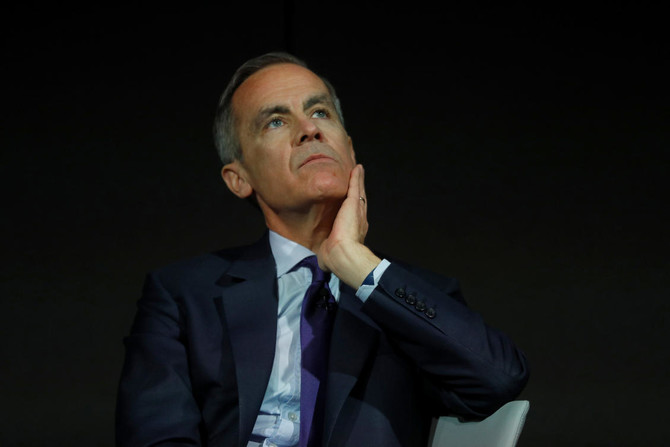

LONDON: Cryptocurrencies are failing as a form of money and have shown classic signs of being a financial bubble, requiring regulators to protect consumers and stop their use for illegal activities, Bank of England Governor Mark Carney said on Friday.

Carney did not call for a ban on cryptocurrencies such as bitcoin but said they needed to be regulated in a similar way to other parts of the financial system, and stressed they could not effectively replace traditional currencies.

“Cryptocurrencies act as money, at best, only for some people and to a limited extent, and even then, only in parallel with the traditional currencies of the users. The short answer is they are failing,” Carney said in a speech.

Carney, who heads the Financial Stability Board, a global financial rule-making body, expressed doubts about cryptocurrencies earlier this year and his speech for a Scottish student economics conference expanded on these.

“At present, crypto-assets raise a host of issues around consumer and investor protection, market integrity, money laundering, terrorism financing, tax evasion, and the circumvention of capital controls and international sanctions,” he said.

For now, they posed little financial stability risk to Britain as whole, due mostly to major banks’ limited involvement with them. But for individual investors, they were a major risk.

“Many cryptocurrencies have exhibited the classic hallmarks of bubbles including new paradigm justifications, broadening retail enthusiasm and extrapolative price expectations reliant in part on finding the greater fool,” he said.

Bitcoin prices have fallen sharply since December 2017.

However, the distributed-ledger technology underlying cryptocurrencies did have potential for improving cash settlement in the banking system and other asset transactions, he added.

Cryptocurrencies are failing as money, Bank of England chief says

Cryptocurrencies are failing as money, Bank of England chief says

Closing Bell: Saudi main index closes in red at 10,947

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Thursday, losing 208.20 points, or 1.87 percent, to close at 10,947.25.

The total trading turnover of the benchmark index was SR4.80 billion ($1.28 billion), as 14 of the listed stocks advanced, while 253 retreated.

The MSCI Tadawul Index decreased, down 25.35 points, or 1.69 percent, to close at 1,477.71.

The Kingdom’s parallel market Nomu lost 217.90 points, or 0.92 percent, to close at 23,404.75. This came as 24 of the listed stocks advanced, while 43 retreated.

The best-performing stock was Musharaka REIT Fund, with its share price up 2.12 percent to SR4.34.

Other top performers included Al Hassan Ghazi Ibrahim Shaker Co., which saw its share price rise by 1.18 percent to SR17.20, and Saudi Industrial Export Co., which saw a 0.8 percent increase to SR2.51.

On the downside, Abdullah Saad Mohammed Abo Moati for Bookstores Co. was among the day’s biggest decliners, with its share price falling 9.3 percent to SR39.

National Medical Care Co. fell 8.98 percent to SR128.80, while National Co. for Learning and Education declined 6.35 percent to SR116.50.

On the announcements front, Red Sea International said its subsidiary, the Fundamental Installation for Electric Work Co., has entered into a framework agreement with King Salman International Airport Development Co.

In a Tadawul statement, the company noted that the agreement establishes the general terms and conditions for the execution of enabling works at the King Salman International Airport project in Riyadh.

Under the 48-month contract, the scope of work includes the supply, installation, testing, and commissioning of all mechanical, electrical, and plumbing systems.

Utilizing a re-measurement model, specific work orders will be issued on a call-off basis, with the final contract value to be determined upon the completion and measurement of actual quantities executed.

The financial impact of this collaboration is expected to begin reflecting on the company’s statements starting in the first quarter of 2026, the statement said.

The company’s share price reached SR23.05, marking a 2.45 percent decrease on the main market.