DUBAI: Qatar Islamic Bank has signed a 1.6-billion Qatari riyal (SR1.65 billion) funding deal with local contractor Al Jaber Engineering to finance a large food security facility at the new Hamad Port.

The new food security facility is being built on a 530,000-square-meter site and contains facilities that can be used for storing, processing and manufacturing of various foods, including rice, raw sugar and edible oils.

The complex will house rice silos, oil storage tanks and associated infrastructure such as conveyor systems, processing and warehousing space. There will also be a recycling facility that will help to turn waste products from basic commodity processing into animal feed.

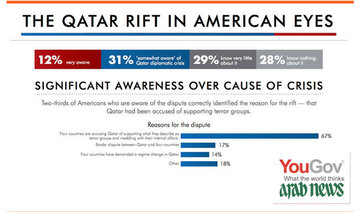

Doha’s new port has been ramping up throughput as the country tries to mitigate the impact of the embargo imposed by Saudi Arabia, the UAE, Bahrain and Egypt in June.

The anti-terror quartet has accused Qatar of supporting and financing terror groups and attempting to destabilize the region, which was denied by the Doha government.

Qatar has been resetting its supply chains through ports in Oman, which has remained neutral in the crisis, with Iran and Turkey becoming the two major suppliers of Doha’s food imports.

Qatar’s imports slumped 40 percent to 5.9 billion riyals in June after the closure of the Saudi land border, where most of its staple supplies pass through.

Qatar’s new food security depot receives $439 million in funding

Qatar’s new food security depot receives $439 million in funding

Closing Bell: Saudi main index slips to close at 11,228

RIYADH: Saudi Arabia’s Tadawul All Share Index slipped on Sunday, lost 23.17 points, or 0.21 percent, to close at 11,228.64.

The total trading turnover of the benchmark index was SR2.99 billion ($797 million), as 170 of the stocks advanced and 82 retreated.

On the other hand, the Kingdom’s parallel market Nomu gained 449.38 points, or 1.90 percent, to close at 24,093.12. This comes as 43 of the stocks advanced while 27 retreated.

The MSCI Tadawul Index lost 6.07 points, or 0.40 percent, to close at 1,511.36.

The best-performing stock of the day was Obeikan Glass Co., whose share price surged 7.54 percent to SR27.66.

Other top performers included Alamar Foods Co., whose share price rose 6.80 percent to SR47.10, as well as Saudi Kayan Petrochemical Co., whose share price climbed 6.79 percent to SR5.66.

Saudi Investment Bank recorded the steepest drop, falling 3.21 percent to SR13.56.

Jahez International Co. for Information System Technology also saw its share price fall 3.15 percent to SR13.55.

Rabigh Refining and Petrochemical Co. declined 2.78 percent to SR7.34.

On the announcements front, Tanmiah Food Co. reported its annual financial results for the period ending Dec. 31. According to a Tadawul statement, the company recorded a net loss of SR18.8 million, compared with a net profit of SR95.8 million a year earlier.

The net loss was mainly due to ongoing market challenges that resulted in continued pricing pressures in fresh poultry, inflationary cost pressures, higher financing expenses, and depreciation and ramp-up costs from new facilities, partially offset by increased production volumes and cost-optimization initiatives.

Tanmiah Food Co. ended the session at SR58.20, up 3.72 percent.

United International Holding Co., also known as Tas’heel, announced its annual financial results for the period ending Dec. 31. A bourse filing showed the company recorded a net profit of SR273.64 million in 2025, up 23.05 percent from 2024, primarily driven by a 23.4 percent rise in revenues. The revenue growth helped lift gross profit by 23.7 percent.

Tas’heel ended the session at SR146.80, down 0.28 percent.