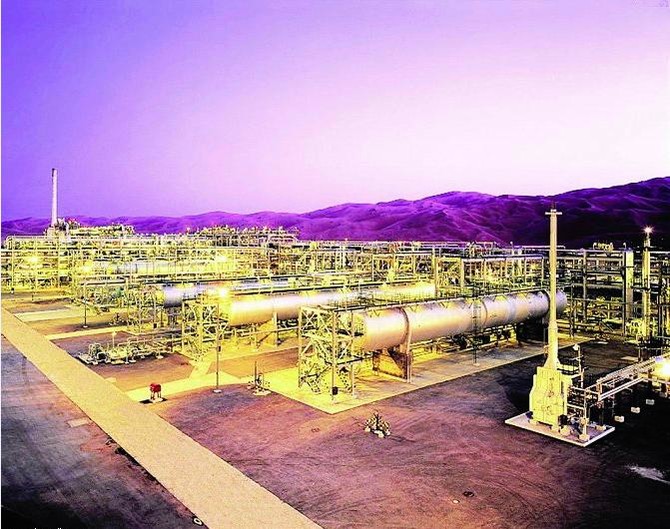

DHAHRAN: As part of Saudi Aramco’s mega projects, it is implementing expansion plans at Shaybah field in the Empty Quarter to increase oil production capacity and natural gas liquids (NGL) at an estimated cost of SR186.75 billion. Saudi Aramco's joint projects in the field of refining and petrochemical production are estimated at SR131.25 billion.

The Shaybah field expansion focuses on two major projects. First is oil production increase by 250,000 barrels per day (bpd), for the second time. The expansion will provide the Shaybah field with a capacity of 1 million bpd of Arabian Extra Light crude oil by April, 2016, double its initial capacity in 1998.

Moreover, the Saudi oil company is working to improve the design of wells to increase the average reservoir contact to 10 km, enhancing production from the deep, tight faces of the reservoir.

As for the second project, Saudi Aramco will construct a new NGL plant, to meet the growing demand for petrochemical feedstock through the extraction of high value NGL of the produced gas, which is expected to begin in the second quarter of 2015.

The NGL plant project also includes a major upgrade to increase the power generation capacity to more than 1 GW by installing four cogeneration units, seven single cycle units, and a 50 km transmission line with the ability of 230 kilovolt.

After installing two turbo steam generators by July 2017, the Shaybah total power generation capacity will exceed 1.3 GW.

Aramco uses natural gas as a vital alternative to reduce the Kingdom's dependence on the liquid fuel to generate electricity and to lay the foundation for further development and economic diversification.

On April 2011, Saudi Aramco stated its intentions to expand the Shaybah field after implementing expansion works that included a fourth plant to double production capacity of the Arabian Extra Light crude oil from 500,000 bpd to 750,000 bpd, besides the establishment of a new plant for gas-oil separation.

The Shaybah oil field imposed major challenges during its discovery and development due to the temperatures that soared there to 55° Celsius with heavy dust storms and the shifting sands. Despite the harshness of its climate, the Shaybah field has the best Arabian Extra Light crude oil with a specific gravity of 42 degrees at depth of 4,900 meters.

It includes four plants, and the oil pipeline from the Shaybah field to Abqaiq is 638 km long. The total number of drilled wells reached 255 wells, including 205 horizontal oil wells, 34 vertical oil wells, 8 wells for gas injection, and 5 wells of groundwater.

Aramco implements expansion plans at Shaybah oil field

Aramco implements expansion plans at Shaybah oil field

The Family Office to host global investment summit in Saudi Arabia

RIYADH: The Family Office, one of the Gulf’s leading wealth management firms, will host its exclusive investment summit, “Investing Is a Sea,” from Jan. 29 to 31 on Shura Island along Saudi Arabia’s Red Sea coast.

The event comes as part of the Kingdom’s broader Vision 2030 initiative, reflecting efforts to position Saudi Arabia as a global hub for investment dialogue and strategic economic development.

The summit is designed to offer participants an immersive environment for exploring global investment trends and assessing emerging opportunities and challenges in a rapidly changing financial landscape.

Discussions will cover key themes including shifts in the global economy, the role of private markets in portfolio management, long-term investment strategies, and the transformative impact of artificial intelligence and advanced technologies on investment decision-making and risk management, according to a press release issued on Sunday.

Abdulmohsin Al-Omran, founder and CEO of The Family Office, will deliver the opening remarks, with keynote addresses from Saudi Energy Minister Prince Abdulaziz bin Salman and Prince Turki Al-Faisal, chairman of the King Faisal Center for Research and Islamic Studies.

The press release said the event reflects the firm’s commitment to institutional discipline, selective investment strategies, and long-term planning that anticipates economic cycles.

The summit will bring together prominent international and regional figures, including former UK Treasury Commercial Secretary Lord Jim O’Neill, Mohamed El-Erian, chairman of Gramercy Fund Management, Abdulrahman Al-Rashed, chairman of the editorial board at Al Arabiya, Lebanese Minister of Economy and Trade Dr. Amer Bisat, economist Nouriel Roubini of NYU Stern School of Business, Naim Yazbeck, president of Microsoft Middle East and Africa, John Pagano, CEO of Red Sea Global, Dr. Anne-Marie Imafidon, MBE, co-founder of Stemettes, SRMG CEO Jomana R. Alrashed and other leaders in finance, technology, and investment.

With offices in Bahrain, Dubai, Riyadh, and Kuwait, and through its Zurich-based sister company Petiole Asset Management AG with a presence in New York and Hong Kong, The Family Office has established a reputation for combining institutional rigor with innovative, long-term investment strategies.

The “Investing Is a Sea” summit underscores Saudi Arabia’s growing role as a global center for financial dialogue and strategic investment, reinforcing the Kingdom’s Vision 2030 objective of fostering economic diversification and sustainable development.