WASHINGTON: The US Treasury Department is crafting rules that would block firms with at least 25 percent Chinese ownership from buying US companies in “industrially significant” technologies, the Wall Street Journal reported on Sunday.

Citing people familiar with the matter, the newspaper said the US National Security Council and Commerce Department were also devising plans for “enhanced” export controls to keep such technologies from being shipped to China.

The newspaper said the plans were expected to be announced by the end of the week but were not finalized and that industry would have a chance to comment before they went into effect.

The initiatives, the newspaper said, are designed to hamper plans that Beijing outlined under its “Made in China 2025” strategy to become a global leader in 10 key sectors that include robotics, aerospace and clean-energy cars.

Citing people familiar with the internal Trump administration debate, the newspaper said the United States plans to use the International Emergency Economic Powers Act of 1977 to impose the investment restrictions.

It said the administration would look only at new deals and would not try to unwind existing ones, adding that the planned investment bar would not distinguish between Chinese state-owned and private companies.

The White House on May 29 said the Trump administration would press ahead with restrictions on investment by Chinese companies in the United States as well as export controls for goods exported to China, with details to be announced by June 30. It also said it would unveil a revised list of Chinese goods for tariffs, which it did on June 15.

The White House, Treasury Department and Commerce Department did not immediately respond to requests for comment.

US plans limits on Chinese investment in American technology firms

US plans limits on Chinese investment in American technology firms

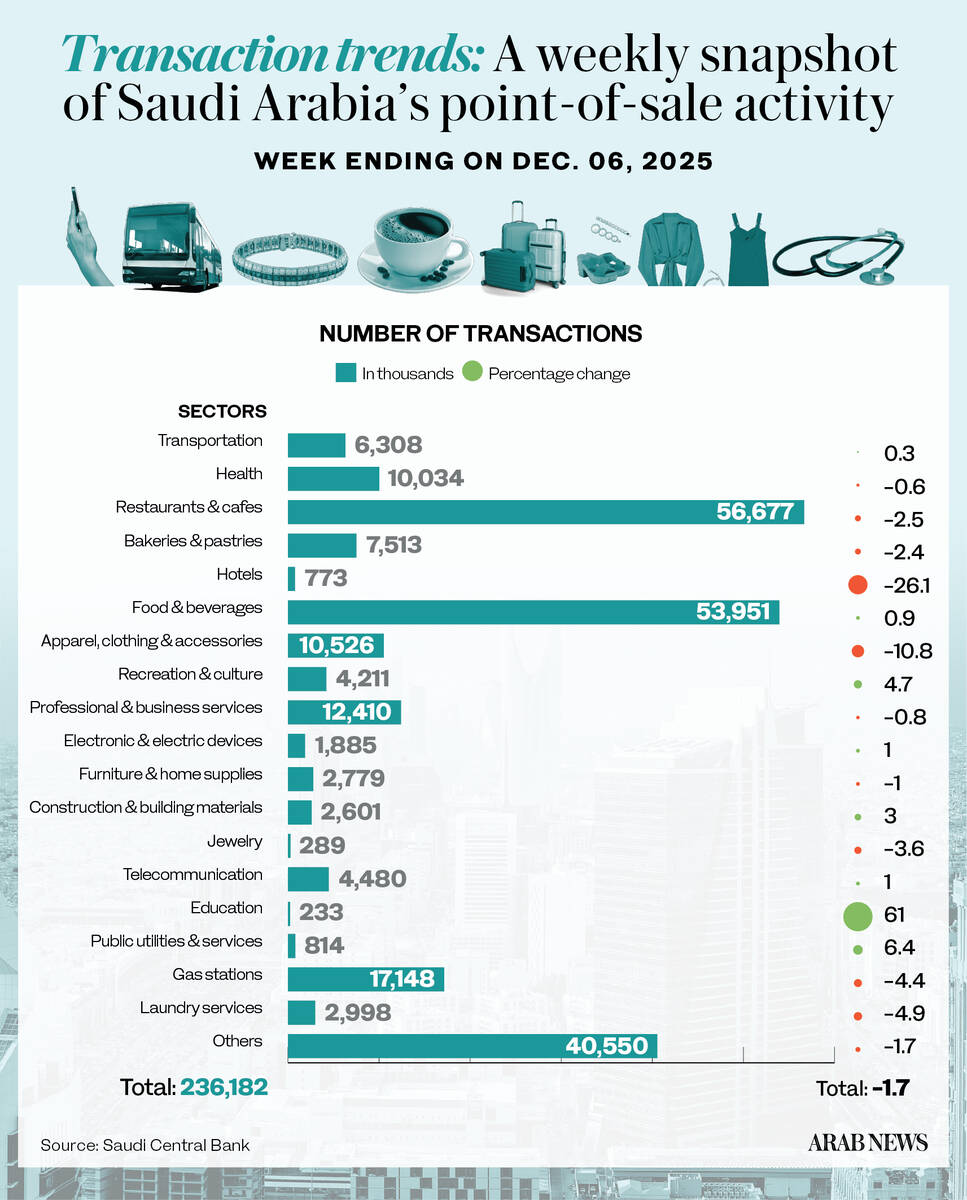

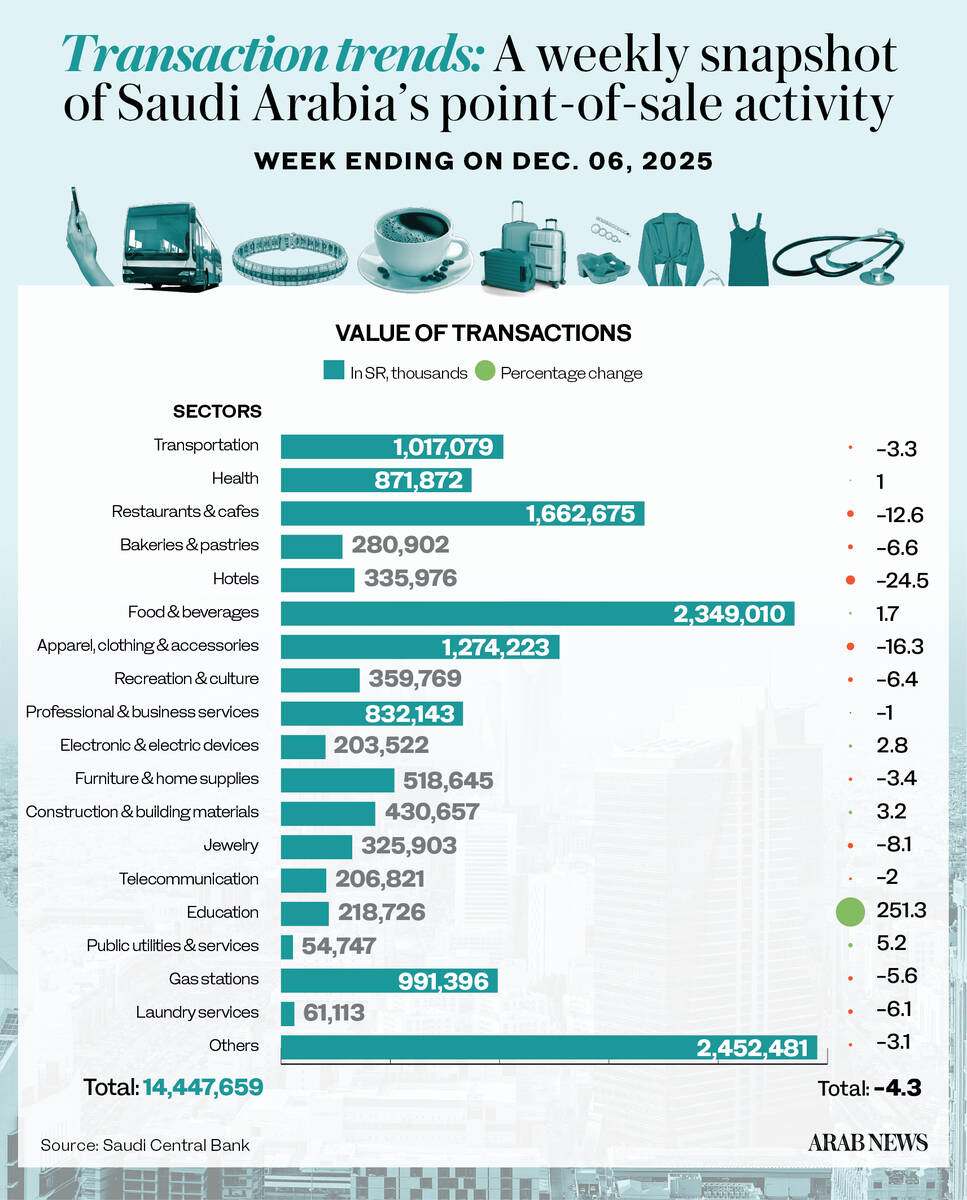

Education spending surges 251% as students return from autumn break: SAMA

RIYADH: Education spending in Saudi Arabia surged 251.3 percent in the week ending Dec. 6, reflecting the sharp uptick in purchases as students returned from the autumn break.

According to the latest data from the Saudi Central Bank, expenditure in the sector reached SR218.73 million ($58.2 million), with the number of transactions increasing by 61 percent to 233,000.

Despite this surge, overall point-of-sale spending fell 4.3 percent to SR14.45 billion, while the number of transactions dipped 1.7 percent to 236.18 million week on week.

The week saw mixed changes between the sectors. Spending on freight transport, postal and courier services saw the second-biggest uptick at 33.3 percent to SR60.93 million, followed by medical services, which saw an 8.1 percent increase to SR505.35 million.

Expenditure on apparel and clothing saw a decrease of 16.3 percent, followed by a 2 percent reduction in spending on telecommunication.

Jewelry outlays witnessed an 8.1 percent decline to reach SR325.90 million. Data revealed decreases across many other sectors, led by hotels, which saw the largest dip at 24.5 percent to reach SR335.98 million.

Spending on car rentals in the Kingdom fell by 12.6 percent, while airlines saw a 3.7 percent increase to SR46.28 million.

Expenditure on food and beverages saw a 1.7 percent increase to SR2.35 billion, claiming the largest share of the POS. Restaurants and cafes retained the second position despite a 12.6 percent dip to SR1.66 billion.

Saudi Arabia’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 3.9 percent dip to SR4.89 billion, down from SR5.08 billion the previous week.

The number of transactions in the capital settled at 74.16 million, down 1.4 percent week on week.

In Jeddah, transaction values decreased by 5.9 percent to SR1.91 billion, while Dammam reported a 0.8 percent surge to SR713.71 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with the Kingdom’s Vision 2030 objectives, promoting electronic transactions and contributing to the nation’s broader digital economy.