DUBAI: Middle East stock markets fell on Tuesday as a tumble by real estate developer DAMAC caused Dubai to break a seven-session rising streak and weak corporate earnings helped to pull down Egypt’s bourse.

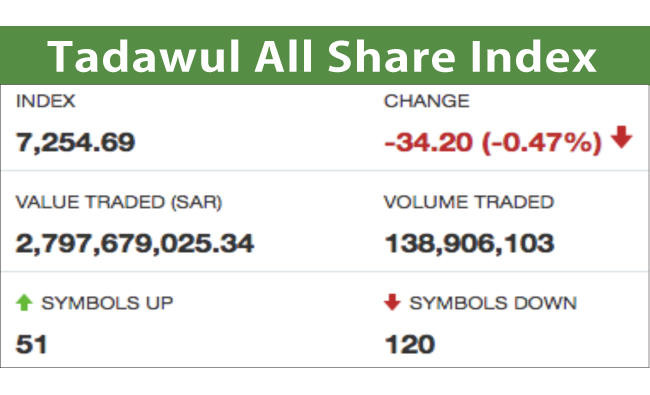

The Tadawul All Share Index (TASI) slipped 0.5 percent. Saudi Kayan rose in early trade but closed 2.1 percent lower after reporting its second-quarter net profit climbed to SR242 million ($64.5 million) from SR97.3 million a year ago; analysts had on average predicted SR212 million.

Qassim Cement fell 0.4 percent after it reported a quarterly profit of SR53.2 million versus SR113.9 million; analysts had on average expected SR66 million.

But National Company for Glass Industries jumped its 10 percent daily limit after reporting a 224 percent leap in quarterly net profit, although operating profit actually fell sharply.

Jouf Cement gained 4.8 percent after shareholders approved a 10 percent capital increase via an issue of bonus shares, to be paid for with the company’s retained earnings.

The Egyptian blue chip index, which had closed at a record high on Monday, sank 1.7 percent in rising turnover — a negative technical sign. The broader EGX100 dropped 1.6 percent.

Ezz Steel plunged 10 percent after it reported a quarterly consolidated net loss after tax and minority interests of 521 million Egyptian pounds ($29.2 million), versus a loss of 137 million pounds a year ago.

The company said it had suffered from a very low rate of capacity utilization because of a working capital shortage after the devaluation of the Egyptian pound; it expects to cover the working capital gap gradually in coming quarters.

Arabian Food Industries slid 5.6 percent after reporting a second-quarter net profit of 12 million pounds, below some analysts’ estimates.

Large-cap Orascom Telecom Media slipped 4.2 percent as its subsidiary Beltone Financial lost 3.6 percent.

In Dubai, the index dropped 0.7 percent to 3,578 points after rising for seven straight sessions through Monday, but it held technical support at 3,573 points, the April peak. DAMAC, which had led the rally, fell back 9 percent in heavy profit-taking.

Qatar’s index slipped 0.5 percent as Masraf Al-Rayan, the second-largest bank by market value, dropped 1.4 percent.

It reported flat quarterly net profit, in line with analysts’ forecasts, suggesting the impact of Qatar’s diplomatic crisis has so far been minor. Customer deposits were 61.21 billion riyals ($16.8 billion) at the end of June, up 5.9 percent from a year earlier but down 3 percent from the previous quarter.

Al-Khalij Commercial Bank, which reported flat first-half earnings, slipped 1.8 percent and Ahli Bank, which reported a 3 percent rise in net profit for the first half, closed flat.

Middle East stock markets slip

Middle East stock markets slip

Egypt’s Sawiris proposed as adidas chairman after brand posts record 2025 results

JEDDAH: Adidas has nominated Egyptian billionaire and board member Nassef Sawiris as its next chairman, succeeding Thomas Rabe.

The move comes as the German sportswear group reported strong 2025 results, with revenue rising 13 percent to a record €24.8 billion ($29 billion) and net income from continuing operations surging nearly 70 percent under CEO Bjorn Gulden.

Rabe, 60, has chaired adidas’ supervisory board since 2020 after joining in 2019. He is also chairman and CEO of Bertelsmann Management SE and CEO of RTL Group.

Cairo-born Sawiris, 65, is an investor and scion of Egypt’s wealthiest family, with an estimated net worth of $9.6 billion, according to Forbes. He runs OCI, one of the world’s largest nitrogen fertilizer producers, and oversees Orascom Construction.

His holdings include nearly 6 percent of adidas through his investment vehicle NNS.

Sawiris’ appointment is subject to shareholder approval at the May 7 annual general meeting. The supervisory board has also proposed extending Gulden’s contract to the end of 2030, following the turnaround he has led since early 2023.

“Following the Annual General Meeting, the Supervisory Board intends to elect Nassef Sawiris as Chairman of the Supervisory Board. He is to succeed Thomas Rabe as Chairman, whose term of office will end as planned at the close of the upcoming Annual General Meeting,” adidas group said in a statement.

“With Nassef Sawiris, the Supervisory Board will win an experienced entrepreneur and investor as Supervisory Board Chairman. Nassef has already accompanied adidas for many years as a Supervisory Board member and has contributed significantly to the strategic development of the company,” Rabe said.

He added that Sawiris’ significant shareholding in adidas through NNS underscores his strong and long-term commitment to the company and alignment with shareholder interests.

Sawiris, deputy chairman of the Supervisory Board since 2025, expressed his delight at the nomination, emphasizing that with vast opportunities in such an attractive industry, it is especially important for him to actively help shape adidas’s future alongside his colleagues and the executive board.

“I greatly appreciate the achievements of Bjorn and his team so far, and I am looking forward to continuing our close collaboration as we jointly guide adidas into its next chapter,” he said, extending thanks to Rabe for his long-standing leadership, the trustful collaboration, and his achievements for the company.