Sharp, concise and fun to read, this collection of essays offers a fresh and dynamic look at the history of economics. Niall Kishtainy teaches at the London School of Economics (LSE) and has been an economic policy adviser to the UK government and the UN Economics Commission for Africa. He has the ability to explain a difficult concept clearly.

“The word ‘economics’ might sound a bit dry and make you think of a load of boring statistics. But all it’s really about is how to help people to survive and to be healthy and educated. It’s about how people get what they need to live full, happy lives and why some people don’t,” writes Kishtainy with a deep sense of pragmatism.

If the first economic thinkers were the Greeks, the world’s first school of economists was led by Frenchman Francois Quesnay (1694-1774), who was the doctor of Madame de Pompadour, King Louis XV’s favorite mistress. Quesnay’s followers were known as physiocrats.

His friend, the Marquis de Mirabeau, had just published a book that not only upset many people, but also got him thrown into prison. Mirabeau’s ideas were quite revolutionary for the time. He demanded that French peasants no longer be required to pay taxes and the aristocracy be taxed instead. He had forgotten that the ruler needed the aristocrats on his side.

Quesnay believed that French society and its economy, which he compared to a goose, “had been plucked so hard that it was nearly bald.” He urged the government to abolish the restrictions that oppressed French peasants and to put an end to the privileges enjoyed by the merchants. He did not want the government to interfere in the country’s economy.

This concept leads us to the Scottish philosopher Adam Smith (1723-1720), a key economic thinker. He was often so buried in his thoughts that he would forget where he was. One morning, he woke up and began walking in his dressing gown around the garden of his home in Scotland. He then walked along the road until he reached the next town 12 miles away.

Smith wanted to know if self-interest is compatible with a good society. He believed that when people pursued their own interests, this would benefit more people. You are able to buy bread because bakers pursue their own interests by baking then selling it. In turn, bakers can make money because you pursue your own interest by buying the bread.

In the end, self-interest promotes social harmony rather than chaos, and Smith came up with one of the most famous thoughts in economics: “It’s as if society is guided by an invisible hand.” He wrote “The Wealth of Nations,” which was published in 1776 and is one of the most important books in the history of economics. “American President Ronald Reagan championed these principles, taking Smith as his inspiration,” writes Kishtainy.

Although the essays are presented in chronological order, each one focuses on a key thinker, idea or event that you can read in any order you fancy. I skipped the big names — Thomas Malthus, John Maynard Keynes, Milton Friedman and Karl Marx — and set my eyes on “The Noisy Trumpeter,” where Kishtainy presents British economist Arthur Cecil Pigou (1877-1959), a typical eccentric professor dressed in an old frumpy suit.

His mentor, the great Victorian economist Alfred Marshall, called his student a genius. Pigou continued the work initiated by his teacher. He stressed the fact that markets do not work perfectly and he created a new field known as “welfare economics.”

Pigou believed that markets fail when there is a difference between social effects, which impact everyone, and private effects, which affect only the person producing the externality. Pigou’s work developed policies that could be used to improve specific markets, such as the oil market.

At the turn of the 20th century, Standard Oil controlled most of America’s oil. This company had no competitors, so could increase the price to make more profit. In a competitive market, there is a bigger choice of goods sold at cheaper prices. The US government eventually broke up Standard Oil into separate companies.

In an essay entitled “Flashing Your Cash,” Kishtainy introduces us to Thorstein Veblen, “one of the most unconventional economic thinkers America ever produced.” His parents, originally Norwegian, had a small farm in Wisconsin and he always considered himself far removed from America’s rich and powerful. From a very young age, he loved unsettling people and breaking conventions.

After earning a PhD from Yale University, he returned to his parents’ farm and wrote his books in the basement of a friend’s house, which he entered through a window. His most famous book, “The Theory of the Leisure Class,” criticizes the conventional way of thinking about economic behavior. Veblen believed that people’s decision to buy is not rational, but based on their instincts and habits shaped by the environment they grew up in.

According to him, writes Kishtainy, “we buy things not so much to satisfy our own desires as a completely rational person would, but in order to be approved of by others. Think about the last T-shirt that you bought: Even if you bought it because you liked it, didn’t you also think about whether your friends would like it too?”

Veblen was fascinated by the American consumer society, especially the leisure class, which indulged in huge houses, cars and jewelry to show off its fortunes. He coined this form of buying “conspicuous consumption” and believed it was a waste. “It diverts economic energy from the production of what people really need into what they can show off with.”

Veblen received recognition late in his life. He was 70-years-old when he was offered the presidency of the American Economic Association, but true to his anti-conventional beliefs, he refused the post and lived the rest of his life in a cabin outside Palo Alto.

Another interesting essay concerns American economist George Akerlof, who was awarded the Nobel Prize for Economics in 2001. He became famous for an article he wrote in 1970. Entitled “The Market for Lemons,” the article is all about buying a second-hand car. The seller knows if the car is a lemon, but will always tell the buyer it is in good condition. The problem is that buyers never know which cars are in good shape and which are not.

Akerlof believes that in the economy, there are always some people who know more than others, but for markets to do well, people need to know everything. He encountered great difficulty in publishing his article. One editor even told him his idea was insignificant.

Eventually, his article got published and it created a new field known as “information economics.” Akerlof met Joseph Stiglitz at the Massachusetts Institute of Technology (MIT) in the 1960s. Stiglitz became an advocate for information economics and shared a Nobel Prize with Akerlof in 2001.

Stiglitz realized that when you are involved in the development of poor countries, information economics has an essential role to play. He has been very critical of Washington officials. “They completely ignored the risks of free-market policies that let money flow in and out of the countries without any restrictions when the lenders didn’t have good information about who they were lending to,” writes Kishtainy.

Information problems cause breakdowns in the market, meaning that the invisible hand is not really working. When Stiglitz received the Nobel Prize, he remarked humorously that Smith’s hand is invisible because it is not there and if it is there, it must be paralyzed.

I have only mentioned a few economists, but Kishtainy has included all the most important ones, along with important events such as the Great Depression, the rise of capitalism and speculation. These crisp and entertaining essays provide a wonderful overview of the history of economics. “A Little History of Economics” gives us the gist of economic thinking in clear language, far from the hermetic verbiage that many economists indulge in.

• [email protected]

A dynamic look at the history of economics

A dynamic look at the history of economics

What We Are Reading Today: Birds of the Middle East

Authors: Richard Porter, Oscar Campbell, & Abdulrahman Al-Sirhan

The Middle East is home to some of the most spectacular birdlife in the world.

It features 180 superb color plates depicting some 900 species and subspecies as well as 646 color distribution maps that show the breeding range for almost every species.

Book Review: ‘The Undiscovered Self’ by Carl Jung

- Loss of personal responsibility, the author suggests, can lead to the rise of mass movements and, ultimately, totalitarianism

“The Undiscovered Self,” written by Swiss psychiatrist and psychoanalyst Carl Jung in 1957, delivers a warning about the dangers of modern collectivism, arguing that individuals are increasingly losing touch with their true selves.

Loss of personal responsibility, the author suggests, can lead to the rise of mass movements and, ultimately, totalitarianism.

The book offers a prescription for individual psychological development and moral autonomy as an antidote to society’s collectivist forces.

Jung explains the structure of the psyche, with the conscious ego and much larger subconscious, which contains universal archetypes, as well as personal complexes and shadows that shape our behavior.

The book emphasizes the importance of understanding and integrating the unconscious rather than just relying on the conscious mind.

Jung also explores the notion of “self,” defining “individuation” as the process of integrating the conscious and unconscious to become a whole, individualized person.

This requires embracing one’s shadow side and personal complexes, not just the socially acceptable persona.

True individuality and freedom come from this process of self-discovery and self-realization, Jung believes.

He encourages individuals to take responsibility for their psychological development, a process that involves introspection, self-knowledge, and a willingness to confront the unconscious.

For additional reading, I would recommend “The Red Book,” which outlines the development of many of Jung’s major theories.

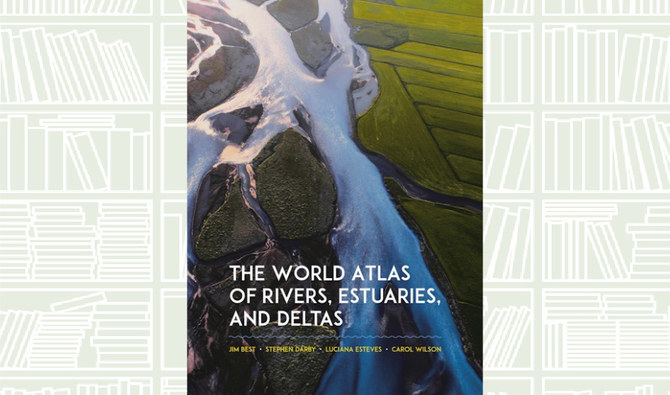

What We Are Reading Today: The World Atlas of Rivers, Estuaries, and Deltas

Authors: Jim Best, Stephen Darby, Luciana Esteves, & Carol Wilson

From the Congo and the Mekong to the Seine and the Mississippi, Earth’s rivers carve through landscapes before coursing into the world’s oceans through estuaries and deltas.

“The World Atlas of Rivers, Estuaries, and Deltas” takes readers on an unforgettable tour of these dynamic bodies of water, explaining how they function at each stage of their flow.

What We Are Reading Today: Money Capital

Authors: Patrick Bolton & Haizhou Huang

In this book, leading economists Patrick Bolton and Haizhou Huang offer a novel perspective, viewing monetary economics through the lens of corporate finance.

They propose a richer theory, where money can be seen as the equity capital of a nation, playing a similar role as stocks for a company.