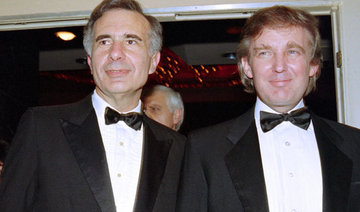

TOKYO: Xerox’s plan to sell itself to Japan’s Fujifilm Holdings has come under further pressure with Carl Icahn and Darwin Deason urging fellow shareholders to oppose the $6.1 billion deal.

The activist shareholders, who own a combined 15 percent of the US printer and copier maker, said the agreement dramatically undervalued Xerox and criticized the deal structure, which calls for the US firm to be combined into the Fuji Xerox joint venture, as “tortured (and) convoluted.”

“We urge you – our fellow shareholders – do not let Fuji steal this company from us,” Icahn and Deason said in an open letter.

They added there was still great opportunity for Xerox to create “enormous value for shareholders, and it does not involve selling control to Fuji without a premium.”

Seeking a firmer footing amid waning demand for office printing, the two firms agreed to a deal under which their existing joint venture Fuji Xerox will buy back Fujifilm’s stake in it for about 75 percent for around $6.1 billion (SR22.87 billion).

Fujifilm will then use those proceeds to purchase 50.1 percent of new Xerox shares.

Xerox said in a statement that it had considered several other options in detail and concluded that the combination with Fuji Xerox is the “best path to create value” for the company.

Fujifilm said in a separate statement that the planned deal “represents compelling strategic and financial value for Xerox shareholders.”

“The combined company will create a strong business foundation under a globally unified management strategy and provide new value by leveraging Fujifilm’s technological resources,” the Japanese company said.

Activist investors urge fellow Xerox shareholders to oppose Fujifilm deal

Activist investors urge fellow Xerox shareholders to oppose Fujifilm deal

Saudi investment pipeline active as reforms advance, says Pakistan minister

ALULA: Pakistan’s Finance Minister Mohammed Aurangzeb described Saudi Arabia as a “longstanding partner” and emphasized the importance of sustainable, mutually beneficial cooperation, particularly in key economic sectors.

Speaking to Arab News on the sidelines of the AlUla Conference for Emerging Market Economies, Aurangzeb said the relationship between Pakistan and Saudi Arabia remains resilient despite global geopolitical tensions.

“The Kingdom has been a longstanding partner of Pakistan for the longest time, and we are very grateful for how we have been supported through thick and thin, through rough patches and, even now that we have achieved macroeconomic stability, I think we are now well positioned for growth.”

Aurangzeb said the partnership has facilitated investment across several sectors, including minerals and mining, information technology, agriculture, and tourism. He cited an active pipeline of Saudi investments, including Wafi’s entry into Pakistan’s downstream oil and gas sector.

“The Kingdom has been very public about their appetite for the country, and the sectors are minerals and mining, IT, agriculture, tourism; and there are already investments which have come in. For example, Wafi came in (in terms of downstream oil and gas stations). There’s a very active pipeline.”

He said private sector activity is driving growth in these areas, while government-to-government cooperation is focused mainly on infrastructure development.

Acknowledging longstanding investor concerns related to bureaucracy and delays, Aurangzeb said Pakistan has made progress over the past two years through structural reforms and fiscal discipline, alongside efforts to improve the business environment.

“The last two years we have worked very hard in terms of structural reforms, in terms of what I call getting the basic hygiene right, in terms of the fiscal situation, the current economic situation (…) in terms of all those areas of getting the basic hygiene in a good place.”

Aurangzeb highlighted mining and refining as key areas of engagement, including discussions around the Reko Diq project, while stressing that talks with Saudi investors extend beyond individual ventures.

“From my perspective, it’s not just about one mine, the discussions will continue with the Saudi investors on a number of these areas.”

He also pointed to growing cooperation in the IT sector, particularly in artificial intelligence, noting that several Pakistani tech firms are already in discussions with Saudi counterparts or have established offices in the Kingdom.

Referring to recent talks with Saudi Minister of Economy and Planning Faisal Alibrahim, Aurangzeb said Pakistan’s large freelance workforce presents opportunities for deeper collaboration, provided skills development keeps pace with demand.

“I was just with (Saudi) minister of economy and planning, and he was specifically referring to the Pakistani tech talent, and he is absolutely right. We have the third-largest freelancer population in the world, and what we need to do is to ensure that we upscale, rescale, upgrade them.”

Aurangzeb also cited opportunities to benefit from Saudi Arabia’s experience in the energy sector and noted continued cooperation in defense production.

Looking ahead, he said Pakistan aims to recalibrate its relationship with Saudi Arabia toward trade and investment rather than reliance on aid.

“Our prime minister has been very clear that we want to move this entire discussion as we go forward from aid and support to trade and investment.”