia’s Red Sea coast.

The event comes as part of the Kingdom’s broader Vision 2030 initiative, reflecting efforts to position Saudi Arabia as a global hub for investment dialogue and strategic economic development.

The summit is designed to offer participants an immersive environment for exploring global investment trends and assessing emerging opportunities and challenges in a rapidly changing financial landscape.

Discussions will cover key themes including shifts in the global economy, the role of private markets in portfolio management, long-term investment strategies, and the transformative impact of artificial intelligence and advanced technologies on investment decision-making and risk management, according to a press release issued on Sunday.

Abdulmohsin Al-Omran, founder and CEO of The Family Office, will deliver the opening remarks, with keynote addresses from Saudi Energy Minister Prince Abdulaziz bin Salman and Prince Turki Al-Faisal, chairman of the King Faisal Center for Research and Islamic Studies.

The press release said the event reflects the firm’s commitment to institutional discipline, selective investment strategies, and long-term planning that anticipates economic cycles.

The summit will bring together prominent international and regional figures, including former UK Treasury Commercial Secretary Lord Jim O’Neill, Mohamed El-Erian, chairman of Gramercy Fund Management, Abdulrahman Al-Rashed, chairman of the editorial board at Al Arabiya, Lebanese Minister of Economy and Trade Dr. Amer Bisat, economist Nouriel Roubini of NYU Stern School of Business, Naim Yazbeck, president of Microsoft Middle East and Africa, John Pagano, CEO of Red Sea Global, Dr. Anne-Marie Imafidon, MBE, co-founder of Stemettes, SRMG CEO Jomana R. Alrashed and other leaders in finance, technology, and investment.

With offices in Bahrain, Dubai, Riyadh, and Kuwait, and through its Zurich-based sister company Petiole Asset Management AG with a presence in New York and Hong Kong, The Family Office has established a reputation for combining institutional rigor with innovative, long-term investment strategies.

The “Investing Is a Sea” summit underscores Saudi Arabia’s growing role as a global center for financial dialogue and strategic investment, reinforcing the Kingdom’s Vision 2030 objective of fostering economic diversification and sustainable development.